Enlarge image

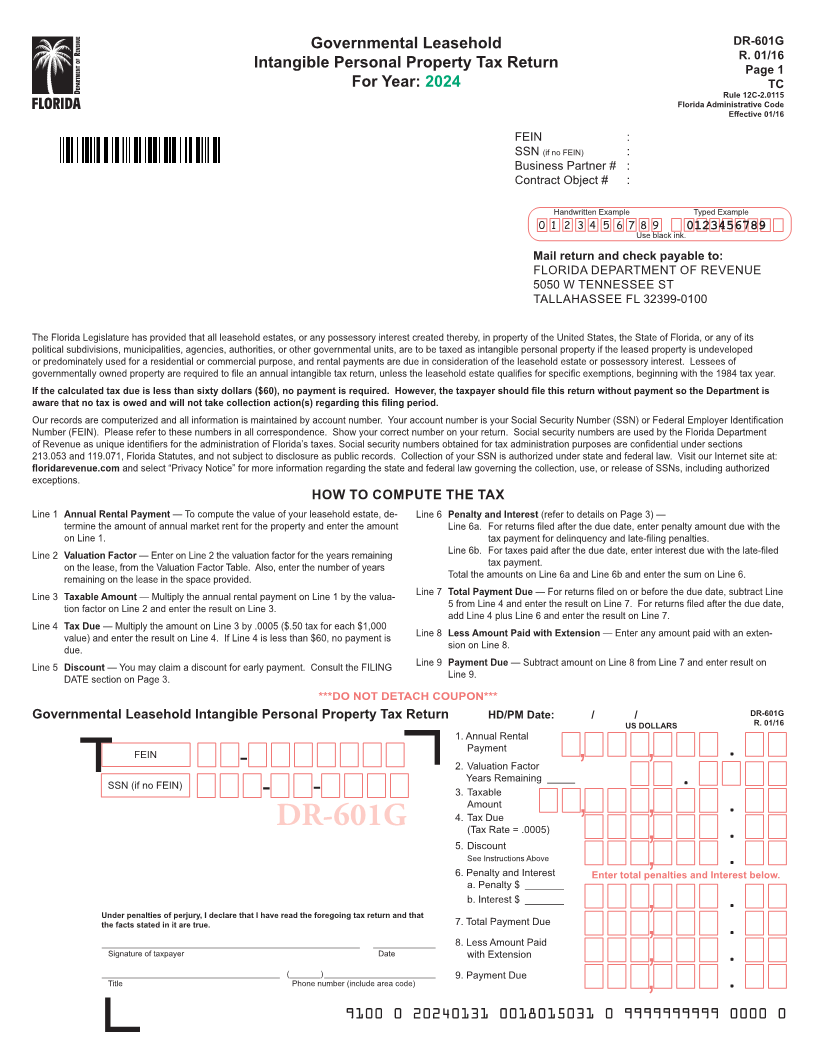

Governmental Leasehold DR-601G

R. 01/16

Intangible Personal Property Tax Return Page 1

For Year: 2024 TC

Rule 12C-2.0115

Florida Administrative Code

Effective 01/16

FEIN :

SSN(if no FEIN):

Business Partner # :

Contract Object # :

Handwritten Example Typed Example

0 1 2 3 4 5 6 7 8 9Use black ink. 0123456789

Mail return and check payable to:

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

TALLAHASSEE FL 32399‑0100

The Florida Legislature has provided that all leasehold estates, or any possessory interest created thereby, in property of the United States, the State of Florida, or any of its

political subdivisions, municipalities, agencies, authorities, or other governmental units, are to be taxed as intangible personal property if the leased property is undeveloped

or predominately used for a residential or commercial purpose, and rental payments are due in consideration of the leasehold estate or possessory interest. Lessees of

governmentally owned property are required to file an annual intangible tax return, unless the leasehold estate qualifies for specific exemptions, beginning with the 1984 tax year.

If the calculated tax due is less than sixty dollars ($60), no payment is required. However, the taxpayer should file this return without payment so the Department is

aware that no tax is owed and will not take collection action(s) regarding this filing period.

Our records are computerized and all information is maintained by account number. Your account number is your Social Security Number (SSN) or Federal Employer Identification

Number (FEIN). Please refer to these numbers in all correspondence. Show your correct number on your return. Social security numbers are used by the Florida Department

of Revenue as unique identifiers for the administration of Florida’s taxes. Social security numbers obtained for tax administration purposes are confidential under sections

213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at:

floridarevenue.com and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized

exceptions.

HOW TO COMPUTE THE TAX

Line 1 Annual Rental Payment — To compute the value of your leasehold estate, de‑ Line 6 Penalty and Interest (refer to details on Page 3) —

termine the amount of annual market rent for the property and enter the amount Line 6a. For returns filed after the due date, enter penalty amount due with the

on Line 1. tax payment for delinquency and late-filing penalties.

