Enlarge image

Illinois Department of Revenue

2023 Form IL-1040 Instructions

What’s New for 2023?

Protecting Illinois Taxpayers

Our enhanced efforts to protect Illinois taxpayers from identity theft and tax fraud have proven to be highly successful. We will

continue to combat the criminals attempting to steal your identity to file fraudulent tax returns while making every effort to get your

tax refund to you as quickly as possible.

Please remember, filing your return electronically and requesting direct deposit is still the fastest way to receive your refund. You

can file for free using MyTax Illinois, our online account management program for taxpayers. For more information, go to mytax.

illinois.gov or visit our website.

Form IL-1040 Due Date

The due date for filing your 2023 Form IL-1040 and paying any tax you owe is April 15, 2024.

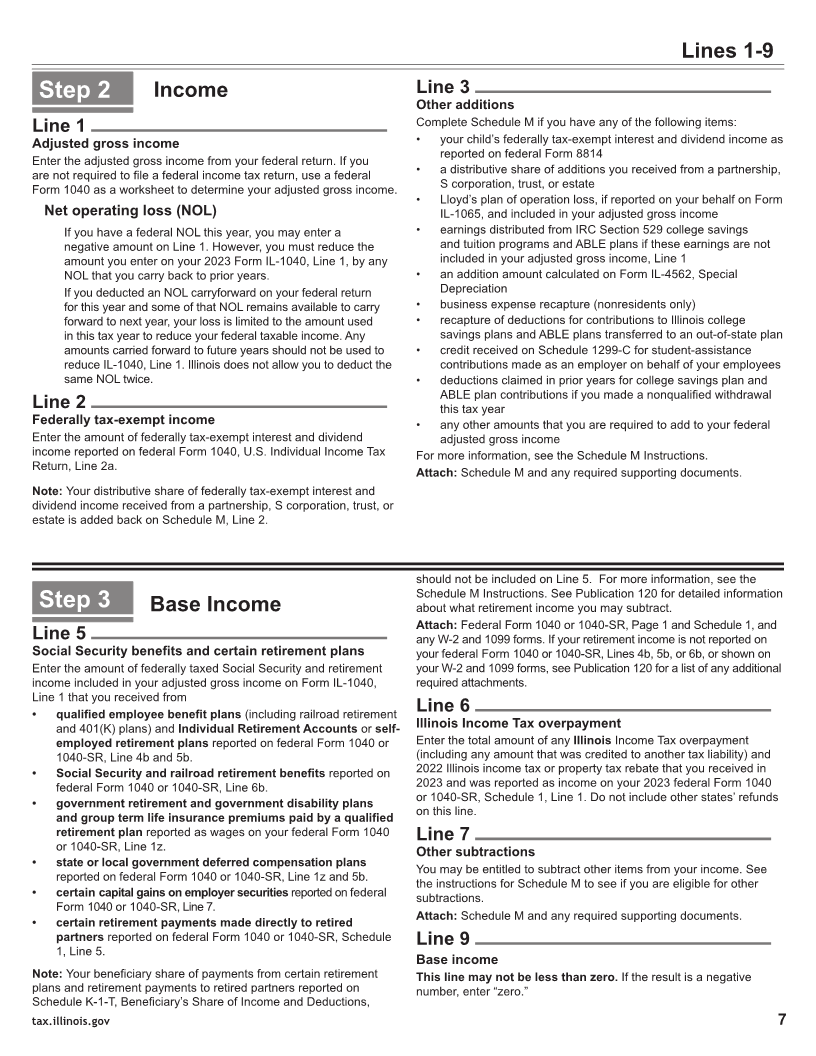

Income Tax Rate

The Illinois income tax rate is 4.95 percent (.0495).

