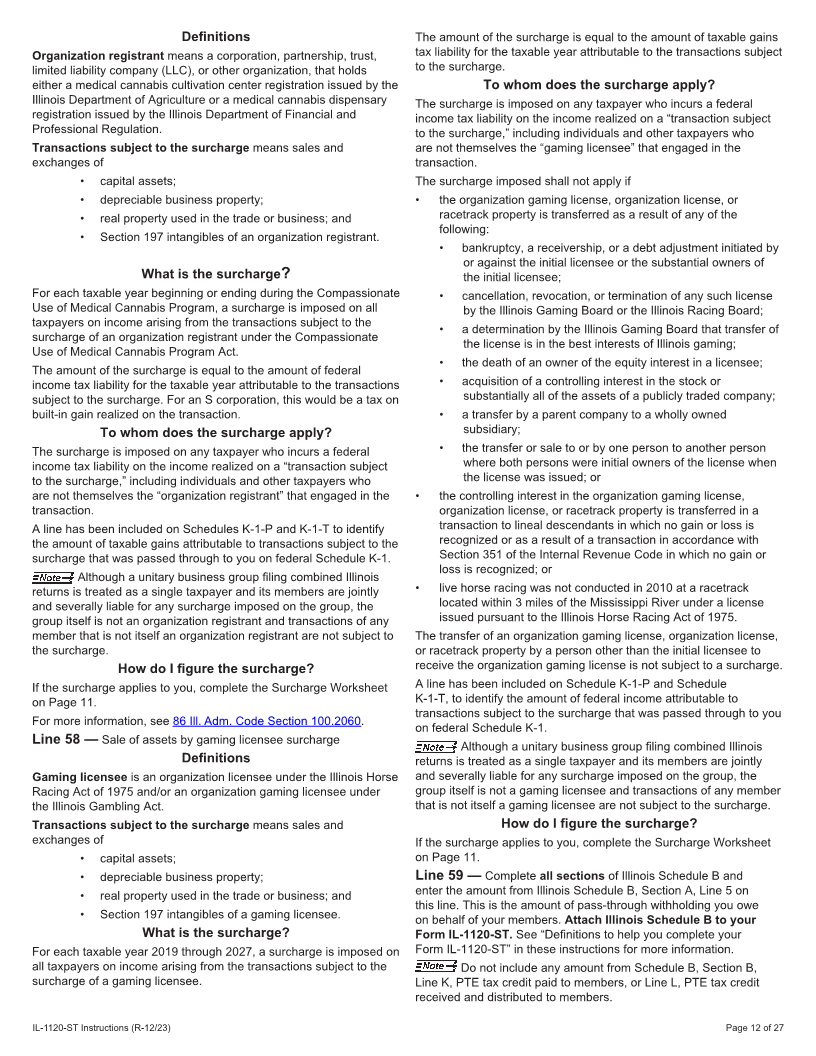

Enlarge image

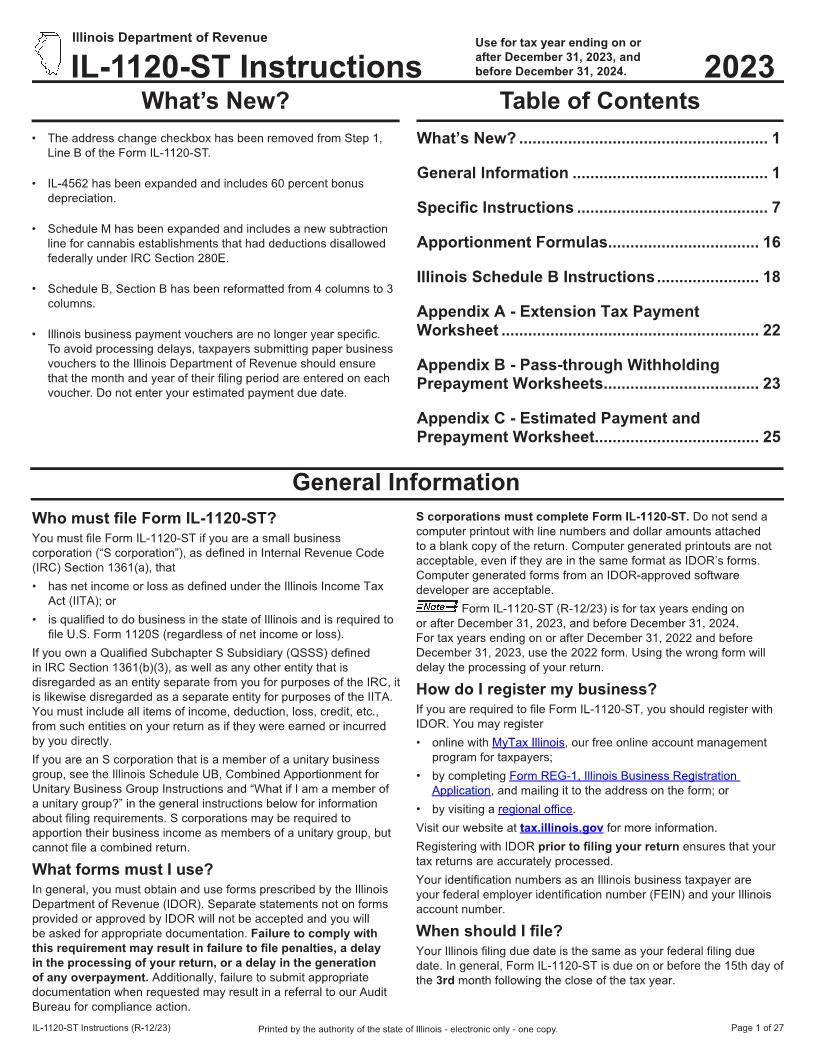

Illinois Department of Revenue Use for tax year ending on or

after December 31, 2023, and

before December 31, 2024.

IL-1120-ST Instructions 2023

What’s New? Table of Contents

• The address change checkbox has been removed from Step 1, What’s New? ........................................................ 1

Line B of the Form IL-1120-ST.

General Information ............................................ 1

• IL-4562 has been expanded and includes 60 percent bonus

depreciation.

Specific Instructions ........................................... 7

• Schedule M has been expanded and includes a new subtraction

line for cannabis establishments that had deductions disallowed Apportionment Formulas .................................. 16

federally under IRC Section 280E.

Illinois Schedule B Instructions ....................... 18

• Schedule B, Section B has been reformatted from 4 columns to 3

columns.

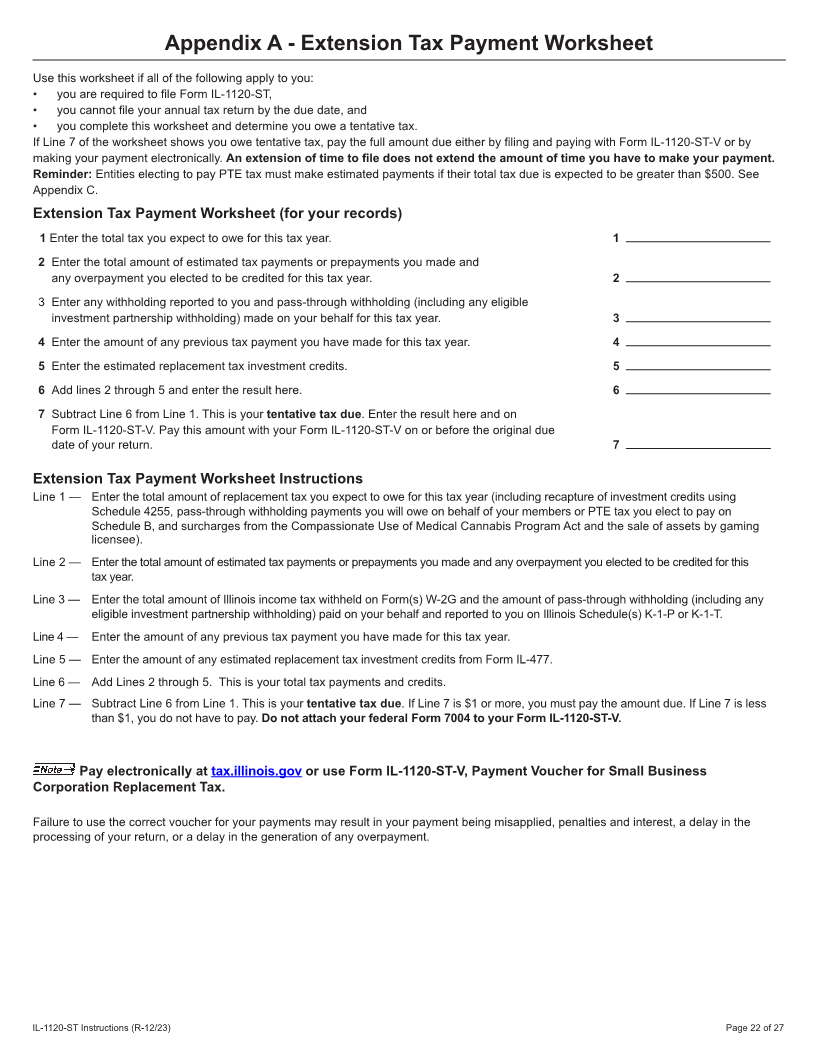

Appendix A - Extension Tax Payment

• Illinois business payment vouchers are no longer year specific. Worksheet .......................................................... 22

