- 2 -

Enlarge image

|

*32812191V*

Illinois Department of Revenue Year ending

Gains from Sales or Exchanges

Schedule F of Property Acquired Month Year

Attach to your Form IL-1120-ST Before August 1, 1969 IL Attachment No. 16

Enter your name as shown on your Form IL-1120-ST. Enter your federal employer identification number (FEIN).

You should file this schedule only if you reported gains from the disposition of property acquired before August 1, 1969, as shown on

U.S. Form 1120S, Schedule D (or U.S. Form 8949, if applicable), and U.S. Form 4797 or U.S. Form 6252. See instructions.

You must attach a copy of U.S. Form 1120S, Schedule D, and U.S. Form 4797, 6252, or 8949, if filed.

TENTATIVE A B C D E FINALF G

Section 1245 Section

Date acquired Date sold Federal gain or 1250 gain 1231 gain

Description of property (month/year) (month/year) this year (see instructions) (see instructions) Capital gain

1 a

b

c

d

H I J K L M

Subtract Col. I from Col. H Section 1231, 1245, Section 1231, 1245,

August 1, 1969, value Federal tax or fraction in and 1250 Gain and 1250 Gain Capital Gain

or applicable fraction basis on Col. H times Col. D Enter smaller of Subtract Col. K from Col. J Enter smaller of

(see instructions) August 1, 1969 (see instructions) Col. E or Col. J but not more than Col. F Col. G or Col. J

a

b

c

d

2 Enter your share of pre-August 1, 1969, appreciation amounts from

partnerships, trusts, and estates. 2

3 Enter the total of Column K here and on Schedule K-1-P, Step 6, Line 48, Col A. 3

4 Enter the total of Column L here and on Schedule K-1-P, Step 6, Line 49, Column A. 4

5 Enter the amount from Line 4 attributable to involuntary conversions by casualty and theft. 5

6 Subtract Line 5 from Line 4. Enter the result here and on Schedule K-1-P, Step 6, Line 50, Column A. 6

7 Enter the total of Column M here and on Schedule K-1-P, Step 6, Line 51, Column A. 7

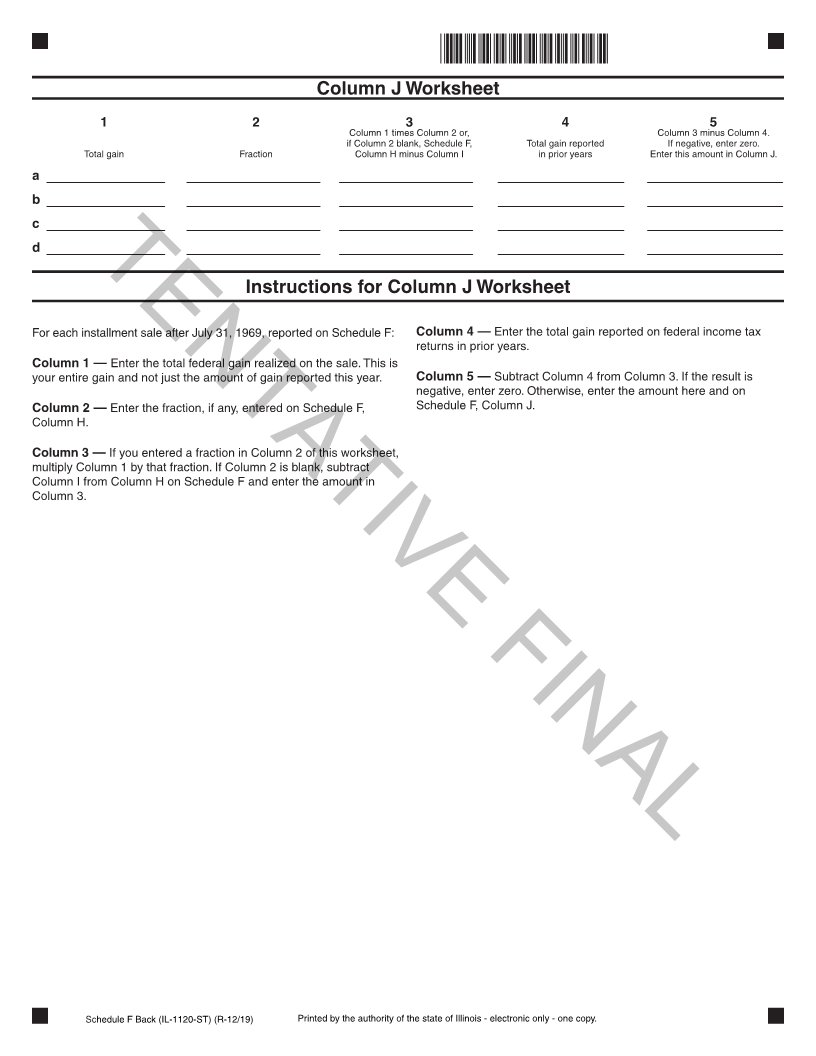

Installment Sales

If, on your U.S. Form 1120S, Schedule D, U.S. Form 8949, or U.S. Form 4797, you reported gains from an installment sale of property acquired before

August 1, 1969, complete the Column J Worksheet. If, for federal tax purposes, you filed U.S. Form 6252 but were not required to file U.S Form 4797,

attach to your Schedule F: (1) a statement that you were not required to file U.S. Form 4797 and (2) a copy of the U.S. Form 6252 as filed.

Installment sales before August 1, 1969 Installment sales on or after August 1, 1969

Complete Schedule F Complete Schedule F

Columns A through C — Follow Schedule F Instructions. Columns A through I — Follow Schedule F Instructions.

Column D — Enter “INST” to indicate installment. Column J — Complete the worksheet on the next page and enter in

Columns E through J — Leave blank. this column the amount from Column 5 of the worksheet.

Column K — Enter the amount of Section 1245 or 1250 gain from

this sale reported this year on your U.S. Form 4797 or 6252. The heading for Column J does not describe this entry.

Column K through M — Follow Schedule F Instructions.

Column L — Enter the amount of Section 1231 gain from this sale

reported this year on your U.S. Form 4797 or 6252.

Column M — Enter the total amount of gain from this sale reported

this year on U.S. Form 1120S, Schedule D, or U.S. Form 8949.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule F Front (IL-1120-ST) (R-12/19) information is REQUIRED. Failure to provide information could result in a penalty.

|