Enlarge image

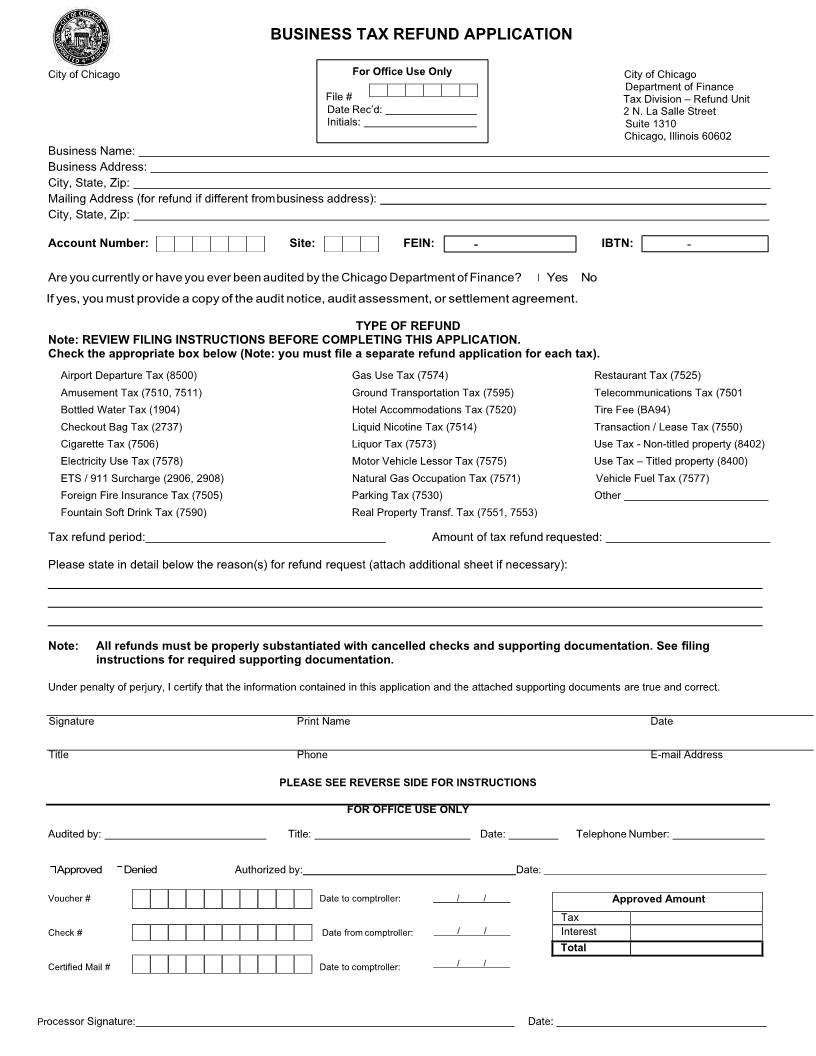

BUSINESS TAX REFUND APPLICATION

City of Chicago For Office Use Only City of Chicago

Department of Finance

File # Tax Division – Refund Unit

Date Rec’d: 2 N. La Salle Street

Initials: Suite 1310

Chicago, Illinois 60602

Business Name:

Business Address:

City, State, Zip:

Mailing Address (for refund if different from business address):

City, State, Zip:

Account Number: Site: FEIN: - IBTN: -

Are you currently or have you ever been audited by the Chicago Department of Finance? Yes No

If yes, you must provide a copy of the audit notice, audit assessment, or settlement agreement.

TYPE OF REFUND

Note: REVIEW FILING INSTRUCTIONS BEFORE COMPLETING THIS APPLICATION.

Check the appropriate box below (Note: you must file a separate refund application for each tax).

◻ Airport Departure Tax (8500) ◻ Gas Use Tax (7574) ◻ Restaurant Tax (7525)

◻ Amusement Tax (7510, 7511) ◻ Ground Transportation Tax (7595) ◻ Telecommunications Tax (7501

◻ Bottled Water Tax (1904) ◻ Hotel Accommodations Tax (7520) ◻ Tire Fee (BA94)

◻ Checkout Bag Tax (2737) ◻ Liquid Nicotine Tax (7514) ◻ Transaction / Lease Tax (7550)

◻ Cigarette Tax (7506) ◻ Liquor Tax (7573) ◻ Use Tax - Non-titled property (8402)

◻ Electricity Use Tax (7578) ◻ Motor Vehicle Lessor Tax (7575) ◻ Use Tax – Titled property (8400)

◻ ETS / 911 Surcharge (2906, 2908) ◻ Natural Gas Occupation Tax (7571) ◻ Vehicle Fuel Tax (7577)

◻ Foreign Fire Insurance Tax (7505) ◻ Parking Tax (7530) ◻ Other

◻ Fountain Soft Drink Tax (7590) ◻ Real Property Transf. Tax (7551, 7553)

Tax refund period: Amount of tax refund requested:

Please state in detail below the reason(s) for refund request (attach additional sheet if necessary):

Note: All refunds must be properly substantiated with cancelled checks and supporting documentation. See filing

instructions for required supporting documentation.

Under penalty of perjury, I certify that the information contained in this application and the attached supporting documents are true and correct.

Signature Print Name Date

Title Phone E-mail Address

PLEASE SEE REVERSE SIDE FOR INSTRUCTIONS

FOR OFFICE USE ONLY

Audited by: Title: Date: Telephone Number:

Approved Denied Authorized by: Date:

Voucher # Date to comptroller: / / Approved Amount

Tax

Check # Date from comptroller: / / Interest

Total

Certified Mail # Date to comptroller: / /

Processor Signature: Date: