- 2 -

Enlarge image

|

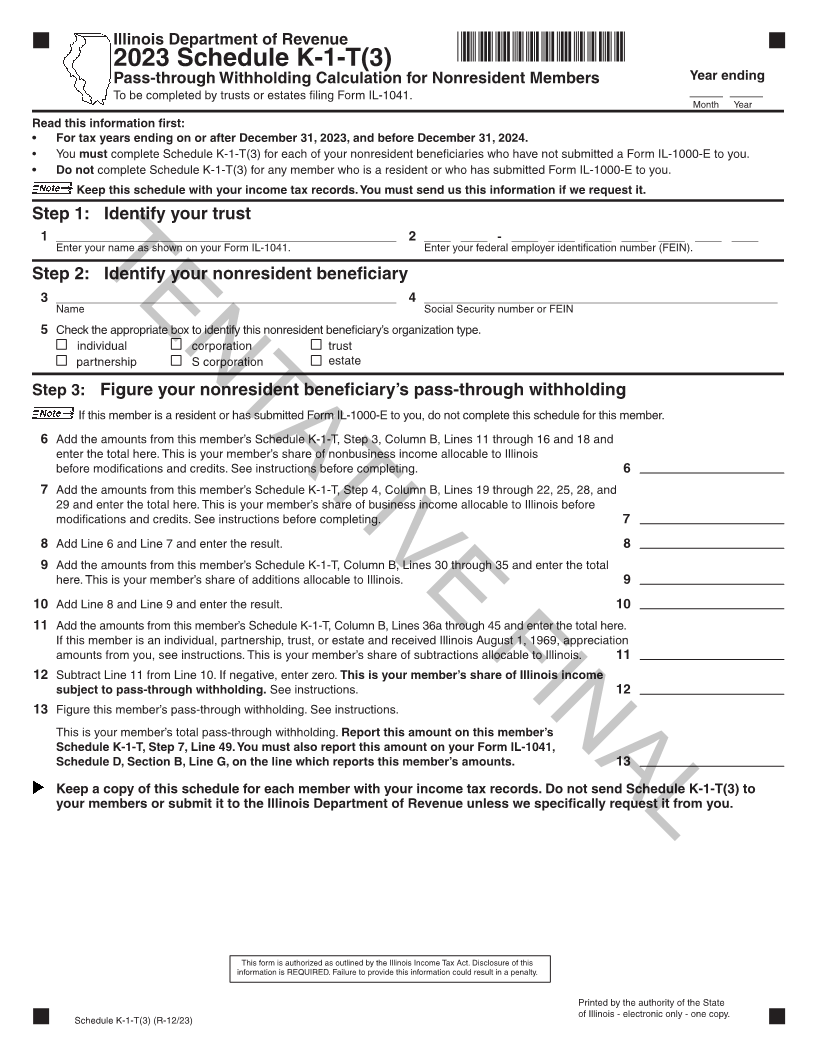

Illinois Department of Revenue

*78312231V*

2023 Schedule K-1-T(3)

Pass-through Withholding Calculation for Nonresident Members Year ending

To be completed by trusts or estates filing Form IL-1041. _____ _____

Month Year

Read this information first:

• For tax years ending on or after December 31, 2023, and before December 31, 2024.

• You must complete Schedule K-1-T(3) for each of your nonresident beneficiaries who have not submitted a Form IL-1000-E to you.

• Do not complete Schedule K-1-T(3) for any member who is a resident or who has submitted Form IL-1000-E to you.

Keep this schedule with your income tax records. You must send us this information if we request it.

Step 1: Identify your trust

1 ___________________________________________________ 2 ____ ____ - ____ ____ ____ ____ ____ ____ ____

Enter your name as shown on your Form IL-1041. Enter your federal employer identification number (FEIN).

Step 2: Identify your nonresident beneficiary TENTATIVE FINAL

3 ___________________________________________________ 4 _____________________________________________________

Name Social Security number or FEIN

5 Check the appropriate box to identify this nonresident beneficiary’s organization type.

individual corporation trust

partnership S corporation estate

Step 3: Figure your nonresident beneficiary’s pass-through withholding

If this member is a resident or has submitted Form IL-1000-E to you, do not complete this schedule for this member.

6 Add the amounts from this member’s Schedule K-1-T, Step 3, Column B, Lines 11 through 16 and 18 and

enter the total here. This is your member’s share of nonbusiness income allocable to Illinois

before modifications and credits. See instructions before completing. 6

7 Add the amounts from this member’s Schedule K-1-T, Step 4, Column B, Lines 19 through 22, 25, 28, and

29 and enter the total here. This is your member’s share of business income allocable to Illinois before

modifications and credits. See instructions before completing. 7

8 Add Line 6 and Line 7 and enter the result. 8

9 Add the amounts from this member’s Schedule K-1-T, Column B, Lines 30 through 35 and enter the total

here. This is your member’s share of additions allocable to Illinois. 9

10 Add Line 8 and Line 9 and enter the result. 10

11 Add the amounts from this member’s Schedule K-1-T, Column B, Lines 36a through 45 and enter the total here.

If this member is an individual, partnership, trust, or estate and received Illinois August 1, 1969, appreciation

amounts from you, see instructions. This is your member’s share of subtractions allocable to Illinois. 11

12 Subtract Line 11 from Line 10. If negative, enter zero. This is your member’s share of Illinois income

subject to pass-through withholding. See instructions. 12

13 Figure this member’s pass-through withholding. See instructions.

This is your member’s total pass-through withholding. Report this amount on this member’s

Schedule K-1-T, Step 7, Line 49. You must also report this amount on your Form IL-1041,

Schedule D, Section B, Line G, on the line which reports this member’s amounts. 13

Keep a copy of this schedule for each member with your income tax records. Do not send Schedule K-1-T(3) to

your members or submit it to the Illinois Department of Revenue unless we specifically request it from you.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide this information could result in a penalty.

Printed by the authority of the State

of Illinois - electronic only - one copy.

Schedule K-1-T(3) (R-12/23)

|