Enlarge image

For Office Use Only

Acct#

City of Chicago

Tax Division

2 N. La Salle Street, Suite 1310

Chicago, IL 60602

(Please Do Not Send Any Payments with This Form)

FOR TAX PURPOSES ONLY – DO NOT USE THIS FORM IF YOU ARE REQUIRED TO HOLD A

CHICAGO BUSINESS LICENSE

New Accounts Information Sheet – Corporations/Partnerships/LLC’s etc.

(This form is not required if this Corp./Partnership etc. currently or previously has held a City of Chicago Business license.)

(Bold faced items are required to begin the processing of your application.)

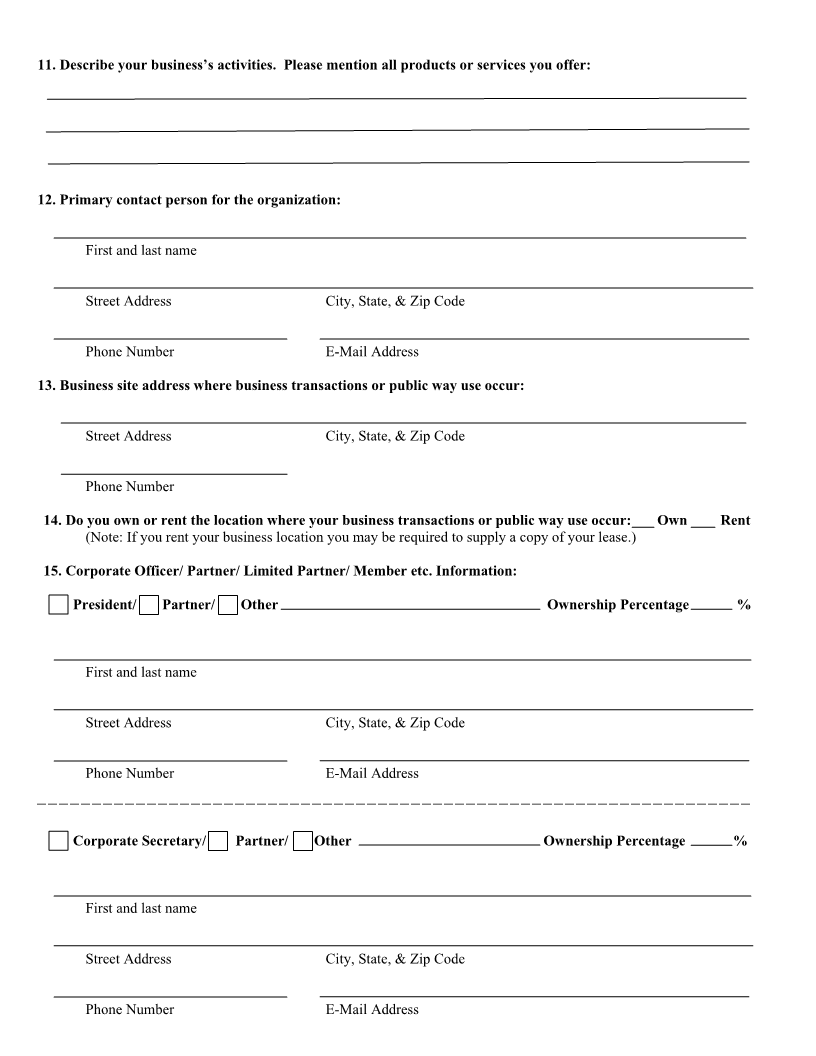

1. What is the Legal Name of your Corporation, Partnership, Limited Partnership, LLC, or Not-For Profit

Corporation?

2. What is the Doing Business As (DBA) name of your entity (if different than Legal Name)? *

*(If different you must apply for an Assumed Name at 118 N. Clark Street, Lower Level, Chicago, IL 60602 (312) 603-5652))

3. FEIN #: 4. In which State did you Incorporate:

5. Date of Incorporation (for Corp or LLC): 6. State of IL File:

7. State of IL Exemption # (for non-profit): Exp. Date:

8. Illinois Business Tax (IBT) Number **:

(Needed if goods are sold or if you have employees other than yourself on your payroll)

**If you do not have a current IBT#, you may obtain one from the IL Dept. of Revenue at 100 W. Randolph St., 7 thFloor (217) 785-3707.

9. Do you employ 50 or more individuals who work in Chicago: Yes / No (Circle one)

10. Do you rent out or lease tangible items which are used in Chicago: Yes / No (Circle one)