Enlarge image

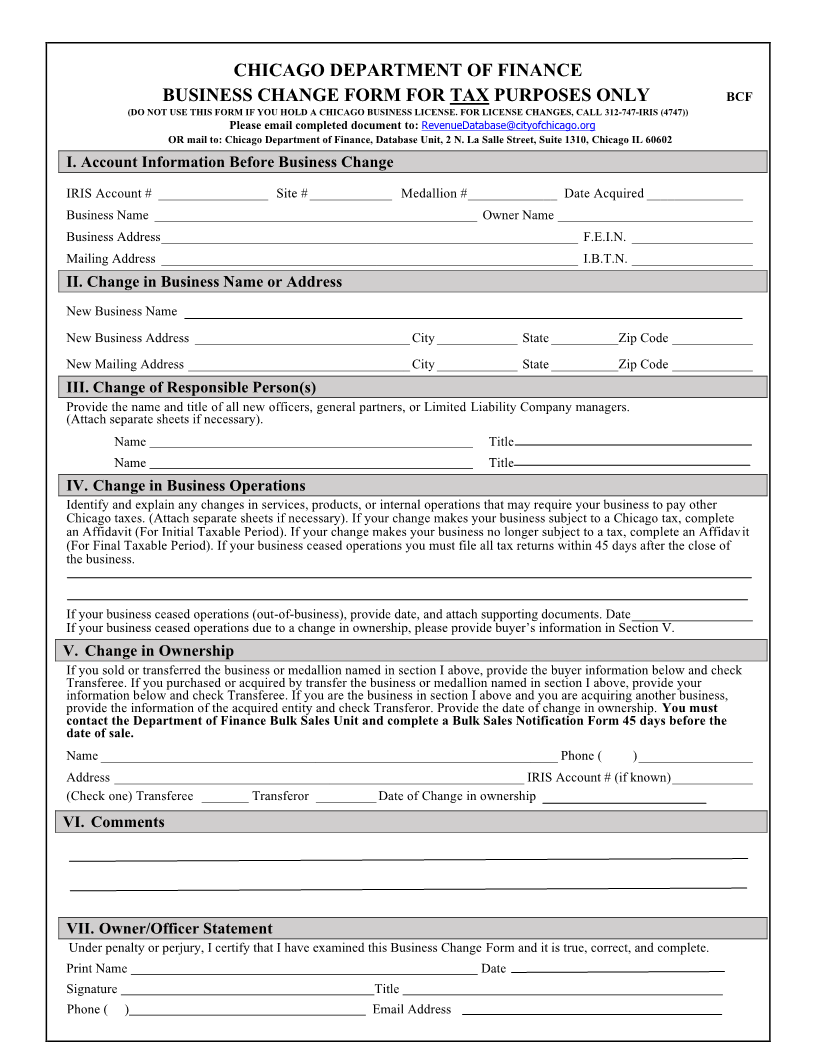

CHICAGO DEPARTMENT OF FINANCE

BUSINESS CHANGE FORM FOR TAX PURPOSES ONLY BCF

(DO NOT USE THIS FORM IF YOU HOLD A CHICAGO BUSINESS LICENSE. FOR LICENSE CHANGES, CALL 312-747-IRIS (4747))

Please email completed document to: RevenueDatabase@cityofchicago.org

OR mail to: Chicago Department of Finance, Database Unit, 2 N. La Salle Street, Suite 1310, Chicago IL 60602

I. Account Information Before Business Change

IRIS Account # ________________ Site # ____________ Medallion # _____________ Date Acquired ______________

Business Name ________________________________________________ Owner Name _____________________________

Business Address ______________________________________________________________ F.E.I.N. __________________

Mailing Address ______________________________________________________________ I.B.T.N. __________________

II. Change in Business Name or Address

New Business Name

New Business Address ________________________________ City ____________ State __________Zip Code ____________

New Mailing Address _________________________________ City ____________ State __________Zip Code ____________

III. Change of Responsible Person(s)

Provide the name and title of all new officers, general partners, or Limited Liability Company managers.

(Attach separate sheets if necessary).

Name Title

Name Title

IV. Change in Business Operations

Identify and explain any changes in services, products, or internal operations that may require your business to pay other

Chicago taxes. (Attach separate sheets if necessary). If your change makes your business subject to a Chicago tax, complete

an Affidavit (For Initial Taxable Period). If your change makes your business no longer subject to a tax, complete an Affidavit

(For Final Taxable Period). If your business ceased operations you must file all tax returns within 45 days after the close of

the business.

If your business ceased operations (out-of-business), provide date, and attach supporting documents. Date __________________

If your business ceased operations due to a change in ownership, please provide buyer’s information in Section V.

V. Change in Ownership

If you sold or transferred the business or medallion named in section I above, provide the buyer information below and check

Transferee. If you purchased or acquired by transfer the business or medallion named in section I above, provide your

information below and check Transferee. If you are the business in section I above and you are acquiring another business,

provide the information of the acquired entity and check Transferor. Provide the date of change in ownership. You must

contact the Department of Finance Bulk Sales Unit and complete a Bulk Sales Notification Form 45 days before the

date of sale.

Name ____________________________________________________________________ Phone ( ) _________________

Address _____________________________________________________________ IRIS Account # (if known) ____________

(Check one) Transferee _______ Transferor _________ Date of Change in ownership

VI. Comments

VII. Owner/Officer Statement

Under penalty or perjury, I certify that I have examined this Business Change Form and it is true, correct, and complete.

Print Name Date

Signature Title

Phone ( ) Email Address