Enlarge image

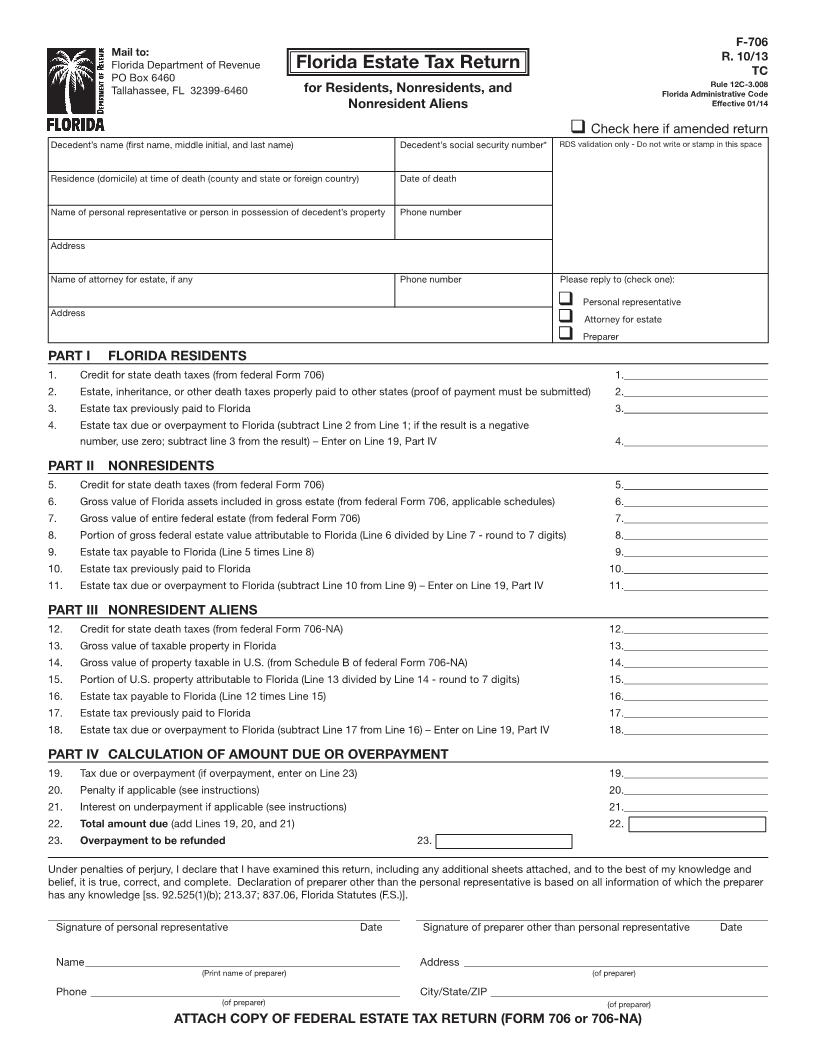

F-706

Mail to: R. 10/13

Florida Department of Revenue Florida Estate Tax Return TC

PO Box 6460 Rule 12C-3.008

Tallahassee, FL 32399-6460 for Residents, Nonresidents, and Florida Administrative Code

Nonresident Aliens Effective 01/14

q Check here if amended return

Decedent’s name (first name, middle initial, and last name) Decedent’s social security number* RDS validation only - Do not write or stamp in this space

Residence (domicile) at time of death (county and state or foreign country) Date of death

Name of personal representative or person in possession of decedent’s property Phone number

Address

Name of attorney for estate, if any Phone number Please reply to (check one):

q Personal representative

Address Attorney for estate

q

q Preparer

PART I FLORIDA RESIDENTS

1. Credit for state death taxes (from federal Form 706) 1.___________________________

2. Estate, inheritance, or other death taxes properly paid to other states (proof of payment must be submitted) 2.___________________________

3. Estate tax previously paid to Florida 3.___________________________

4. Estate tax due or overpayment to Florida (subtract Line 2 from Line 1; if the result is a negative

number, use zero; subtract line 3 from the result) – Enter on Line 19, Part IV 4.___________________________

PART II NONRESIDENTS

5. Credit for state death taxes (from federal Form 706) 5.___________________________

6. Gross value of Florida assets included in gross estate (from federal Form 706, applicable schedules) 6.___________________________

7. Gross value of entire federal estate (from federal Form 706) 7.___________________________

8. Portion of gross federal estate value attributable to Florida (Line 6 divided by Line 7 - round to 7 digits) 8.___________________________

9. Estate tax payable to Florida (Line 5 times Line 8) 9.___________________________

10. Estate tax previously paid to Florida 10.___________________________

11. Estate tax due or overpayment to Florida (subtract Line 10 from Line 9) – Enter on Line 19, Part IV 11.___________________________

PART III NONRESIDENT ALIENS

12. Credit for state death taxes (from federal Form 706-NA) 12.___________________________

13. Gross value of taxable property in Florida 13.___________________________

14. Gross value of property taxable in U.S. (from Schedule B of federal Form 706-NA) 14.___________________________

15. Portion of U.S. property attributable to Florida (Line 13 divided by Line 14 - round to 7 digits) 15.___________________________

16. Estate tax payable to Florida (Line 12 times Line 15) 16.___________________________

17. Estate tax previously paid to Florida 17.___________________________

18. Estate tax due or overpayment to Florida (subtract Line 17 from Line 16) – Enter on Line 19, Part IV 18.___________________________

PART IV CALCULATION OF AMOUNT DUE OR OVERPAYMENT

19. Tax due or overpayment (if overpayment, enter on Line 23) 19.___________________________

20. Penalty if applicable (see instructions) 20.___________________________

21. Interest on underpayment if applicable (see instructions) 21.___________________________

22. Total amount due (add Lines 19, 20, and 21) 22.

23. Overpayment to be refunded 23.

Under penalties of perjury, I declare that I have examined this return, including any additional sheets attached, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer other than the personal representative is based on all information of which the preparer

has any knowledge [ss. 92.525(1)(b); 213.37; 837.06, Florida Statutes (F.S.)].

__________________________________________________________________ __________________________________________________________________

Signature of personal representative Date Signature of preparer other than personal representative Date

Name ___________________________________________________________ Address _________________________________________________________

(Print name of preparer) (of preparer)

Phone __________________________________________________________ City/State/ZIP ____________________________________________________

(of preparer) (of preparer)

ATTACH COPY OF FEDERAL ESTATE TAX RETURN (FORM 706 or 706-NA)