Enlarge image

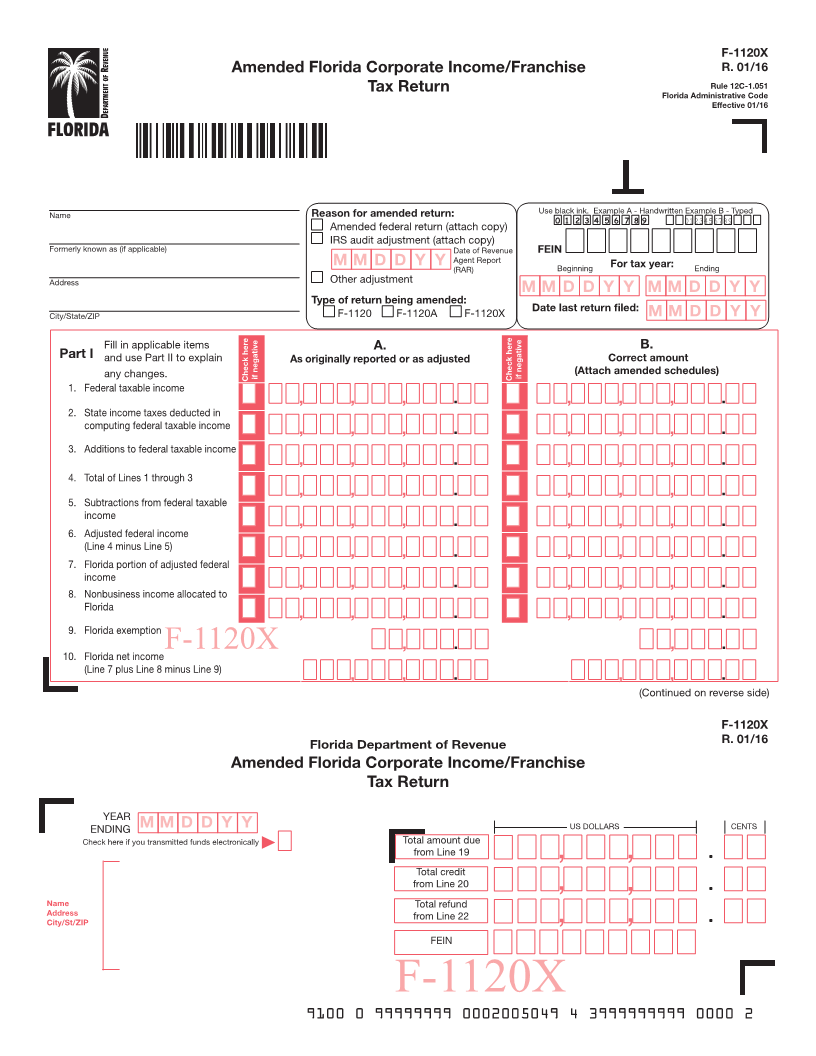

F-1120X

Amended Florida Corporate Income/Franchise R. 01/16

Tax Return Rule 12C-1.051

Florida Administrative Code

Effective 01/16

Name Reason for amended return: Use black ink. Example A - Handwritten Example B - Typed

Amended federal return (attach copy) 0 1 2 3 4 5 6 7 8 9 0123456789

IRS audit adjustment (attach copy)

Formerly known as (if applicable) Date of Revenue FEIN

M M D D Y Y Agent Report For tax year:

(RAR) Beginning Ending

Address Other adjustment

M M D D Y Y M M D D Y Y

Type of return being amended:

