Enlarge image

DR-7N

R. 07/21

Instructions for Consolidated Sales and Use Tax Return

TC 08/22

Rounding to Replace Bracket System in Calculating Sales and Use Taxes Rule 12A-1.097, F.A.C.

Effective 07/21

Effective July 1, 2021, the “Bracket System” for calculating sales tax and discretionary sales Page 1 of 7

surtax is replaced by a rounding algorithm in Florida. For more information, see Tax Information

Publication (TIP )21A01-02.

Account Changes Keep records that support all transactions for at least three

If you change your business name, mailing address, location years from the date you file your return or the date it is required

address within the same county, or close or sell your business, to be filed, whichever is later.

immediately notify the Department. You can also notify the Florida Annual Resale Certificate

Department when you temporarily suspend or resume your Registered sales and use tax dealers are provided a Florida

business operations. The quickest way to notify the Department Annual Resale Certificate to make tax-exempt purchases or

is by visiting floridarevenue.com/taxes/updateaccount. rentals of property or services for resale. You may provide a

To notify us in writing, mail a letter to: paper or electronic copy of your current Florida Annual Resale

Account Management - MS 1-5730 Certificate or the certificate number to any seller when making

Florida Department of Revenue purchases or rentals of property or services that you intend

5050 W Tennessee St to resell or re-rent as part of your business. You may provide

Tallahassee, FL 32399-0160 your Florida Annual Resale Certificate or certificate number

Be sure to include your business partner number, your for either the consolidated number (80-code number) or for an

consolidated sales tax filing number, and the certificate number active location reported under the consolidated number. If you

for each location in any written correspondence sent to the purchase or rent property or services that will be used in your

Department. business, your Florida Annual Resale Certificate shouldnot be

used.

Submit a new registration (online or paper) if you:

• move a business location from one Florida county to another; As a dealer, you have an obligation to collect the applicable

• add another location; amount of sales and use tax and discretionary sales surtax

• purchase or acquire an existing business; or when you resell or re-rent the property or service at retail. If you

• change the form of ownership of your business. need help determining what you may buy or rent tax exempt

for resale, the Florida Annual Resale Certificate for Sales Tax

Due Dates, Electronic Filing and Payment, and brochure (Form GT-800060) is available on the Department’s

Other Filing Information website.

Electronic Filing and Payment: Consolidated sales and

use tax returns and tax payments must be filed and paid Sellers who make tax-exempt sales or rentals for purposes of

electronically. You can file and pay sales and use tax by using resale or re-rental must document the exemption using any one

the Department’s website or you may purchase software from a of these methods:

software vendor. • Obtain a paper or electronic copy of your customer’s

Due Dates: Tax returns and payments are due on the 1 stand current Florida Annual Resale Certificate.

late after the 20 thday of the month following each reporting • For each tax-exempt sale, use your customer’s Florida

period. If the 20 thfalls on a Saturday, Sunday, or a state or sales tax certificate number to obtain a transaction

authorization number.

federal holiday, your tax return must be received electronically • For each tax-exempt customer, use your customer’s

on the first business day following the 20th.

Florida sales tax certificate number to obtain a vendor

Due Dates for Electronic Payments: To avoid penalty and authorization number.

interest, you must initiate your electronic payment and Sellers may verify a Florida Annual Resale Certificate number

receive a confirmation number no later than 5:00 p.m. ET and obtain an authorization number:

on the business day prior to the 20th. Keep the confirmation • Online: Visit floridarevenue.com/taxes/certificates

number in your records. For a list of deadlines for initiating • Phone: 877-357-3725

electronic payments on time, visit floridarevenue.com/forms, • Mobile app: Available for iPhone, iPad, Android devices, and

select the eServices section, and then select the current year Windows phones.

Florida eServices Calendar of Electronic Payment Deadlines

(Form DR-659).