To avoid processing delays, taxpayers submitting paper business

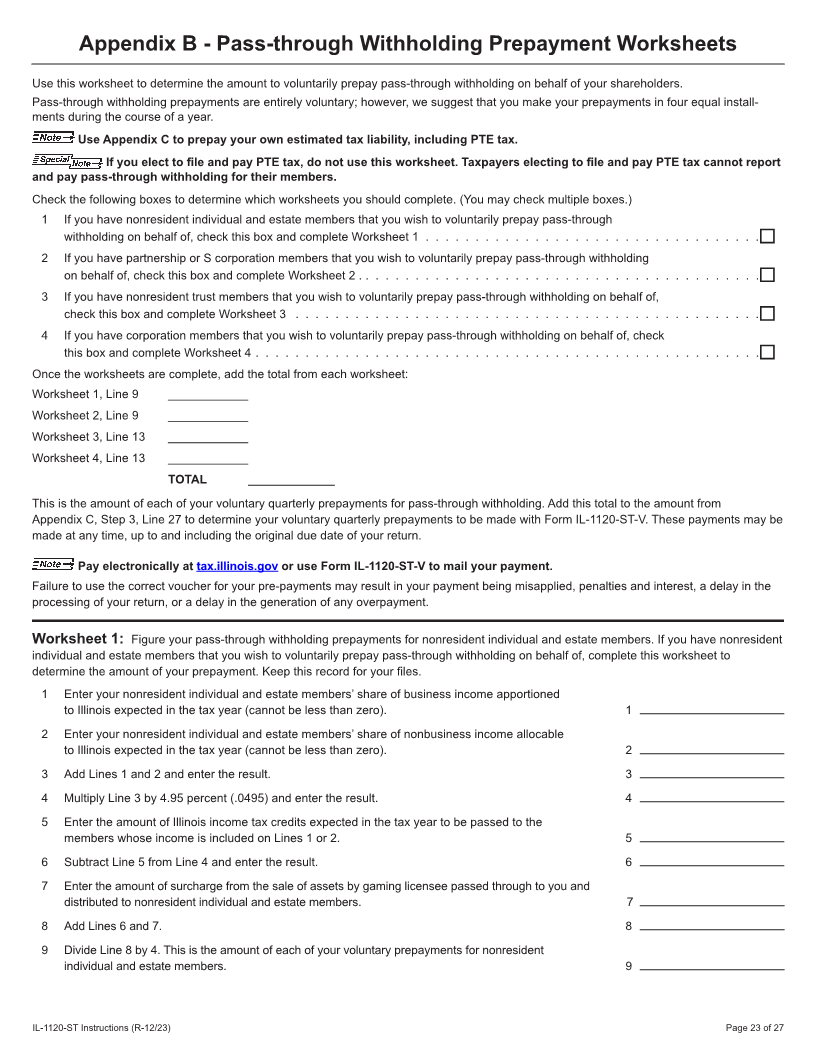

vouchers to the Illinois Department of Revenue should ensure Appendix B - Pass-through Withholding

