Enlarge image

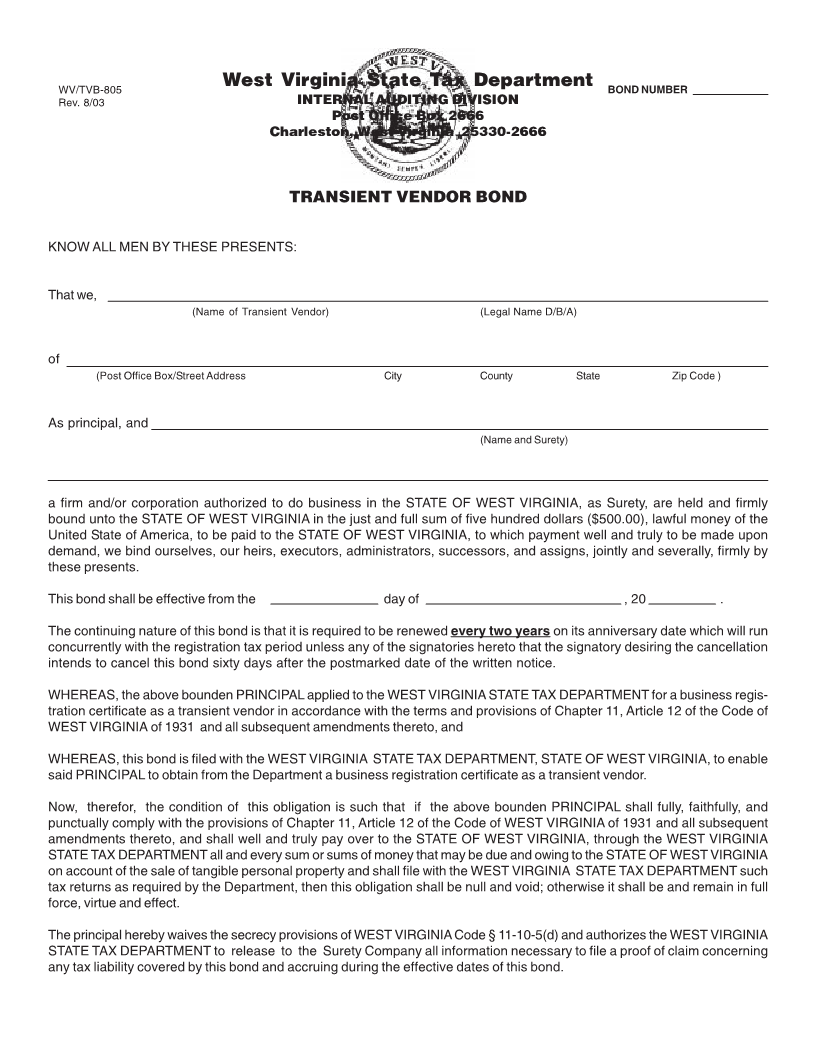

WV/TVB-805 West Virginia State Tax Department BOND NUMBER

Rev. 8/03 INTERNAL AUDITING DIVISION

Post Office Box 2666

Charleston, West Virginia 25330-2666

TRANSIENT VENDOR BOND

KNOW ALL MEN BY THESE PRESENTS:

That we,

(Name of Transient Vendor) (Legal Name D/B/A)

of

(Post Office Box/Street Address City County State Zip Code )

As principal, and

(Name and Surety)

a firm and/or corporation authorized to do business in the STATE OF WEST VIRGINIA, as Surety, are held and firmly

bound unto the STATE OF WEST VIRGINIA in the just and full sum of five hundred dollars ($500.00), lawful money of the

United State of America, to be paid to the STATE OF WEST VIRGINIA, to which payment well and truly to be made upon

demand, we bind ourselves, our heirs, executors, administrators, successors, and assigns, jointly and severally, firmly by

these presents.

This bond shall be effective from the day of , 20 .

The continuing nature of this bond is that it is required to be renewed every two years on its anniversary date which will run

concurrently with the registration tax period unless any of the signatories hereto that the signatory desiring the cancellation

intends to cancel this bond sixty days after the postmarked date of the written notice.

WHEREAS, the above bounden PRINCIPAL applied to the WEST VIRGINIA STATE TAX DEPARTMENT for a business regis-

tration certificate as a transient vendor in accordance with the terms and provisions of Chapter 11, Article 12 of the Code of

WEST VIRGINIA of 1931 and all subsequent amendments thereto, and

WHEREAS, this bond is filed with the WEST VIRGINIA STATE TAX DEPARTMENT, STATE OF WEST VIRGINIA, to enable

said PRINCIPAL to obtain from the Department a business registration certificate as a transient vendor.

Now, therefor, the condition of this obligation is such that if the above bounden PRINCIPAL shall fully, faithfully, and

punctually comply with the provisions of Chapter 11, Article 12 of the Code of WEST VIRGINIA of 1931 and all subsequent

amendments thereto, and shall well and truly pay over to the STATE OF WEST VIRGINIA, through the WEST VIRGINIA

STATE TAX DEPARTMENT all and every sum or sums of money that may be due and owing to the STATE OF WEST VIRGINIA

on account of the sale of tangible personal property and shall file with the WEST VIRGINIA STATE TAX DEPARTMENT such

tax returns as required by the Department, then this obligation shall be null and void; otherwise it shall be and remain in full

force, virtue and effect.

The principal hereby waives the secrecy provisions of WEST VIRGINIA Code § 11-10-5(d) and authorizes the WEST VIRGINIA

STATE TAX DEPARTMENT to release to the Surety Company all information necessary to file a proof of claim concerning

any tax liability covered by this bond and accruing during the effective dates of this bond.