Proper Collection of Tax

Vendor software: You may purchase software from a software Collecting the right amount of tax is important because mistakes

vendor to file and pay sales and use tax electronically. While will cost you money. Florida’s general state sales tax rate is 6%.

you may use purchased software to file your sales and use Additionally, most counties also have a local option discretionary

tax electronically, you may not use software to create paper sales surtax. Surtax rates are published in the Discretionary

(alternative or substitute) returns to file with the Department. Sales Surtax Information form (DR-15DSS) each year and

If you use vendor software to prepare a “tax calculation available online at floridarevenue.com/forms under the

worksheet,” do not file the worksheet with the Department as Discretionary Sales Surtax section.

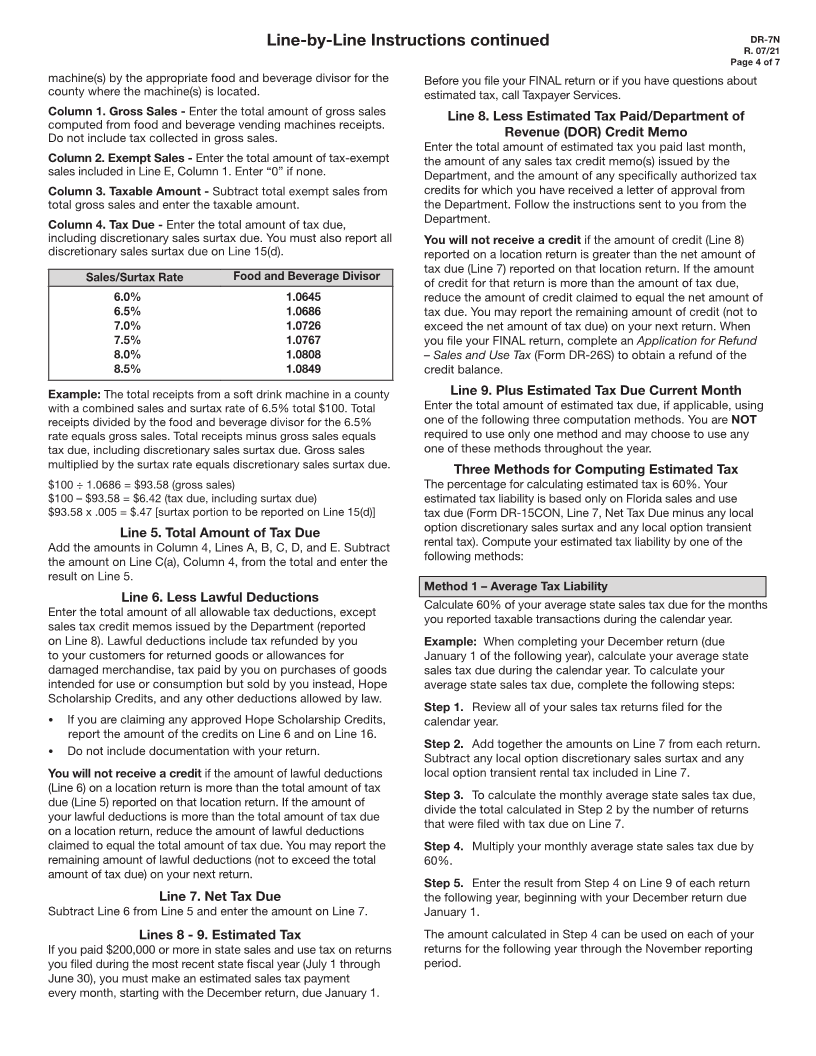

a tax return. To ensure proper credit to your account, be sure [State Sales and Use Tax Rate] + [Surtax Rate] = [Total Tax Rate]

to transfer information from the worksheet to your personalized

return. Dealers must calculate the total tax due on each sale. The

tax must be shown separately on each invoice and may be

Amended Returns: If you discover that your original return calculated on either the combined taxable amount or the

was incorrect, call Taxpayer Services at 850-488-6800 Monday individual taxable amounts on an invoice.

through Friday, excluding holidays, for assistance amending

your returns.