that the month and year of their filing period are entered on each

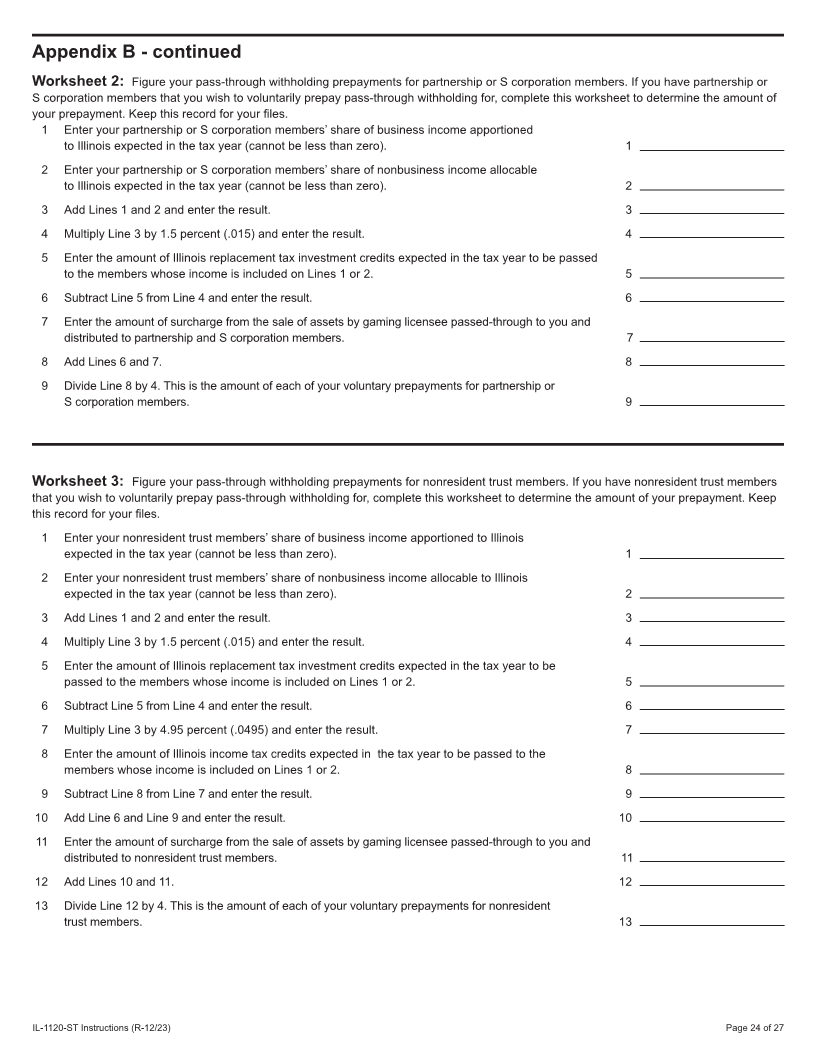

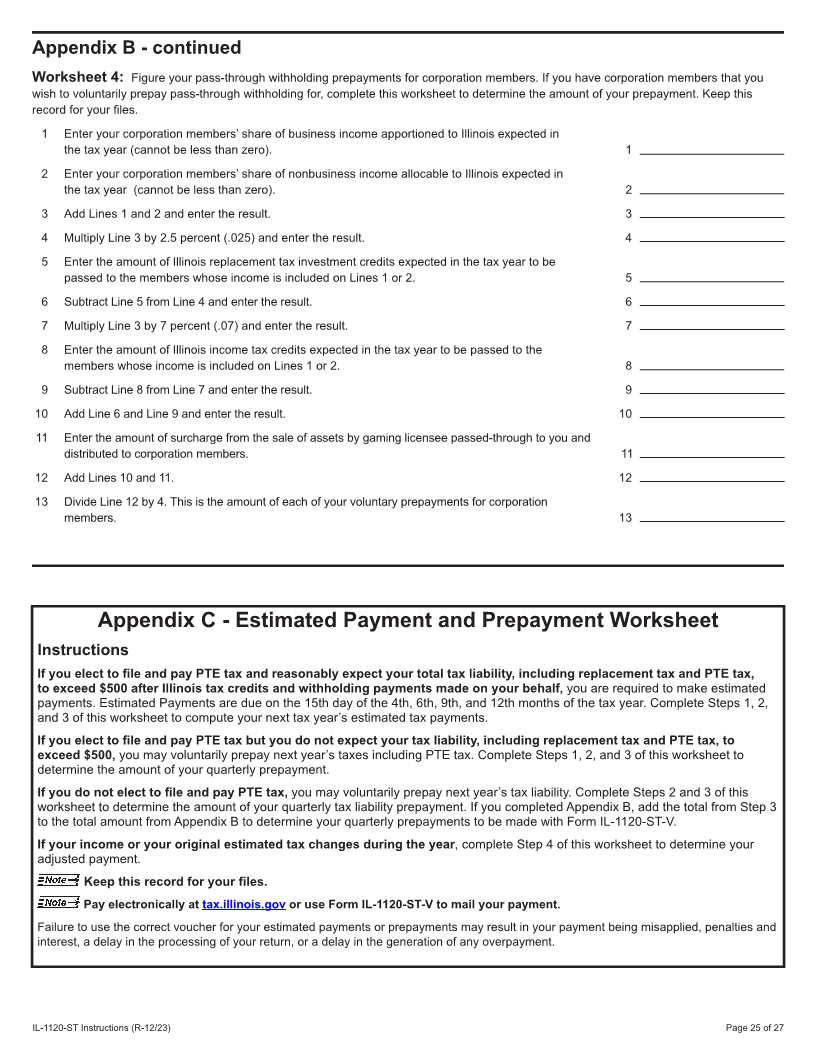

voucher. Do not enter your estimated payment due date. Prepayment Worksheets................................... 23

