Enlarge image

STATE OF WEST VIRGINIA

State Tax Department, Charitable Bingo/Raffle Unit

P.O. Box 1143

Charleston, WV 25324-1143

JIMMY J. JIMSON_____________________________________________________________ Letter Id: L0060522496

Name

10_____________________________________________________________ JIM STREET AccountIssued:#: ________________11/23/2022

AddressJIMTOWN WV 29181 Account #: 2271-0791

_____________________________________________________________

City State Zip

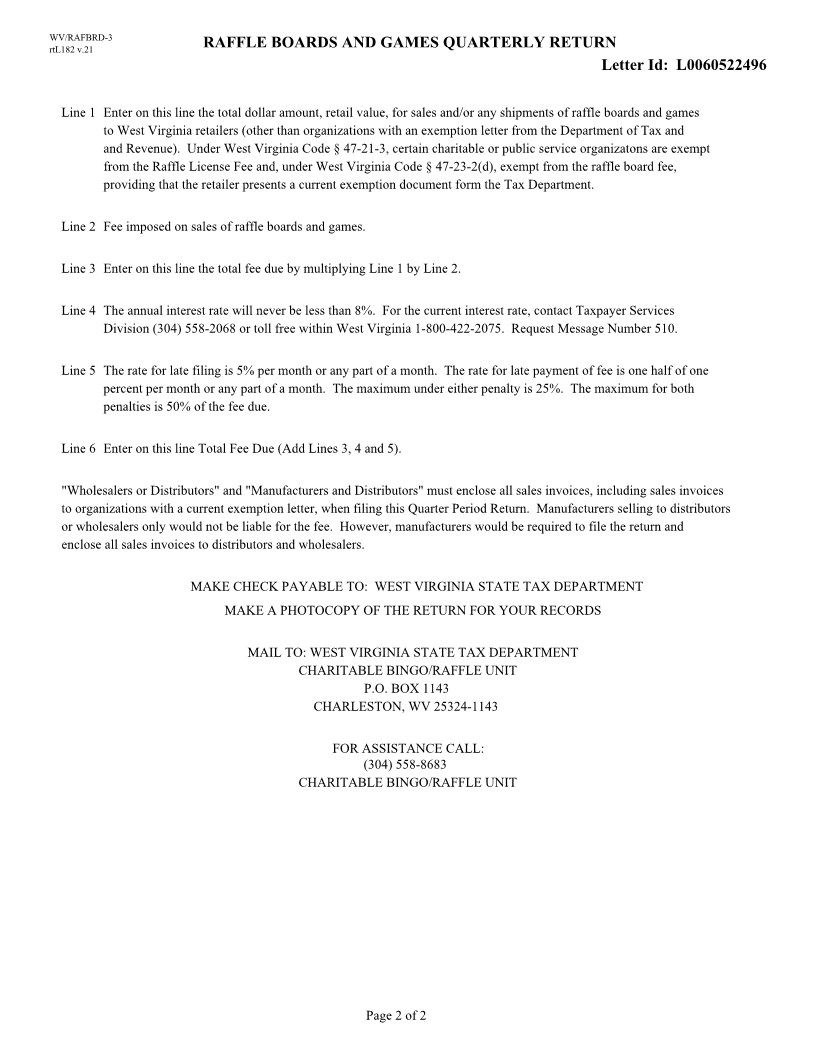

WV/RAFBRD-3

rtL182 v.21 RAFFLE BOARDS AND GAMES QUARTERLY RETURN

Filing Period: to Due Date:

THIS FORM MUST BE COMPLETED AND RETURNED EVEN THOUGH NO FEES ARE DUE

SECTION 1 - FEE CALCULATION

1. Total Sales of Raffle Boards and Games to Retailers in West Virginia for this Quarter

.

2. Rate

0.20

3. Fee Due (Multiply Line 1 by Line 2)

.

4. Non-Waivable Interest

.

5. Additions to Tax

.

6. Total Tax Due (Add Lines 3, 4 and 5)

.

FOR ASSISTANCE, CALL THE BINGO AND RAFFLE UNIT AT (304) 558-8683

SECTION 2 - CERTIFICATION TO REPORT

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number) (Email Address)

(Signature of preparer other than taxpayer) (Address) (Date)

PLEASE SEE INSTRUCTIONS ON REVERSE SIDE OF RETURN

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Charitable Bingo/Raffle Unit

P.O. Box 1143, Charleston, WV 25324-1143

FOR ASSISTANCE CALL (304) 558-8683

For more information visit our web site at: www.tax.wv.gov

O 1 3 0 8 0 9 0 1 W