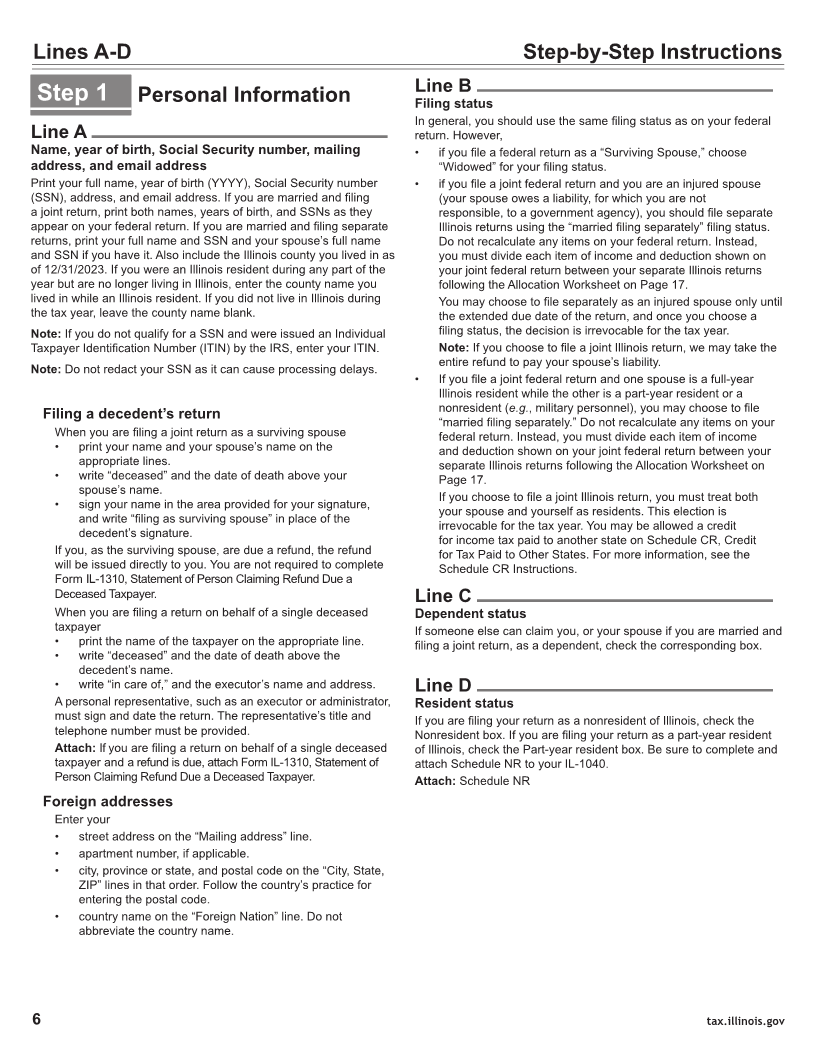

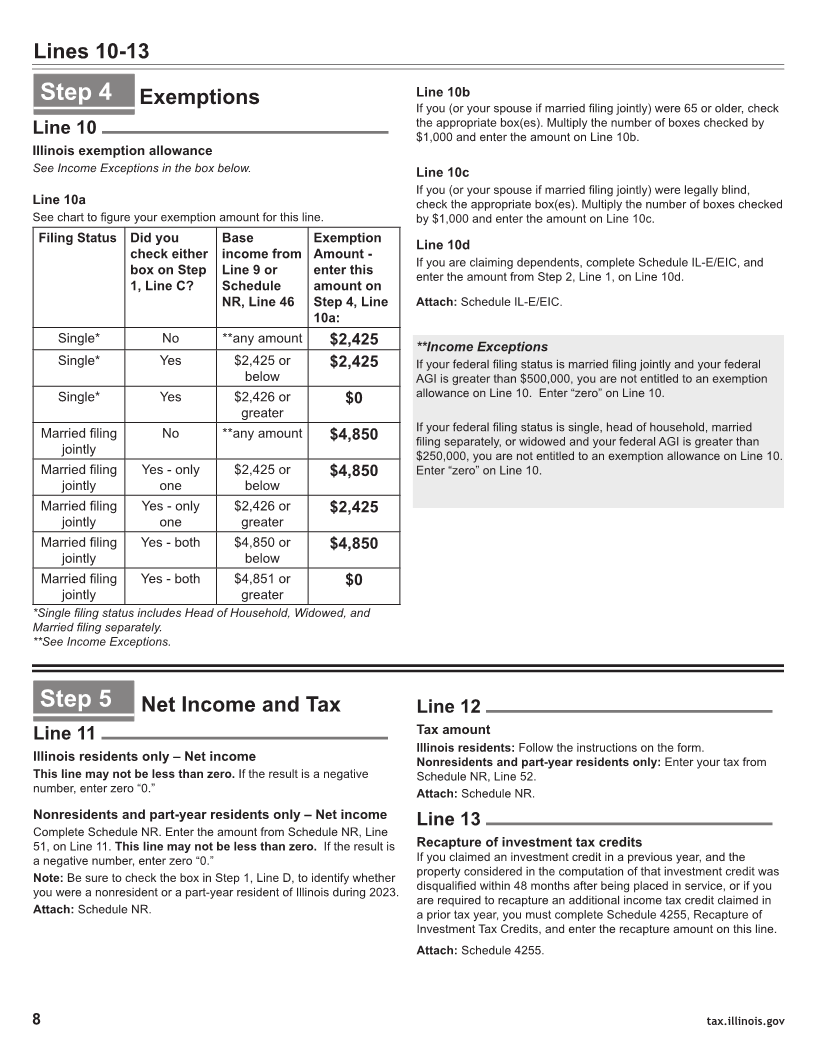

Exemption Allowance

Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425.

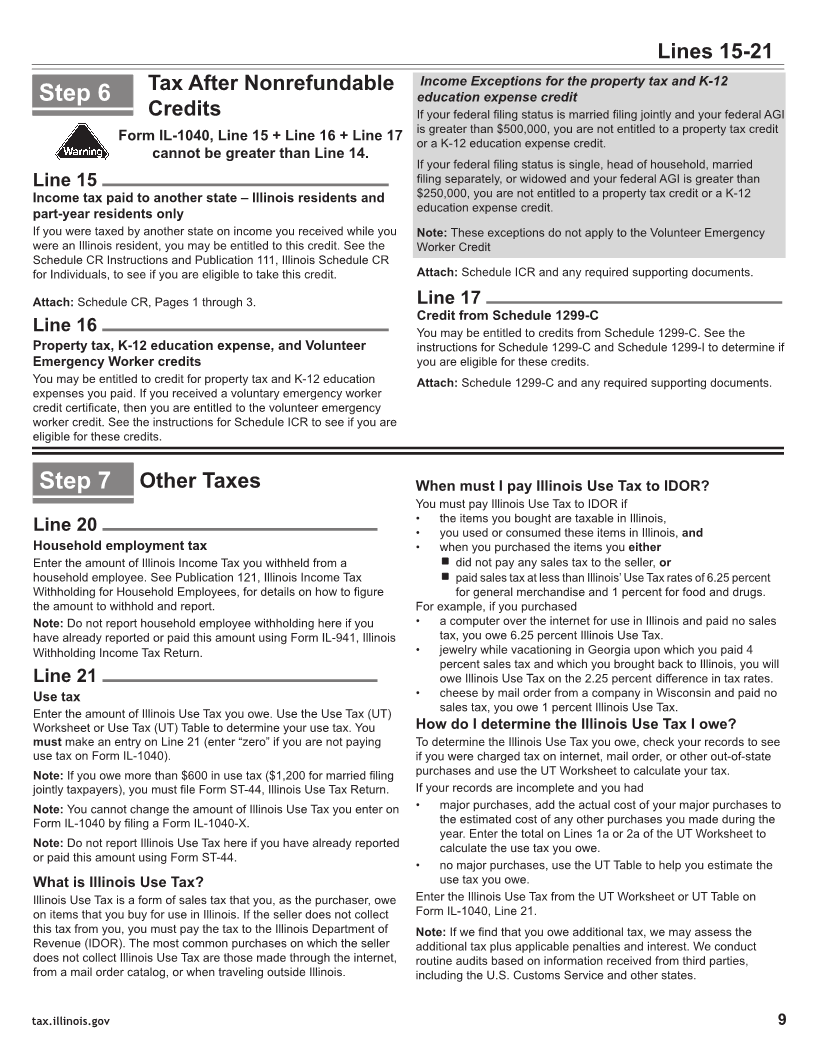

Forms IL-1040 and IL-1040-X

Per Public Act 103-0009, the Volunteer Emergency Worker Credit was added to Line 16. Additional instructions were added

throughout the return to better assist the taxpayer when filing.

Schedule 1299-C

Per Public Act 102-0700, the K-12 Instructional Materials and Supplies Credit (5740) was increased to $500.

Note: Information about all the credits can be found in Schedule 1299-I.

Schedule M

Per Public Act 103-0008, a new subtraction was added for deductions for cannabis establishments that were disallowed under IRC Section

280E for the taxable year, on Line 40.