F-1120 F-1120A F-1120X Date last return filed: M M D D Y Y

City/State/ZIP

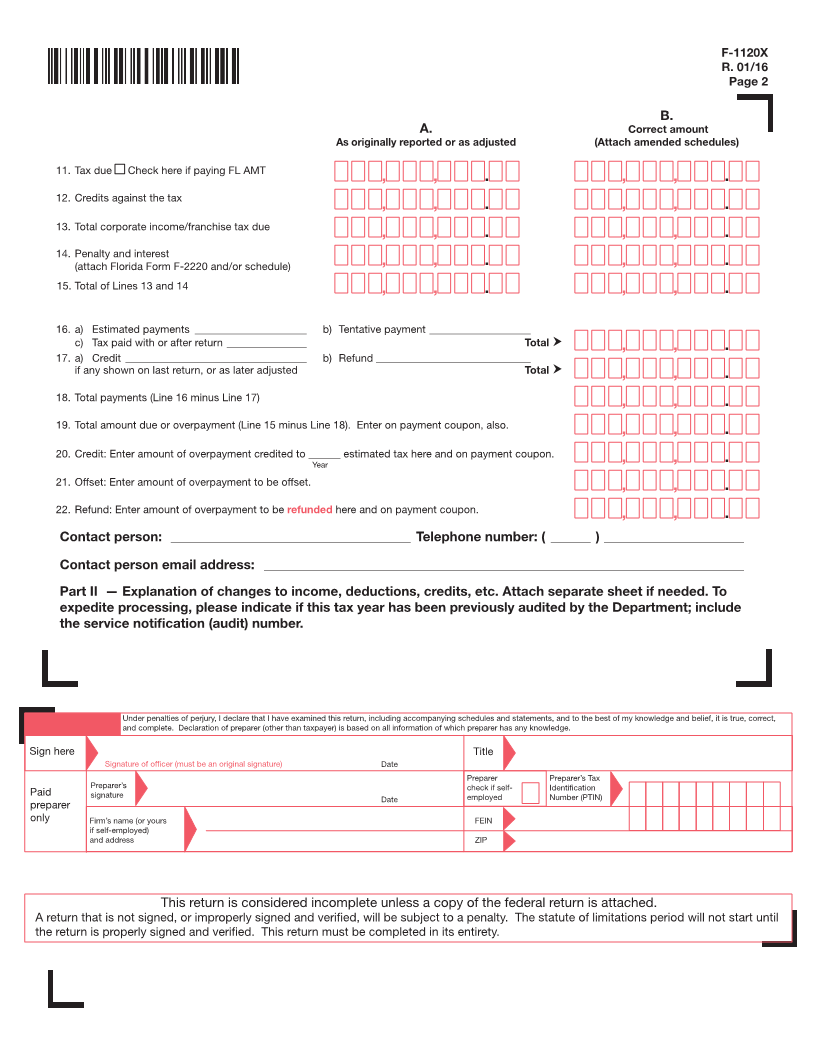

Fill in applicable items A. B.

Part I and use Part II to explain As originally reported or as adjusted Correct amount

any changes. Check here if negative Check here if negative (Attach amended schedules)

1. Federal taxable income

, , , . , , , .

2. State income taxes deducted in

computing federal taxable income , , , . , , , .

3. Additions to federal taxable income

, , , . , , , .

4. Total of Lines 1 through 3

, , , . , , , .

5. Subtractions from federal taxable

income

, , , . , , , .

6. Adjusted federal income

(Line 4 minus Line 5)

, , , . , , , .

7. Florida portion of adjusted federal

income

, , , . , , , .

8. Nonbusiness income allocated to

Florida

, , , . , , , .

9. Florida exemption

F-1120X , , , . , , , .

10. Florida net income

(Line 7 plus Line 8 minus Line 9)

, , , . , , , .

(Continued on reverse side)

F-1120X

Florida Department of Revenue R. 01/16

Amended Florida Corporate Income/Franchise

Tax Return

YEAR

ENDING M M D D Y Y US DOLLARS CENTS

Check here if you transmitted funds electronically Total amount due

from Line 19

, ,

Total credit

from Line 20

, ,

Name Total refund

Address from Line 22

City/St/ZIP , ,

FEIN

F-1120X

9100 0 99999999 0002005049 4 3999999999 0000 2