Enlarge image

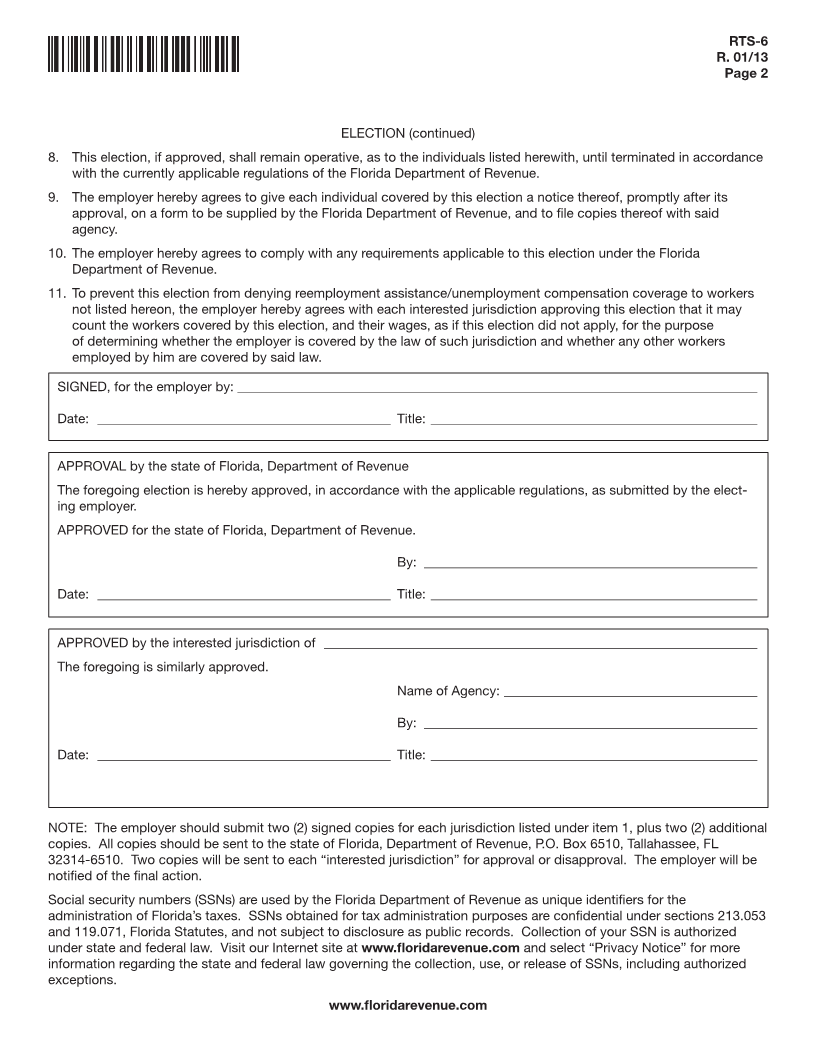

RTS-6

Employer’s Reciprocal Coverage Election R. 01/13

TC

Rule 73B-10.037

Florida Administrative Code

Effective Date 11/14

Reemployment Tax Account Number

Employer’s Name: _______________________________________________________ —

The above employer hereby elects, subject to approval by the agencies involved, to cover certain individuals (those

customarily performing services in more than one jurisdiction) named below and on any attached form, under the

Reemployment Tax (formerly Unemployment Tax) law of Florida.

1. The employer accordingly requests the state of Florida, Department of Revenue to enter into a reciprocal coverage

arrangement to that effect, with each of the following other “interested jurisdictions” (in which the individuals

named under Item 2 perform some services for the employer, and under whose unemployment compensation laws

they might otherwise be covered):

State % Of Service State % Of Service

(If more space is required, use and attach Form RTS-6A, formerly UCS-6A)

2. List employees covered by this election:

Basis for Election in Florida

Social Security Employee’s Legal a) Does some work in Florida

Employee’s Name

Number Residence b) Residence in Florida

c) Related to a place of business in Florida

(If more space is required, use and attach Form RTS-6A, formerly UCS-6A)

3. Nature of employer’s business. _________________________________________________________________________

4. The employer has a place of business in the states listed above. ____________________________________________

5. Nature of work to be performed by the individual(s) listed under Item 2. ______________________________________

6. Employer’s reason for requesting coverage in Florida. _____________________________________________________

7. The employer requests that this election become effective as of the beginning of a calendar quarter, namely

as of ______________________________________

www.floridarevenue.com