Enlarge image

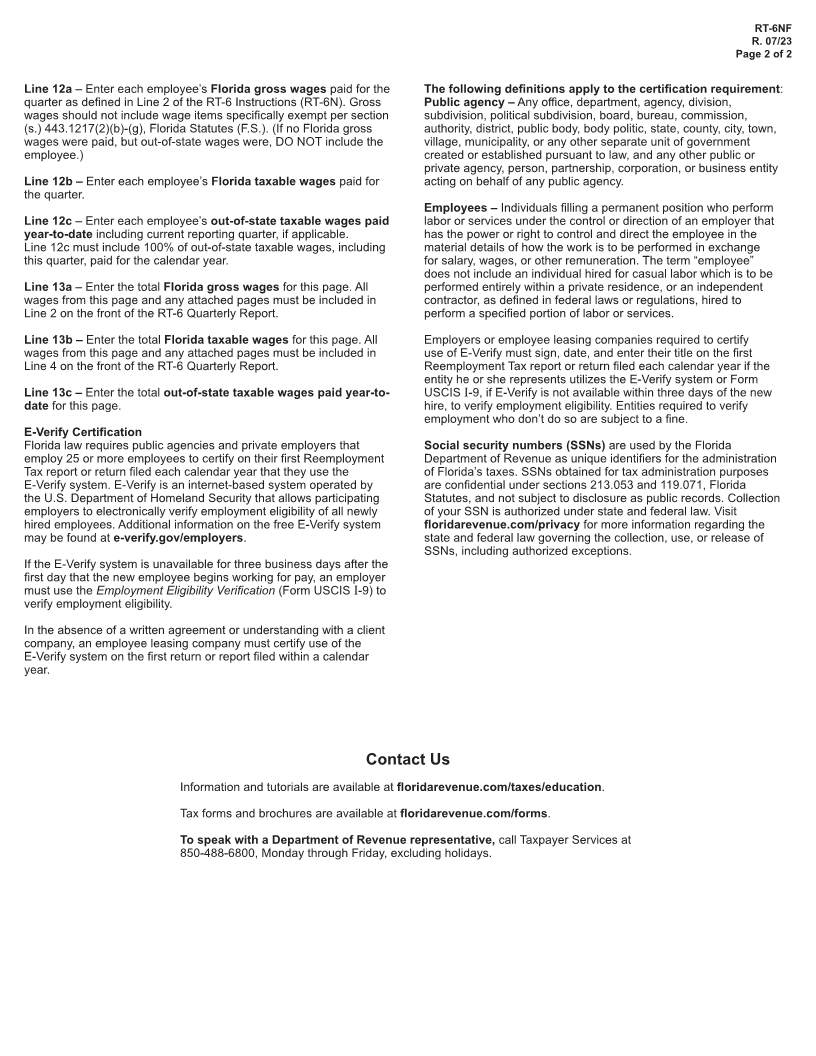

Employer’s Quarterly Report RT-6NF

R. 07/23

for Out-of-State Taxable Wages Rule 73B-10.037, F.A.C.

Effective XX/XX

Page 1 of 2

QUARTER ENDING EMPLOYER’S NAME RT ACCOUNT NUMBER Provisional

/ /

F.E.I. NUMBER

10. EMPLOYEE’S SOCIAL SECURITY NUMBER -

11. EMPLOYEE’S NAME (please print first twelve characters of last name and first eight 12a. EMPLOYEE’S FLORIDA GROSS WAGES PAID THIS QUARTER 12c. EMPLOYEE’S OUT-OF-STATE TAXABLE WAGES

characters of first name in boxes) 12b. EMPLOYEE’S FLORIDA TAXABLE WAGES PAID THIS QUARTER PAID YEAR-TO-DATE

Social Security Only the first $7,000 paid to each employee per calendar year is taxable.

Number - -

Last

Name 12a.

First Middle

Name Initial 12b. 12c.

Social Security

Number - -

Last

Name 12a.

First Middle

Name Initial 12b. 12c.

Social Security

Number - -

Last

Name 12a.

First Middle

Name Initial 12b. 12c.

Social Security

Number - -

Last

Name 12a.

First Middle

Name Initial 12b. 12c.

Social Security

Number - -

Last

Name 12a.

First Middle

Name Initial 12b. 12c.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and 13c. Total Out-of-State Taxable Wages paid

totals from additional pages in Line 2 on page 1 of the RT-6. 13a. year-to-date (add Lines 12c only). Total

this page only.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this

and totals from additional pages in Line 4 on page 1 of the RT-6. 13b.

E-Verify Certification

I attest, under penalty of perjury, that this employer uses the E-Verify system defined in section 448.095(1)(c), Florida Statutes or the

Employment Eligibility Verification (Form USCIS I-9), if E-Verify is not available within three business days of a new hire, to verify the

employment eligibility of newly hired employees.

Signature _____________________________________________

Title _____________________________________________

Today’s Date _____________________________________________

Instructions for Employer’s Quarterly Report for Out-of-State Taxable Wages

This form is used by employers to report employees who first Line 10 – Enter each employee’s social security number (NINE digits

received out-of-state taxable wages who worked and received – Do not suppress the leading zeros). Every employee, regardless

wages from the same employer in Florida during the reporting of age, is required to have a social security number (SSN). If the

quarter. This form must be submitted with the completed employee’s SSN is not included, no credit will be given for previously

first page (containing items 1 through 9) of your Employer’s reported taxable wages, and the first (up to) $7,000 of wages on this

Quarterly Report (RT-6). Also, if an employee customarily performs quarterly report will be taxed at your reemployment tax rate.

services on a continuing basis in more than one state, this form

should not be used. Instead, you should contact the Department’s Line 11 – Enter each employee’s last name, first name, and middle

Account Management process at 850-717-6628 to request a initial.

reciprocal coverage agreement.