Enlarge image

F-1196

R. 01/18

Rule 12C-1.051

Florida Administrative Code

Effective 01/18

Allocation for Research and Development Tax Credit for

Florida Corporate Income/Franchise Tax

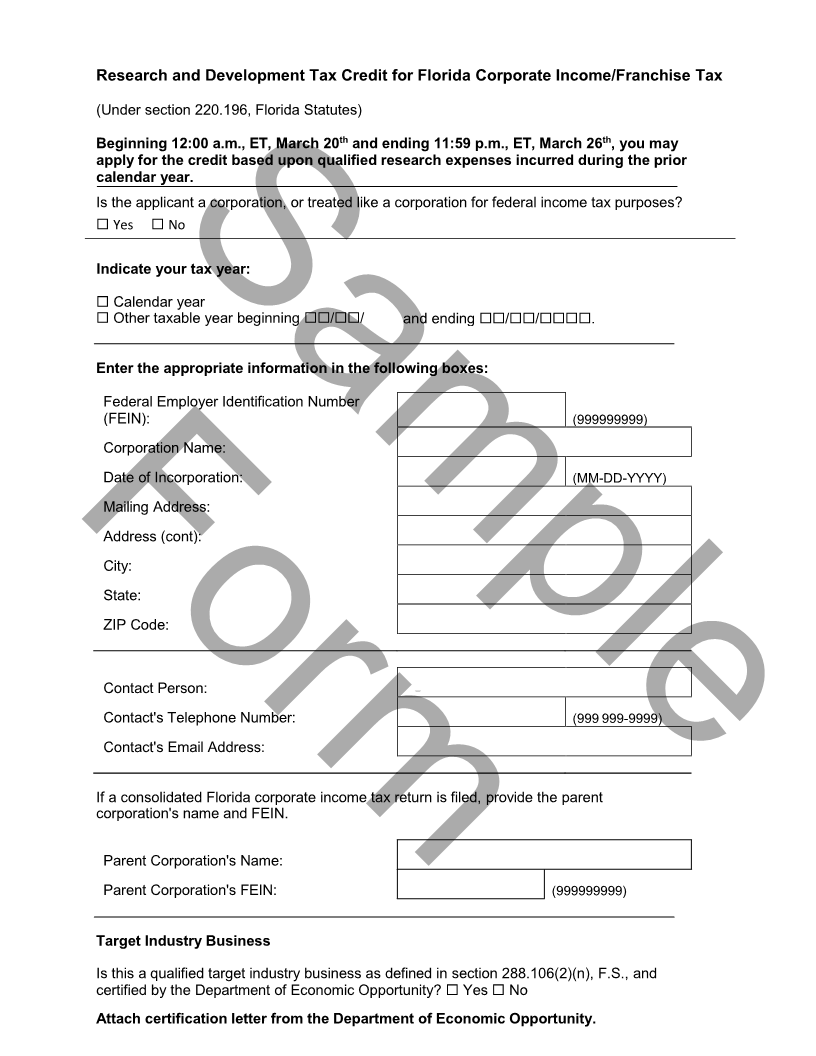

Applications may be filed with the Department between 12:00 a.m., ET, March 20 and

11:59 p.m., ET, March 26 of each calendar year for which the credit is available. If the

Sample

total credits for all qualified applicants exceed the tax credit cap, the Department will

allocate credits on a prorated basis.

Instructions

Once you complete this application, you will receive a confirmation number. The screen will

display the information entered and confirm receipt of the electronic application for credit

allocation. You will be able to print this information and confirmation number.

The Department will send you written correspondence either approving an allocation of tax

credit or explaining why a credit allocation could not be made.