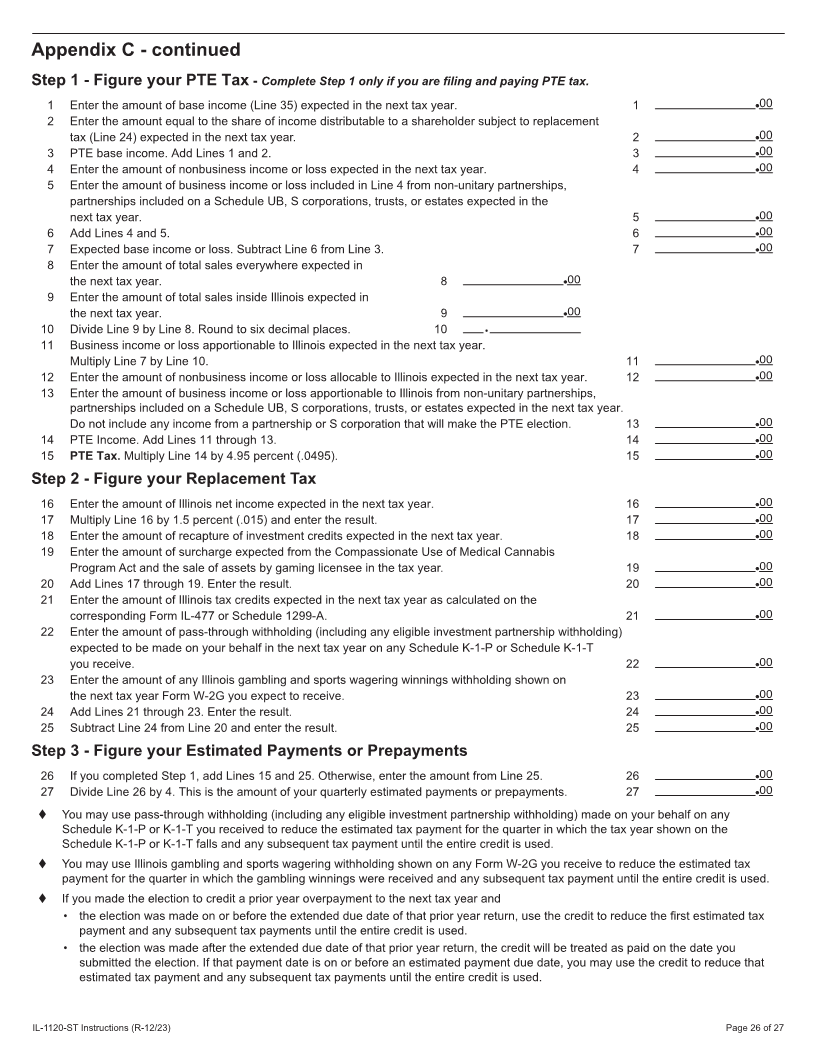

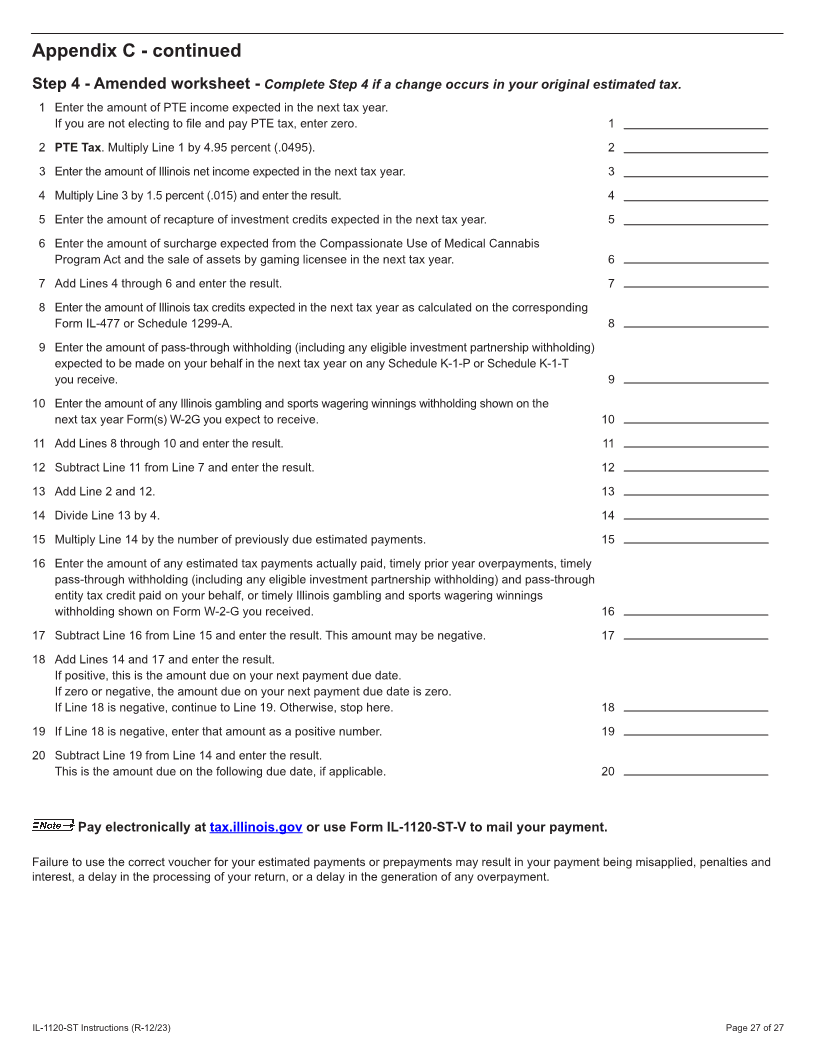

Appendix C - Estimated Payment and

Prepayment Worksheet..................................... 25

General Information

Who must file Form IL-1120-ST? S corporations must complete Form IL-1120-ST. Do not send a

computer printout with line numbers and dollar amounts attached

You must file Form IL-1120-ST if you are a small business

to a blank copy of the return. Computer generated printouts are not

corporation (“S corporation”), as defined in Internal Revenue Code

acceptable, even if they are in the same format as IDOR’s forms.

(IRC) Section 1361(a), that

Computer generated forms from an IDOR-approved software

• has net income or loss as defined under the Illinois Income Tax developer are acceptable.

Act (IITA); or

Form IL-1120-ST (R-12/23) is for tax years ending on

• is qualified to do business in the state of Illinois and is required to or after December 31, 2023, and before December 31, 2024.

file U.S. Form 1120S (regardless of net income or loss). For tax years ending on or after December 31, 2022 and before

If you own a Qualified Subchapter S Subsidiary (QSSS) defined December 31, 2023, use the 2022 form. Using the wrong form will

in IRC Section 1361(b)(3), as well as any other entity that is delay the processing of your return.

disregarded as an entity separate from you for purposes of the IRC, it

is likewise disregarded as a separate entity for purposes of the IITA. How do I register my business?

You must include all items of income, deduction, loss, credit, etc., If you are required to file Form IL-1120-ST, you should register with

from such entities on your return as if they were earned or incurred IDOR. You may register

by you directly. • online with MyTax Illinois, our free online account management