Schedule ICR

Per Public Act 103-0009, the Volunteer Emergency Worker Credit was created to allow a limited amount of $500 non-refundable

credits for qualified volunteer emergency workers awarded through the Illinois State Fire Marshall (ISFM) and Illinois Department

of Revenue (IDOR). Step 2, Section 3 was added to claim this credit. Note: You must have a Voluntary Emergency Worker Credit

Certificate to claim this credit.

Schedule IL-E/EIC

Per Public Act 102-0700, the Illinois Earned Income Tax Credit (EITC) was expanded. Taxpayers, who otherwise meet federal

income guidelines for the EITC, now qualify for the Illinois EITC if the taxpayer is filing

• with an Individual Taxpayer Identification Number (ITIN), or

• without a qualifying child and is at least age 18 or older (including taxpayers over ages 65).

The Schedule IL-E/EIC was updated to

• allow entry of an ITIN in place of social security number for dependents and qualifying children, and

• include the Illinois Expanded EITC Worksheet for taxpayers who do not qualify for the EITC federally to calculate the federal

EITC amount from which their Illinois EITC amount is derived.

Note: See Schedule IL-E/EIC Instructions for information on if you qualify for and how to claim the Illinois EITC credit.

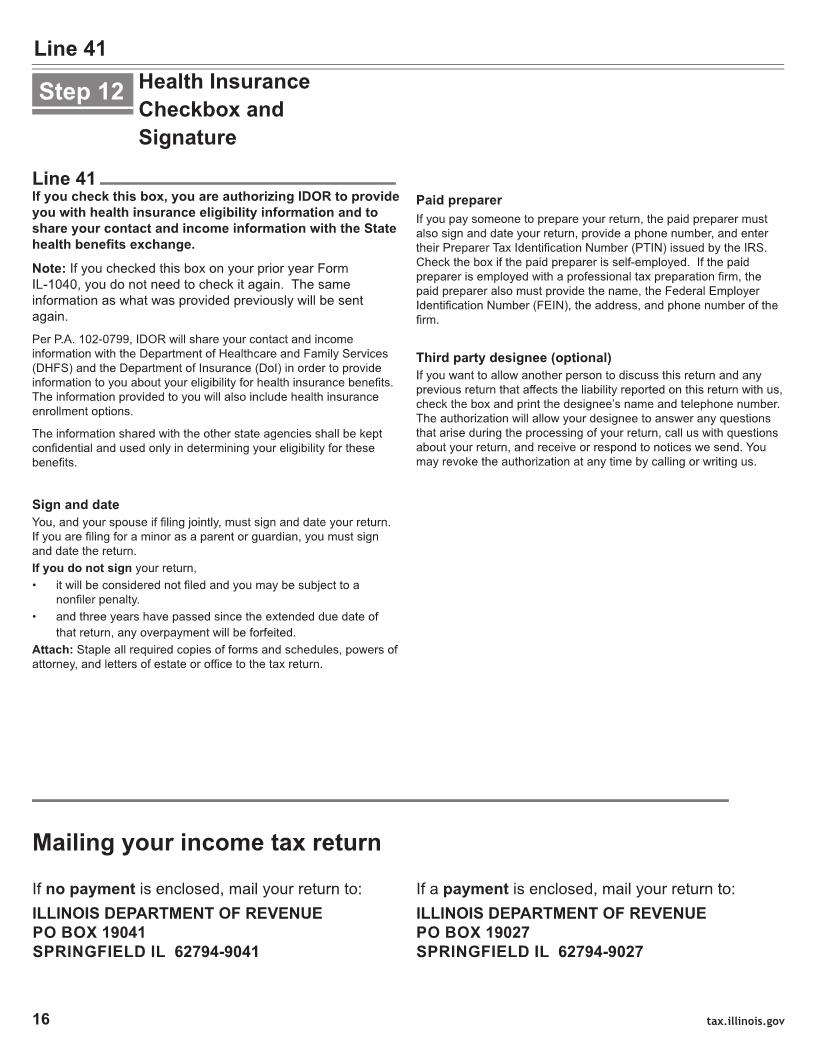

Mailing your income tax return:

If no payment is enclosed, mail your return to: If a payment is enclosed, mail your return to:

ILLINOIS DEPARTMENT OF REVENUE ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19041 PO BOX 19027

SPRINGFIELD IL 62794-9041 SPRINGFIELD IL 62794-9027

IL-1040 Instructions (R-12/23)

Printed by authority of the state of Illinois. Electronic only, one copy.