Enlarge image

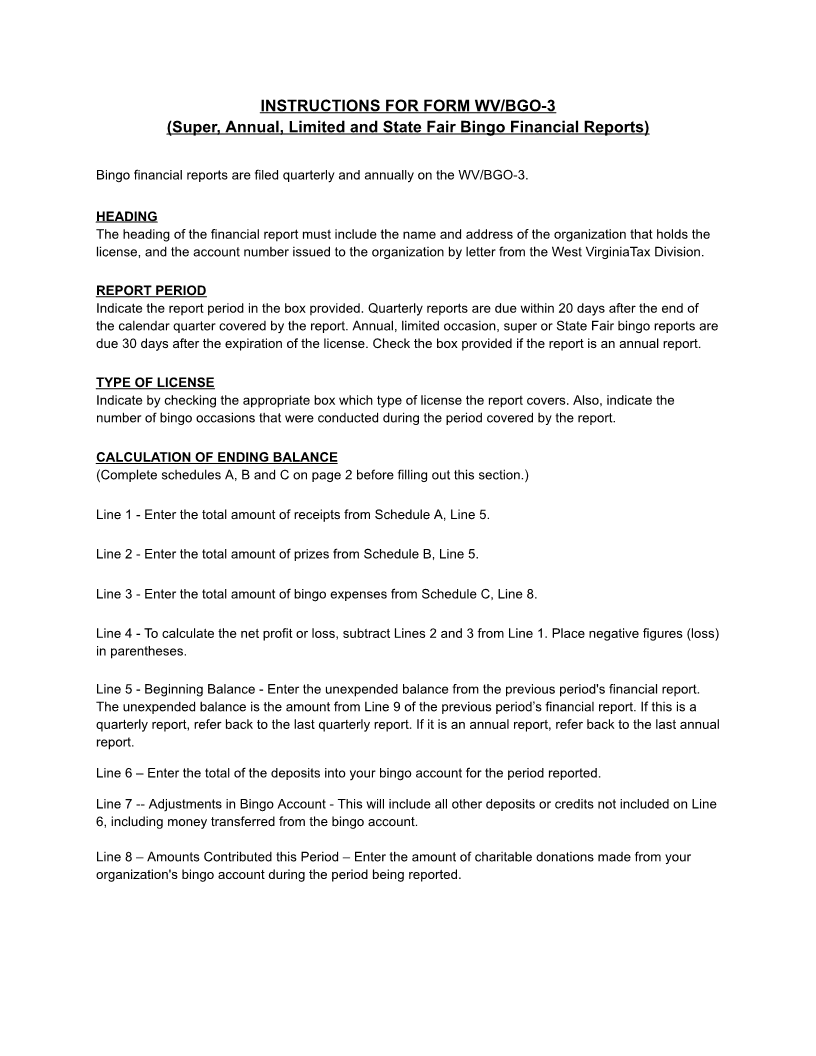

INSTRUCTIONS FOR FORM WV/BGO-3

(Super, Annual, Limited and State Fair Bingo Financial Reports)

Bingo financial reports are filed quarterly and annually on the WV/BGO-3.

HEADING

The heading of the financial report must include the name and address of the organization that holds the

license, and the account number issued to the organization by letter from the West VirginiaTax Division.

REPORT PERIOD

Indicate the report period in the box provided. Quarterly reports are due within 20 days after the end of

the calendar quarter covered by the report. Annual, limited occasion, super or State Fair bingo reports are

due 30 days after the expiration of the license. Check the box provided if the report is an annual report.

TYPE OF LICENSE

Indicate by checking the appropriate box which type of license the report covers. Also, indicate the

number of bingo occasions that were conducted during the period covered by the report.

CALCULATION OF ENDING BALANCE

(Complete schedules A, B and C on page 2 before filling out this section.)

Line 1 - Enter the total amount of receipts from Schedule A, Line 5.

Line 2 - Enter the total amount of prizes from Schedule B, Line 5.

Line 3 - Enter the total amount of bingo expenses from Schedule C, Line 8.

Line 4 - To calculate the net profit or loss, subtract Lines 2 and 3 from Line 1. Place negative figures (loss)

in parentheses.

Line 5 - Beginning Balance - Enter the unexpended balance from the previous period's financial report.

The unexpended balance is the amount from Line 9 of the previous period’s financial report. If this is a

quarterly report, refer back to the last quarterly report. If it is an annual report, refer back to the last annual

report.

Line 6 – Enter the total of the deposits into your bingo account for the period reported.

Line 7 -- Adjustments in Bingo Account - This will include all other deposits or credits not included on Line

6, including money transferred from the bingo account.

Line 8 – Amounts Contributed this Period – Enter the amount of charitable donations made from your

organization's bingo account during the period being reported.