Enlarge image

Illinois Department of Revenue Use for tax year ending on or

after December 31, 2023, and

before December 31, 2024.

IL-1120 Instructions 2023

What’s New? Table of Contents

• The address change checkbox has been removed from Step 1, What’s New? ........................................................ 1

Line B of the Form IL-1120.

• IL-4562 has been expanded and includes 60 percent bonus General Information ............................................ 1

depreciation.

• Schedule M has been expanded and includes a new subtraction Specific Instructions ........................................... 6

line for cannabis establishments that had deductions disallowed

federally under IRC Section 280E.

Apportionment Formulas .................................. 15

• Income Tax Credits -- Information about all the credits can be

found in Schedule 1299-I.

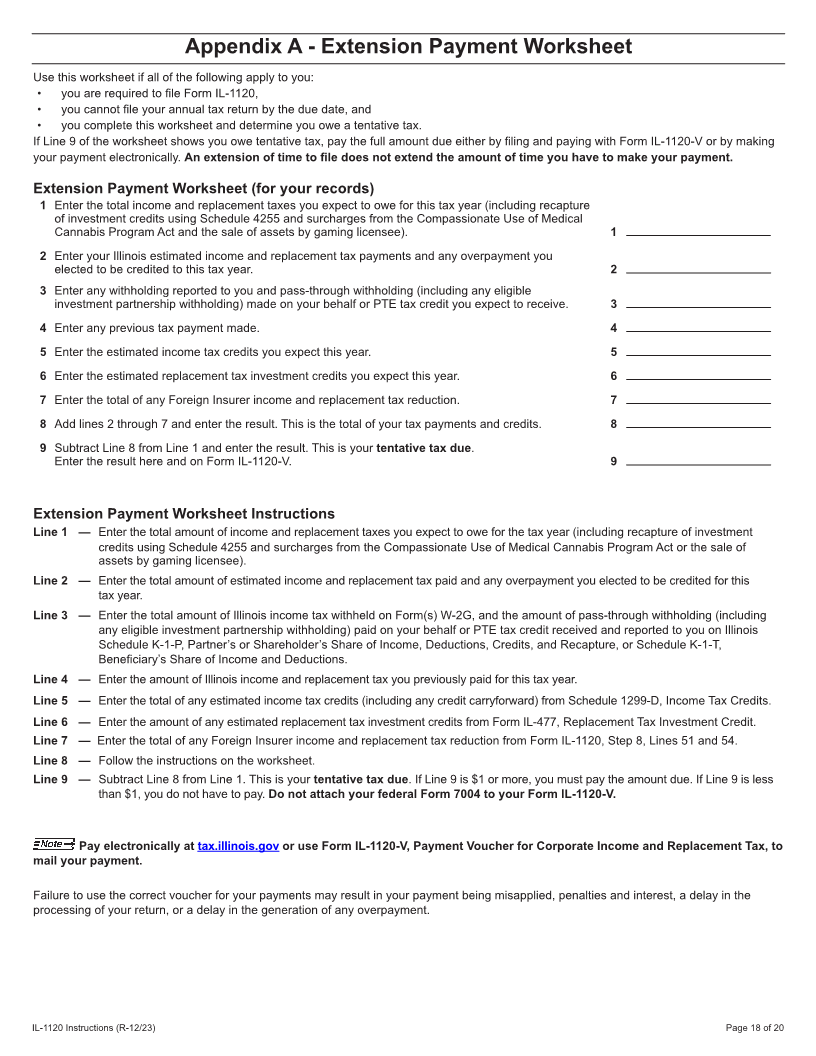

Appendix A - Extension Tax Payment

• No new credits will be issued for the:

