Enlarge image

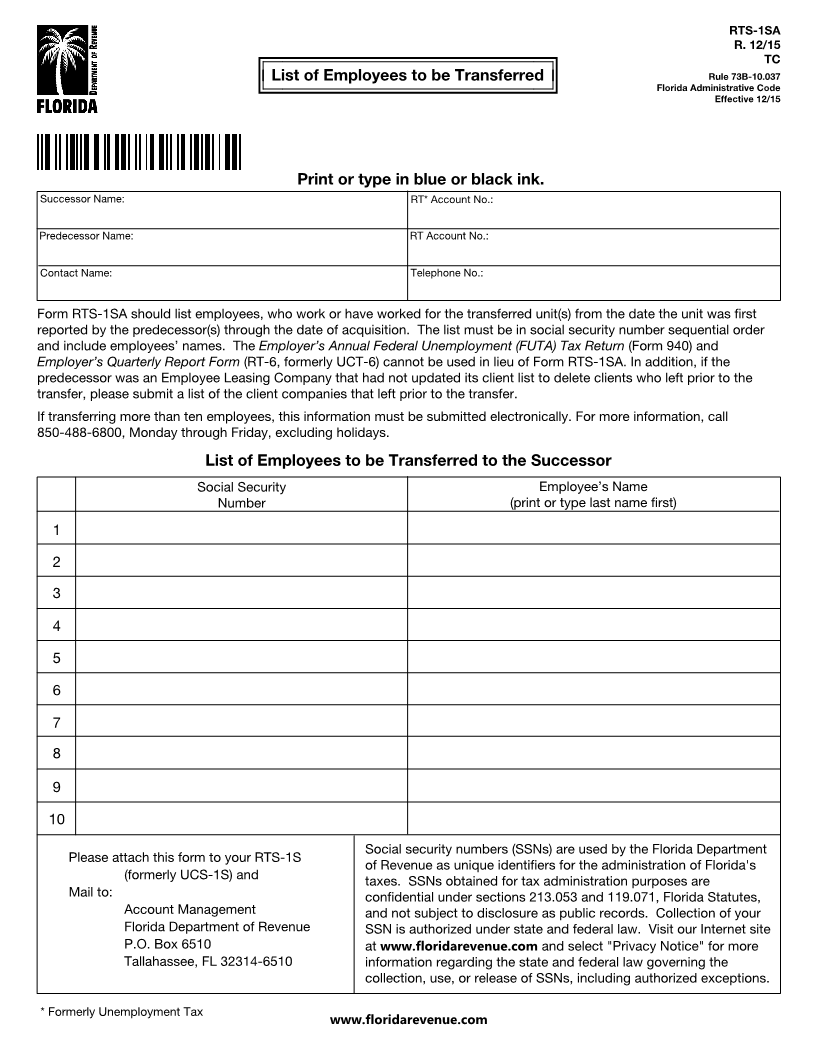

RTS-1SA

R. 12/15

TC

List of Employees to be Transferred Rule 73B-10.037

Florida Administrative Code

Effective 12/15

Print or type in blue or black ink.

Successor Name: RT* Account No.:

Predecessor Name: RT Account No.:

Contact Name: Telephone No.:

Form RTS-1SA should list employees, who work or have worked for the transferred unit(s) from the date the unit was first

reported by the predecessor(s) through the date of acquisition. The list must be in social security number sequential order

and include employees’ names. The Employer’s Annual Federal Unemployment (FUTA) Tax Return(Form 940) and

Employer’s Quarterly Report Form (RT-6, formerly UCT-6) cannot be used in lieu of Form RTS-1SA. In addition, if the

predecessor was an Employee Leasing Company that had not updated its client list to delete clients who left prior to the

transfer, please submit a list of the client companies that left prior to the transfer.

If transferring more than ten employees, this information must be submitted electronically. For more information, call

850-488-6800, Monday through Friday, excluding holidays.

List of Employees to be Transferred to the Successor

Social Security Employee’s Name

Number (print or type last name first)

1

2

3

4

5

6

7

8

9

10

Social security numbers (SSNs) are used by the Florida Department

Please attach this form to your RTS-1S

of Revenue as unique identifiers for the administration of Florida's

(formerly UCS-1S) and taxes. SSNs obtained for tax administration purposes are

Mail to: confidential under sections 213.053 and 119.071, Florida Statutes,

Account Management and not subject to disclosure as public records. Collection of your

Florida Department of Revenue SSN is authorized under state and federal law. Visit our Internet site

P.O. Box 6510 at www.floridarevenue.com and select "Privacy Notice" for more

Tallahassee, FL 32314-6510 information regarding the state and federal law governing the

collection, use, or release of SSNs, including authorized exceptions.

* Formerly Unemployment Tax

www.floridarevenue.com