Line 2 Valuation Factor — Enter on Line 2 the valuation factor for the years remaining Line 6b. For taxes paid after the due date, enter interest due with the late-filed

on the lease, from the Valuation Factor Table. Also, enter the number of years tax payment.

remaining on the lease in the space provided. Total the amounts on Line 6a and Line 6b and enter the sum on Line 6.

Line 3 Taxable Amount — Multiply the annual rental payment on Line 1 by the valua‑ Line 7 Total Payment Due — For returns filed on or before the due date, subtract Line

tion factor on Line 2 and enter the result on Line 3. 5 from Line 4 and enter the result on Line 7. For returns filed after the due date,

add Line 4 plus Line 6 and enter the result on Line 7.

Line 4 Tax Due — Multiply the amount on Line 3 by .0005 ($.50 tax for each $1,000

value) and enter the result on Line 4. If Line 4 is less than $60, no payment is Line 8 Less Amount Paid with Extension — Enter any amount paid with an exten‑

due. sion on Line 8.

Line 5 Discount — You may claim a discount for early payment. Consult the FILING Line 9 Payment Due — Subtract amount on Line 8 from Line 7 and enter result on

DATE section on Page 3. Line 9.

***DO NOT DETACH COUPON***

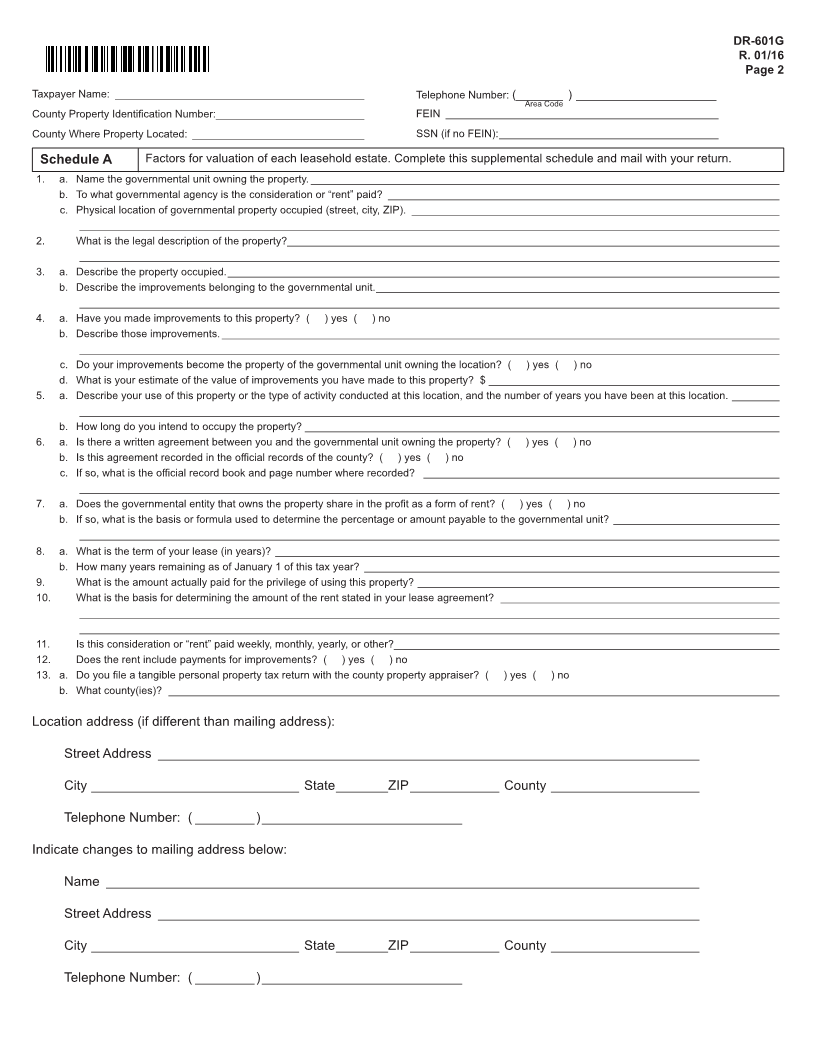

Governmental Leasehold Intangible Personal Property Tax Return HD/PM Date: / / DR-601G

US DOLLARS R. 01/16

1. Annual Rental

Payment

FEIN 2. Valuation Factor , ,

‑

Years Remaining _____

SSN (if no FEIN)

‑ ‑ 3. Taxable

Amount

4. Tax Due , ,

DR-601G (Tax Rate = .0005)

5. Discount ,

See Instructions Above

6. Penalty and Interest Enter total penalties, and Interest below.

a. Penalty $ _______

b. Interest $ _______

Under penalties of perjury, I declare that I have read the foregoing tax return and that ,

the facts stated in it are true. 7. Total Payment Due

__________________________________________________________ ______________ 8. Less Amount Paid ,

Signature of taxpayer Date with Extension

,

________________________________________ (_______) _________________________ 9. Payment Due

Title Phone number (include area code)

,

9100 0 20240131 0018015031 0 9999999999 0000 0