Worksheet .......................................................... 18

• Agritourism Liability Insurance income tax credit (Credit Code

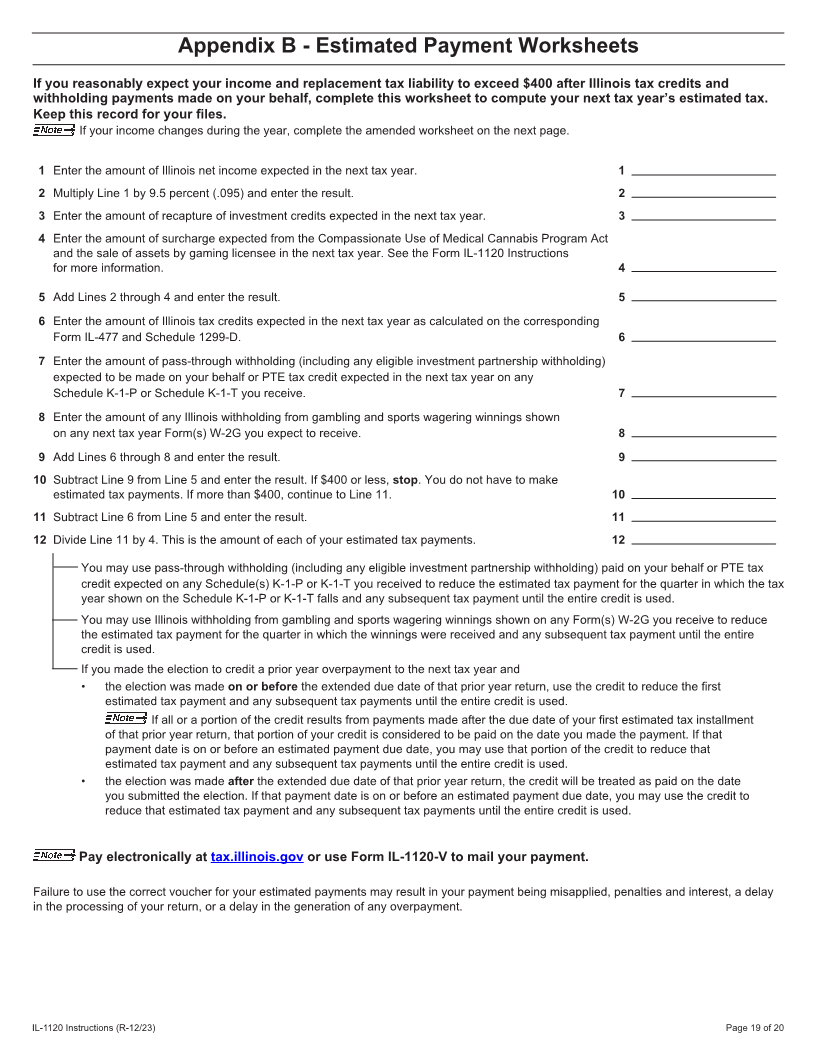

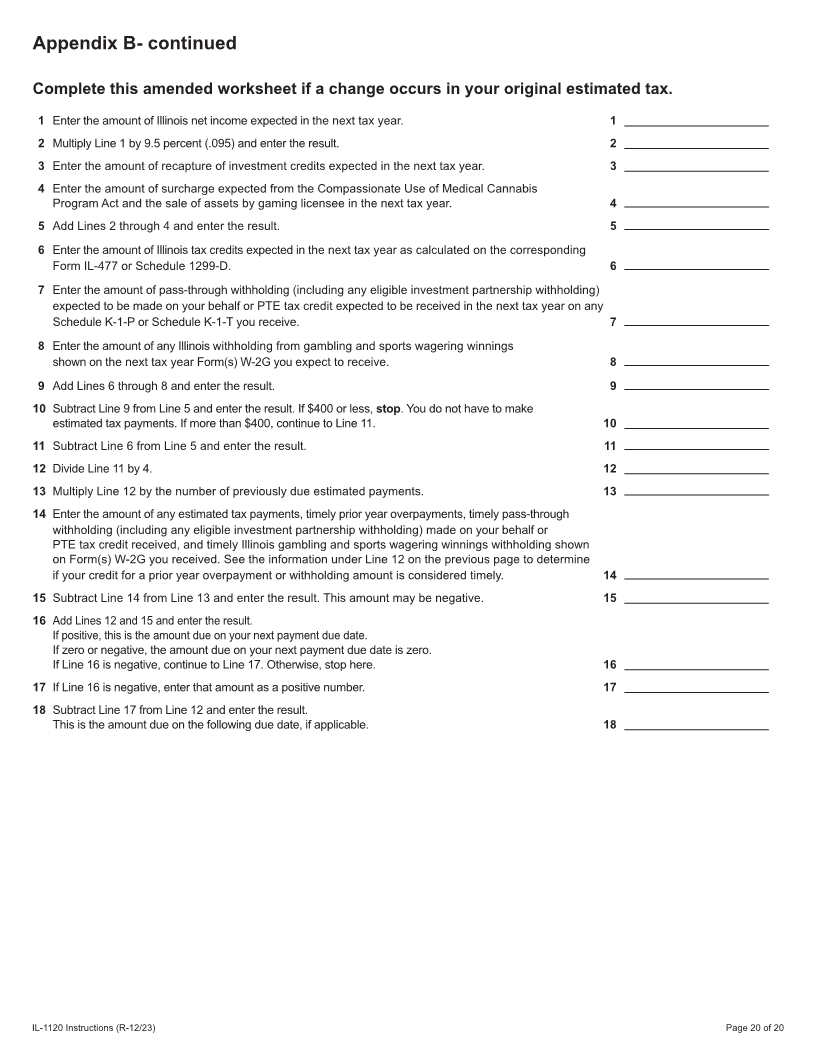

5440) for tax years ending after December 31, 2023 Appendix B - Estimated Payment

• Invest in Kids credit (Credit Code 5660) for tax years ending Worksheets ........................................................ 19

after December 31, 2023

• Illinois business payment vouchers are no longer year specific.

To avoid processing delays, taxpayers submitting paper

business vouchers to the Illinois Department of Revenue should

ensure that the month and year of their filing period are entered

on each voucher. Do not enter your estimated payment due

date.

