Enlarge image

RT-6N

R. 07/23

Employer’s Quarterly Report Instructions Rule 73B-10.037, F.A.C

Effective XX/XX

Page 1 of 2

Provisional

Registration – If you do not have a reemployment tax account number, For more information on correcting RT-6 reports electronically, please

you are required to register to report and pay tax in Florida before filing see the Guide to Electronic Submission of Corrections to the Quarterly

the Employer’s Quarterly Report (RT-6). To register online, go to Report at floridarevenue.com/forms in the Reemployment Tax section.

floridarevenue.com/taxes/registration.

Certification/Signature/Paid Preparer – The report must be signed

Filing Reports – Every employer who is liable for filing quarterly under by (1) the individual owner, (2) the corporate president, treasurer, or

the Florida reemployment assistance program law, must complete and other principal officer, (3) partner or member/managing member, and/or

file the Employer’s Quarterly Report (RT-6). The report should cover only (4) a responsible and duly authorized agent of the employer. Complete

employment for the employer during a single calendar quarter. If wages the paid preparer information, if applicable.

are paid but No Tax is Due, an Employer’s Quarterly Report (RT-6) still

must be completed and filed timely. Line 1 – Enter the total number of full-time and part-time employees

subject to this chapter who worked during or received pay for the payroll

No Employment – A registered employer who had no employees or period including the 12th of each month.

paid no wages during the quarter must still complete, sign, and return

the Employer’s Quarterly Report (RT-6). If you need to cancel your Line 2 – Enter the total Gross Wages paid (before deductions), including

registration, contact us. salaries, commissions, bonuses, vacation and sick pay, back pay awards,

and the cash value of all remuneration paid in any medium other than

Electronic Filing and Paying –The Department of Revenue offers cash. Tips and gratuities are wages when included by the employer to

the convenience of using a free and secure website to file and pay meet minimum wage requirements and/or when the employee receives

reemployment tax. If you employed 10 or more employees in any and reports in writing to the employer $20 or more per month. Gross

wages should not include wage items specifically exempt per section

quarter during the State of Florida’s prior fiscal year (July 1 through

June 30), you are required to electronically file and pay. To enroll, or get 443.1217(2)(b)-(g), Florida Statutes. Note that Line 2, Gross Wages,

more information, go to floridarevenue.com/taxes/eEnroll. After you appears on both the report and the payment coupon.

complete your electronic enrollment we will send you a User ID, PIN/ Line 3 – Enter the amount of Excess Wages for this quarter. Excess

Password, and instructions based on the filing/payment method you wages are wages exceeding $7,000 paid to each employee in a calendar

choose. Once you are set up to file/pay electronically, you will not receive year. The following should be considered when determining excess

paper reports from the Department. Please do not mail a paper report if wages: (1) Wages reported to another state by the same employer for

you file electronically. an employee. See Employer’s Quarterly Report for Out-of-State Taxable

Wages (RT-6NF); (2) Wages paid by your predecessor during the

Due Dates – The original report must be filed and the tax due paid, if calendar year, if you are the legal successor.

applicable, no later than the last day of the month following the end of

the quarter (Penalty After Date): April 30, July 31, October 31, and Line 4 – Enter the Taxable Wages paid this quarter (Line 2 minus Line 3),

January 31. If the last day of the month falls on a Saturday, Sunday, or which should equal the total of all Line 13b entries.

state or federal holiday, your report must be filed and the tax due paid on Enter tax due. Multiply Line 4 by tax rate.

Line 5 –

the next business day. If you are paying electronically, you must initiate

the payment by 5 p.m. ET and receive a confirmation number, on the Line 6 – If this report is past due, compute penalty of $25 for each 30

business day prior to the due date for your payment to be considered days or fraction thereof that the report is delinquent (see Due Dates).

timely. Reports must be electronically date stamped (submission or

transmission date) on or before the “Penalty After Date” of any given Line 7 – If tax due from Line 5 is not paid by the end of the month

following the report quarter, interest is owed on tax due. Florida law

quarter. Keep the confirmation/trace number or acknowledgement in your

provides a floating rate of interest for late payments of taxes and fees

records. Form DR-659, the Calendar of Electronic Payment Deadlines,

due. Interest rates, including daily rates, are updated semiannually on

provides all the payment deadlines at floridarevenue.com/forms in the

January 1 and July 1 each year and posted online at

eServices section.

floridarevenue.com/taxes/rates.

