Enlarge image

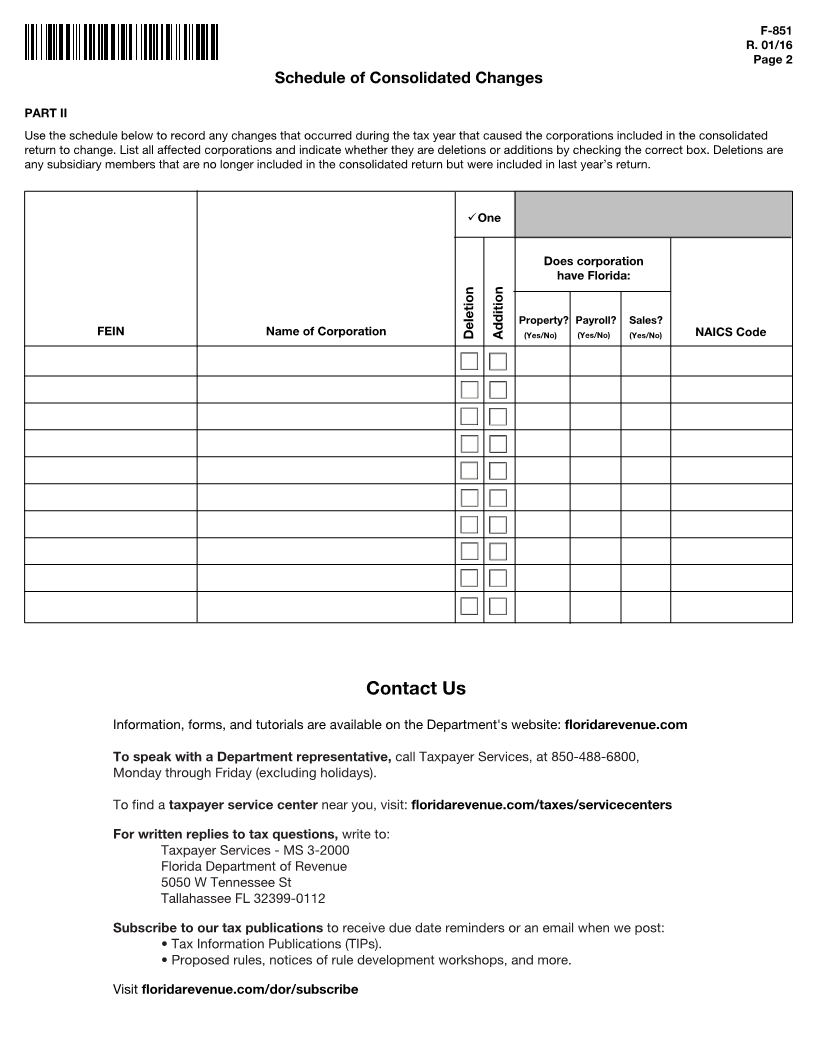

Corporate Income/Franchise Tax Affiliations Schedule F-851

Attach this schedule to Florida Form F-1120 R. 01/16

TC 02/18

Rule 12C-1.051

Florida Administrative Code

Effective 01/16

For Calendar Year or Other taxable year beginning , , and ending , .

Who must file Florida Form F-851?

This form must be used by taxpayers filing a Florida consolidated income tax return and is used to report the members of the consolidated

group. It must be filed by the parent corporation of the consolidated group. You may substitute IRS Form 851 if the federal and Florida

consolidated groups are identical. Report changes to the consolidated group in Part II, on the reverse side of this form.

PART I

Florida Common Parent Corporation Federal Employer Identification Number (FEIN)

Address

City, State, and ZIP

No. Name and Address of Corporation FEIN

1

2

3

4

5

6

7

8

9

10

Statement of Affiliation — Do the above corporations comprise an affiliated group of corporations as

described in section 1504(a) of the Internal Revenue Code? Yes No

Florida Nexus Group — Check the box if the Florida consolidated group is different than the federal

consolidated group.

Note: Section (s.) 220.131, Florida Statutes (F.S.), requires the Florida consolidated group to be

composed of the identical component members as the federal consolidated group. Only those

taxpayers that made a valid election in 1985 under s. 220.131(1), F.S. (1985) to file a consolidated

Florida nexus subgroup return and have continued to file as a subgroup for Florida corporate income

tax purposes should check this box.

Under penalties of perjury, I declare that I have examined the above information and statements and they are true, correct, and

complete to the best of my knowledge and belief, for the taxable year as stated above.

Signature of Officer Date

Title Telephone Number