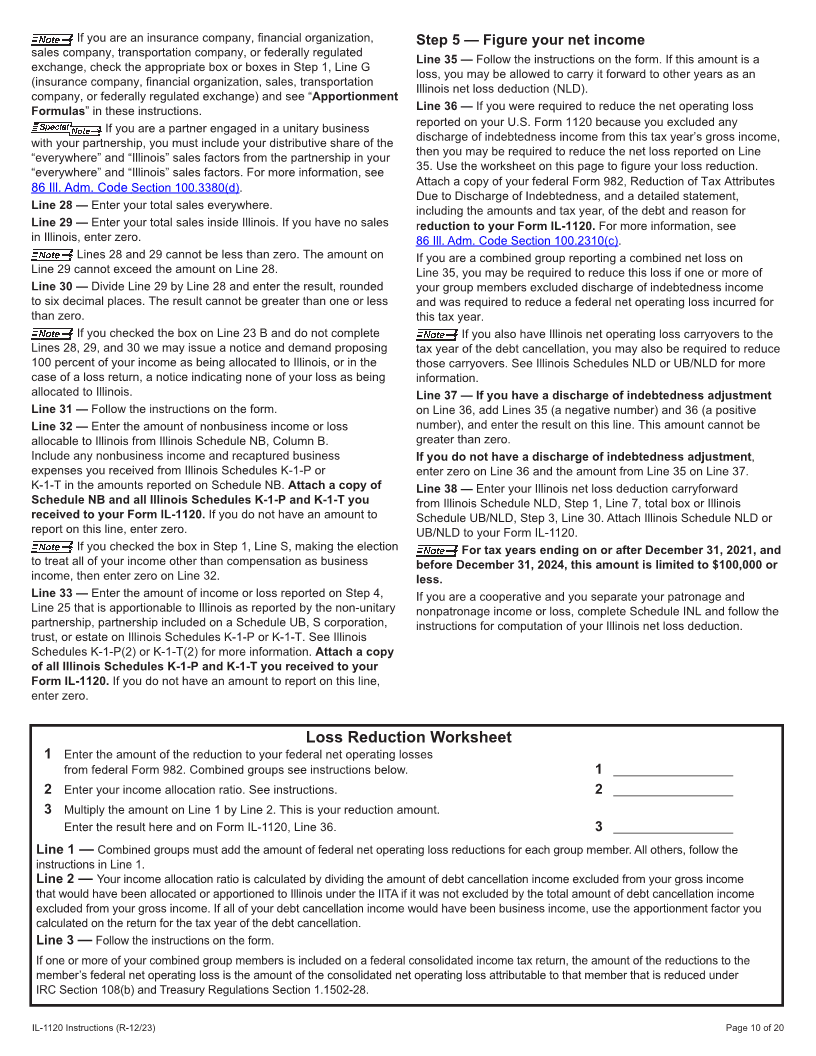

General Information

Who must file Form IL-1120? Foreign corporations — If you are a foreign corporation, you must

You must file Form IL-1120 if you are a corporation that observe the same filing requirements as U.S. domestic corporations.

For Illinois purposes, you should report the taxable income you are

• has net income or loss as defined under the Illinois Income Tax reporting for federal purposes under IRC Sections 881 through 885.

Act (IITA); or You must use only the domestic factor information regarding sales

• is qualified to do business in the state of Illinois and is required information in the “everywhere” denominator when apportioning

to file a federal income tax return (regardless of net income or business income to Illinois. If you are a foreign corporation that is a

loss). member of a unitary business group, see Illinois Schedule UB and

Unitary filers — If you are a corporation that is a member of Instructions for information about filing requirements.

a unitary business group, see Illinois Schedule UB, Combined Domestic international sales corporations and foreign sales

Apportionment for Unitary Business Group, and its Instructions for corporations — If you are a Domestic International Sales

information about filing requirements. Corporation (DISC) under IRC Section 992, you are not subject to

Political organizations and homeowners’ associations — If you the taxes imposed by IRC Subtitle A (except for the tax imposed on

are a corporation that falls under the definition in Internal Revenue transfers to avoid income tax under IRC Section 1491). Similarly, you

Code (IRC), Sections 527 and 528, and you report your federal are not required to file Form IL-1120.

taxable income on U.S. Form 1120-POL or U.S. Form 1120-H, you For Illinois purposes, distributions from DISCs are treated in

are subject to Illinois Income and Replacement Taxes and must file accordance with the federal rules pertaining to dividends, dividend

Form IL-1120. exclusions, and dividend-received deductions.

Cooperatives — If you are a corporation operating on a cooperative If you are a Foreign Sales Corporation (FSC) for federal purposes

basis under IRC Section 1381, and file U.S. Form 1120-C, you are and have federal taxable income apportionable or allocable to Illinois,

subject to Illinois Income and Replacement Taxes and must file you are subject to Illinois tax rules applicable to all corporations. You

Form IL-1120. are taxed by Illinois to the extent that your nonexempt foreign trade

Settlement funds — If you are a settlement fund under IRC income, investment income, and carrying charges (taxable for federal

Section 468B and you report your federal taxable income on purposes) are apportionable or allocable to Illinois.

U.S. Form 1120-SF, you are subject to Illinois Income and Corporate shareholders who derive income from Illinois

Replacement Taxes and must file Form IL-1120. should include actual and deemed distributions from a DISC or FSC

Limited liability companies — If you are a limited liability company in business income.

and you file as a corporation for federal income tax purposes, you Real estate mortgage investment conduits (REMIC) — If you

are treated as a corporation for Illinois purposes. are a real estate mortgage investment conduit in accordance

with IRC Section 860A through G, you are not required to file

Form IL-1120.

IL-1120 Instructions (R-12/23) Printed by the authority of the State of Illinois - web only - one copy. Page 1 of 20