Form

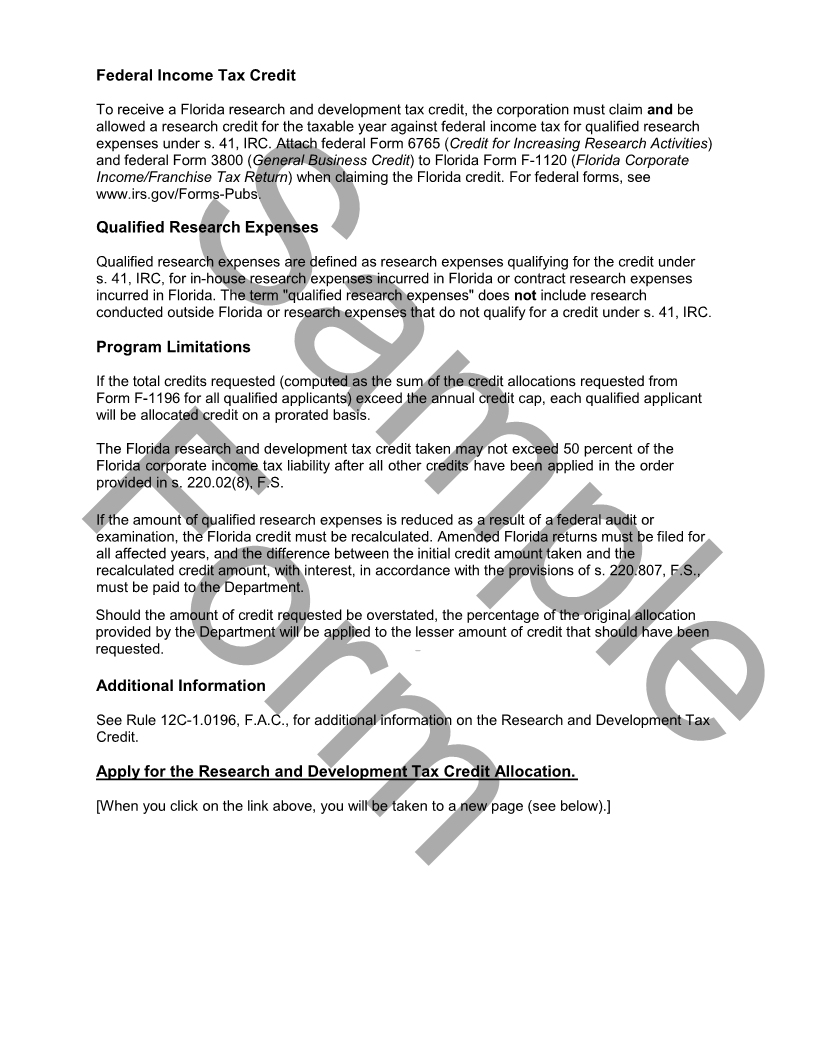

About the Research and Development Tax Credit

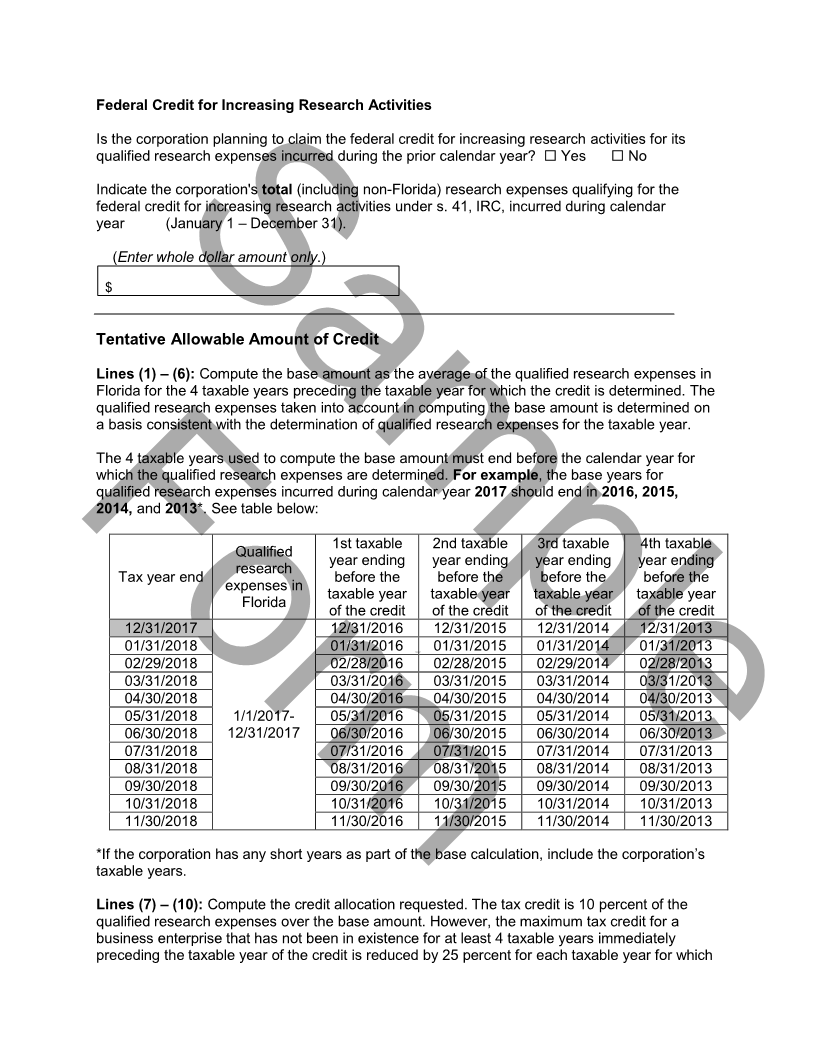

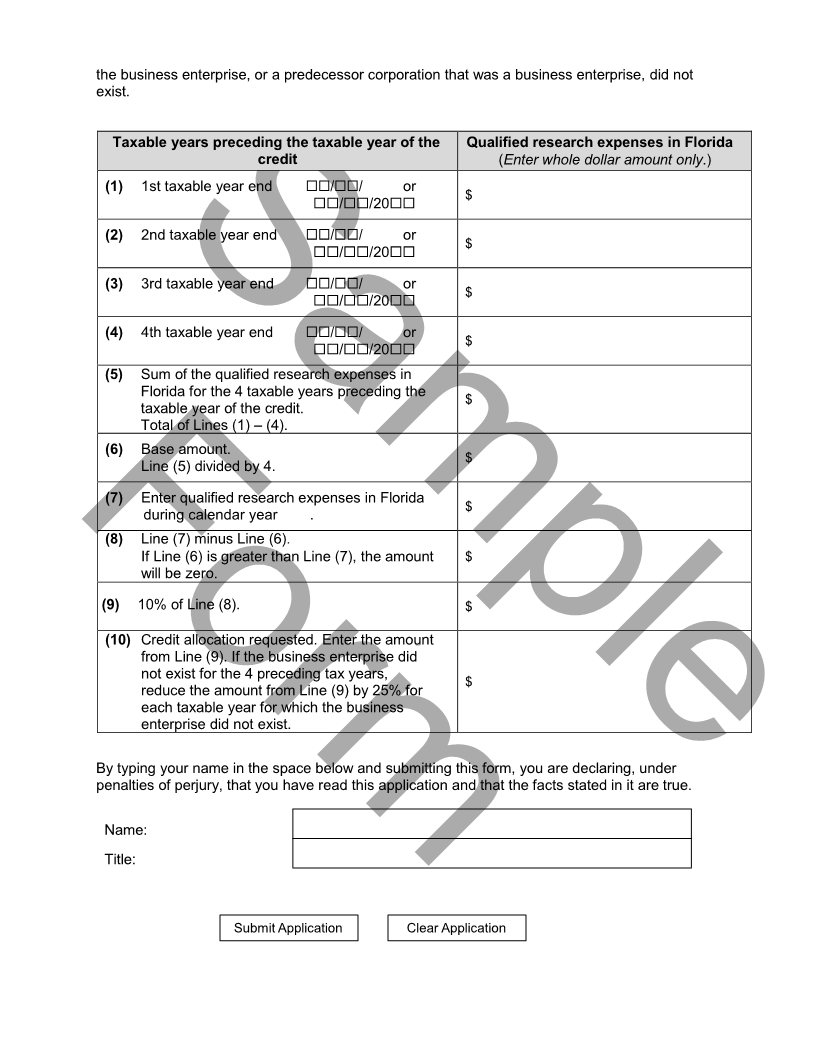

The credit is available annually and is based upon qualified research expenses in Florida

allowed under section (s.) 41 of the Internal Revenue Code (IRC). Approved tax credits will be

based on qualified research expenses incurred during the prior calendar year.

Who May Apply

Corporations, as defined in s. 220.03, F.S., that also meet the definition of qualified target

industry business, as defined in s. 288.106(2)(n), F.S., may apply. However, only qualified target

industry businesses in the manufacturing, life sciences, information technology, aviation and

aerospace, homeland security and defense, cloud information technology, marine sciences,

materials science, and nanotechnology industries may qualify for a tax credit.

Businesses that are partnerships, limited liability companies taxed as partnerships, or

disregarded single member limited liability companies, are not corporations under Section

220.03, F.S., and, therefore, may not apply for an allocation of credit. However, each corporate

partner of a partnership may apply separately for an allocation of credit based on the

corporation’s separate research expenses, including allocated partnership research expenses, if

the corporate partner is also a qualified target industry business. For disregarded entities, the

corporation that owns the single member limited liability company may apply separately for an

allocation of credit based on the corporation’s separate research expenses, including those of

the disregarded single member limited liability company, if the corporate owner is also a qualified

target industry business. For purposes of 26 U.S.C. s. 41, the research expenses are

apportioned among the partners during the taxable year and are treated as paid or incurred

directly by the partners rather than by the partnership.

A corporation applying for the tax credit must include a letter from the Department of

Economic Opportunity certifying that it is an eligible qualified target industry business

with its application, or documentation that it has timely protested the Department of

Economic Opportunity’s determination not to issue such a certification letter.