Enlarge image

DR-570

APPLICATION FOR HOMESTEAD TAX DEFERRAL R.10/11

Rule 12D-16.002

Section 197.2423, Florida Statutes Florida Administrative Code

Effective 11/12

Due to the tax collector by March 31

This application is classified confidential if federal income tax returns are attached.

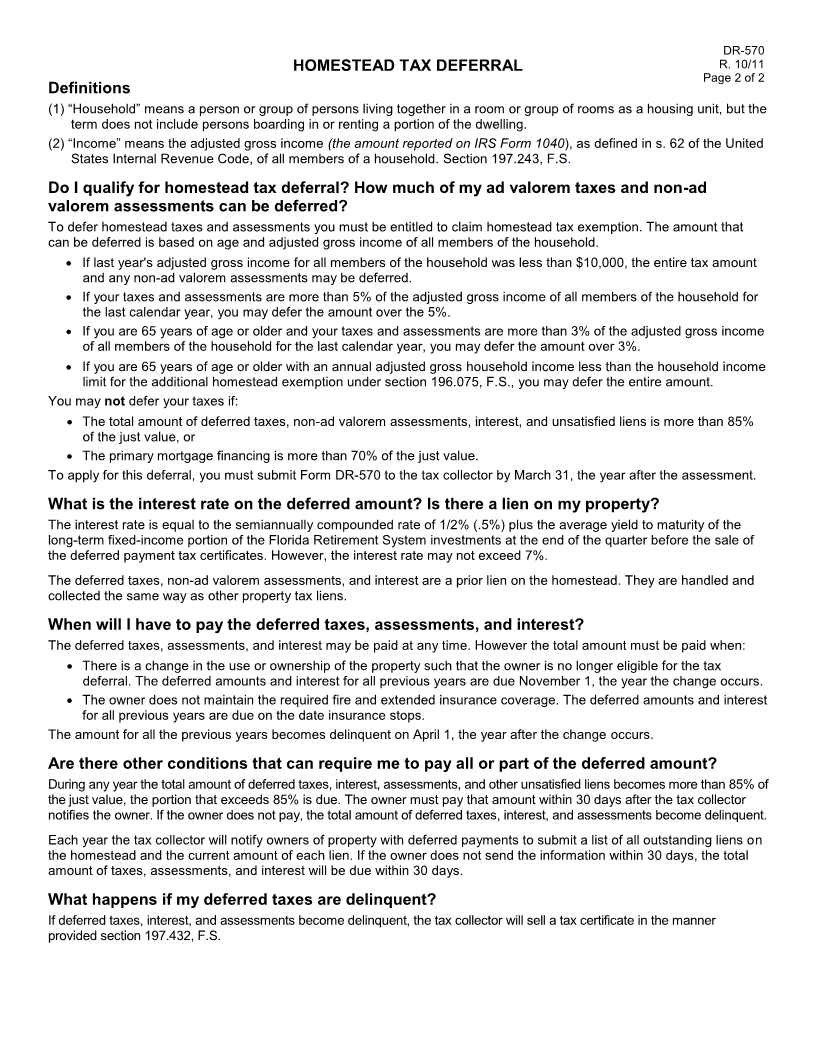

COMPLETED BY TAXPAYER

Applicant Parcel ID

Mailing Property

address address

Phone Property

Date of birth description

Number of household members

Current value of primary mortgage outstanding on the home

Other outstanding liens on the homestead

Annual adjusted gross income for all household members based on federal income tax return

Annual adjusted gross income for all household members if no federal income tax return filed

Other income

I am applying to defer payment of a portion or all of the ad valorem taxes and any non-ad valorem

assessments that would be covered by a tax certificate sold under Chapter 197, Florida Statutes, for 20 .

I will submit copies of my federal income tax returns for last year. I will provide other documents as required by the

tax collector, for each member of the household (not including boarders or renters of a portion of this property).

I understand that I must furnish proof of fire and extended coverage insurance at least equal to the total of all

outstanding liens, deferred taxes, non-ad valorem assessments, and interest with a loss payable clause to the

county tax collector.

The information above is true and correct to the best of my knowledge.

____________________________________________ _________________

Signature, applicant Date

See page 2 for more information.

COMPLETED BY TAX COLLECTOR

Part 1. Ad valorem taxes and non ad valorem

Part 2

assessments. Do not complete if entire amount is deferred

1. Total due before discount 1. Total deferred (taxes and assessments)

2. Less 3% or 5% annual 2. Interest prior year(s)

adjusted gross income 3. All other unsatisfied liens including

3. Total deferred (1 minus 2) primary mortgage outstanding

4. Total not deferred (1 minus 3) 4. Total (1+2+3)

5. Less applicable discount 5. Just value

6. Total due and payable (4 minus 5) 6. 4 divided by 5 (cannot exceed 85%) %

7. Total primary mortgage outstanding

8. 7 divided by 5 (cannot exceed 70%) %

Approved

Not approved Signature Date Date copy sent to applicant