If you are an S corporation that is a member of a unitary business program for taxpayers;

group, see the Illinois Schedule UB, Combined Apportionment for • by completing Form REG-1, Illinois Business Registration

Unitary Business Group Instructions and “What if I am a member of Application, and mailing it to the address on the form; or

a unitary group?” in the general instructions below for information • by visiting a regional office.

about filing requirements. S corporations may be required to

apportion their business income as members of a unitary group, but Visit our website at tax.illinois.gov for more information.

cannot file a combined return. Registering with IDOR prior to filing your return ensures that your

tax returns are accurately processed.

What forms must I use?

Your identification numbers as an Illinois business taxpayer are

In general, you must obtain and use forms prescribed by the Illinois your federal employer identification number (FEIN) and your Illinois

Department of Revenue (IDOR). Separate statements not on forms account number.

provided or approved by IDOR will not be accepted and you will

be asked for appropriate documentation. Failure to comply with When should I file?

this requirement may result in failure to file penalties, a delay Your Illinois filing due date is the same as your federal filing due

in the processing of your return, or a delay in the generation date. In general, Form IL-1120-ST is due on or before the 15th day of

of any overpayment. Additionally, failure to submit appropriate the 3rd month following the close of the tax year.

documentation when requested may result in a referral to our Audit

Bureau for compliance action.

IL-1120-ST Instructions (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 1 of 27