Correcting Reports/Other Changes – Do Not make corrections on Line 8 – Enter $5 if you file and pay on time and choose to pay your

your current RT-6 Quarterly Report for prior quarters. Corrections to quarterly tax due in installments. This $5 fee is payable only with the first

prior quarters must be done online using the File and Pay website at installment; one time per calendar year. You do not owe this fee if you are

floridarevenue.com/taxes/filepay. When you get to the website, select paying 100% of the Total Amount Due (Line 9a) now.

the applicable reemployment category (Agent, Employer, or Employee

Leasing) and then you will log into the webpage using your credentials. Line 9a – Enter the sum of Lines 5, 6, 7, and 8. If the total is less than $1,

Once there, you will find the option of electronically filing an RT-8A. If you send the report with no payment.

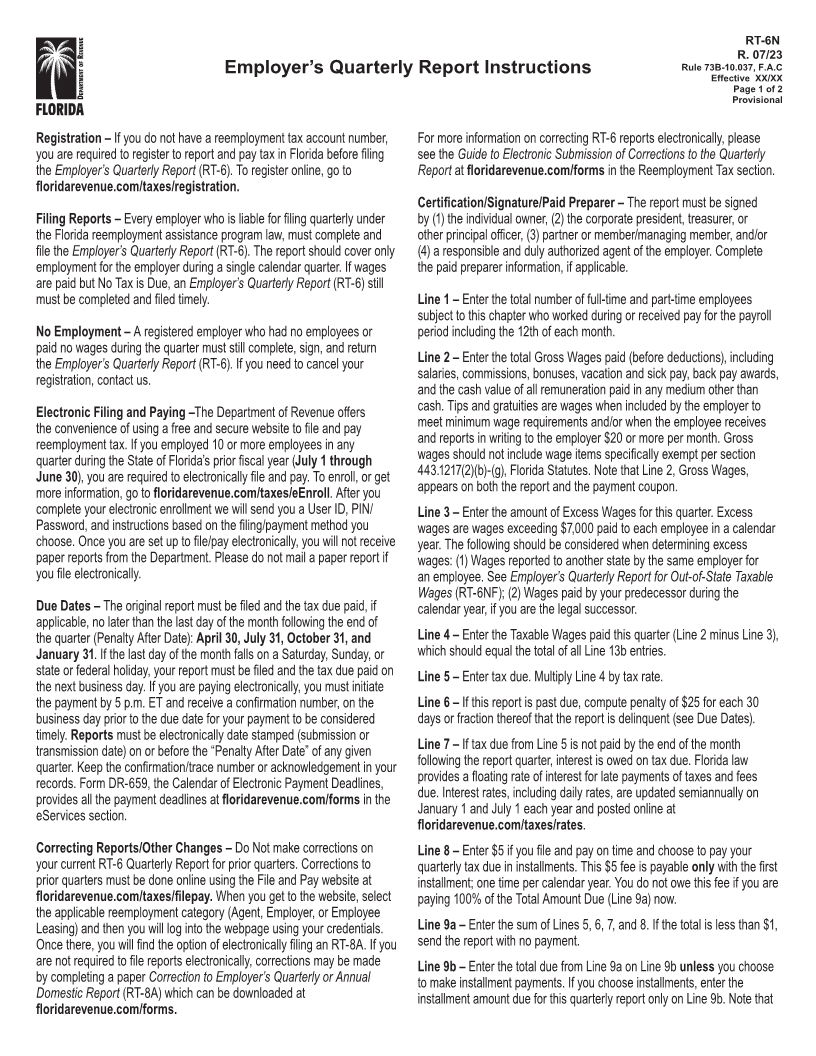

are not required to file reports electronically, corrections may be made Line 9b – Enter the total due from Line 9a on Line 9b unless you choose

by completing a paper Correction to Employer’s Quarterly or Annual to make installment payments. If you choose installments, enter the

Domestic Report (RT-8A) which can be downloaded at installment amount due for this quarterly report only on Line 9b. Note that

floridarevenue.com/forms.