Enlarge image

Illinois Department of Revenue

2023 Schedule CR (IL-1041) Instructions

General Information

What is the purpose of Schedule CR?

Schedule CR allows you to take an Illinois Income Tax credit for income taxes you paid to another state on income you received while a

resident of Illinois. You are allowed this credit only if you file a tax return with that state and if the same income is taxed by both Illinois and

the other state during the same taxable year. In Illinois, this income is considered to be “double-taxed” income. This credit is limited to the

amount of Illinois tax that you have also paid on the double-taxed income. This credit can be taken against both income and replacement

tax.

Which version of Schedule CR should I use?

Use this form only for calendar year 2023 and subsequent tax years. If you are filing for an earlier tax year, you must use the appropriate

revision for that year. Prior year forms may be found on the Illinois Department of Revenue’s (IDOR) website at tax.illinois.gov.

What taxes qualify for the credit?

Taxes that qualify for the credit are income taxes you paid to another state of the United States, the District of Columbia, Puerto Rico, or any

territory or possession of the United States, or to a political subdivision (such as a city or county) of one of these jurisdictions. No credit is

allowed for taxes paid to the federal government or to foreign countries or to their political subdivisions.

Note: If you have received any employee compensation (i.e., salary received as income in respect of a decedent) from a source in Iowa,

Kentucky, Michigan, or Wisconsin, refer to the instructions for Form IL-1040 (Individual Income Tax Return), Schedule CR (Credit for Taxes

Paid to Other States) for rules concerning compensation in states with reciprocal agreements.

To qualify for this credit, a tax must be deductible as state and local income tax on your federal Form 1041, U.S. Income Tax Return for

Estates and Trusts, Page 1, Line 11, whether or not you actually claimed the deduction. The Michigan Single Business Tax is not an income

tax and does not qualify for the credit.

A resident trust that is a partner or shareholder of a pass-through entity which paid income tax to another state substantially similar to the

Pass-through entity (PTE) tax [Illinois Income Tax Act (IITA)Section 201(p)], may treat a distributive share of such tax paid by the pass-

through entity as tax you paid. See Line 52 instructions for more information.

Note: No credit is allowed for interest or penalties imposed on you, even in connection with an income tax. You may claim the credit for

income taxes paid on your behalf (e.g., by withholding or with a composite return), but only if you are the person legally liable for the tax (i.e.,

if you would be required to pay the tax if it had not been paid on your behalf).

What forms must I attach to receive this credit?

You must attach copies of your federal Form 1041, Page 1, with a detailed breakdown of the amount on Line 11. Keep your out-of-state tax

returns with your records. You must send us this information if we request it.

Should I round?

You must round the dollar amounts on Schedule CR (IL-1041) to whole-dollar amounts. To do this, you should drop any amount less than 50

cents and increase any amount of 50 cents or more to the next higher dollar.

What if I need additional assistance or forms?

• For assistance, forms, or schedules, visit our website at tax.illinois.gov or scan the QR code provided.

• Call 1 800 732-8866 or 217 782-3336 (TTY at 1 800 544-5304).

• Write us at:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19001

SPRINGFIELD, ILLINOIS 62794-9001

• Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m. (Springfield office) and 8:30 a.m. to 5:00 p.m.

(all other offices), Monday through Friday.

Specific Instructions

If a specific line is not referenced, follow the instructions on the form.

Note: The Business or Farm Income Apportionment Formula (IAF) Worksheet and the Partnership, S corporation, Trust (PST) Business

Income Worksheet, which are referenced in many of the following specific line instructions, are located on the last page of this document.

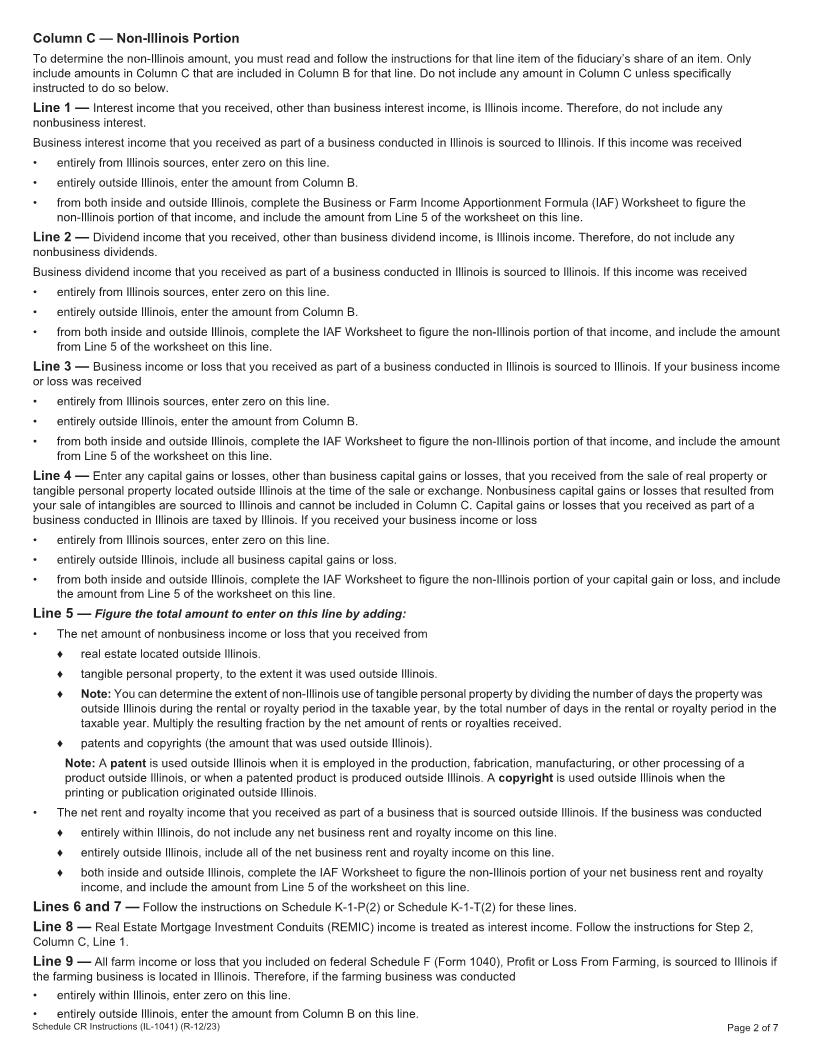

Step 2: Figure the non-Illinois portions of your federal taxable income

Column A — Federal Form 1041

Enter the amounts exactly as reported on your federal Form 1041.

Column B — Fiduciary’s Share

For each line item, enter the fiduciary’s share of the amounts shown in Column A.

Schedule CR Instructions (IL-1041) (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 1 of 7