Enlarge image

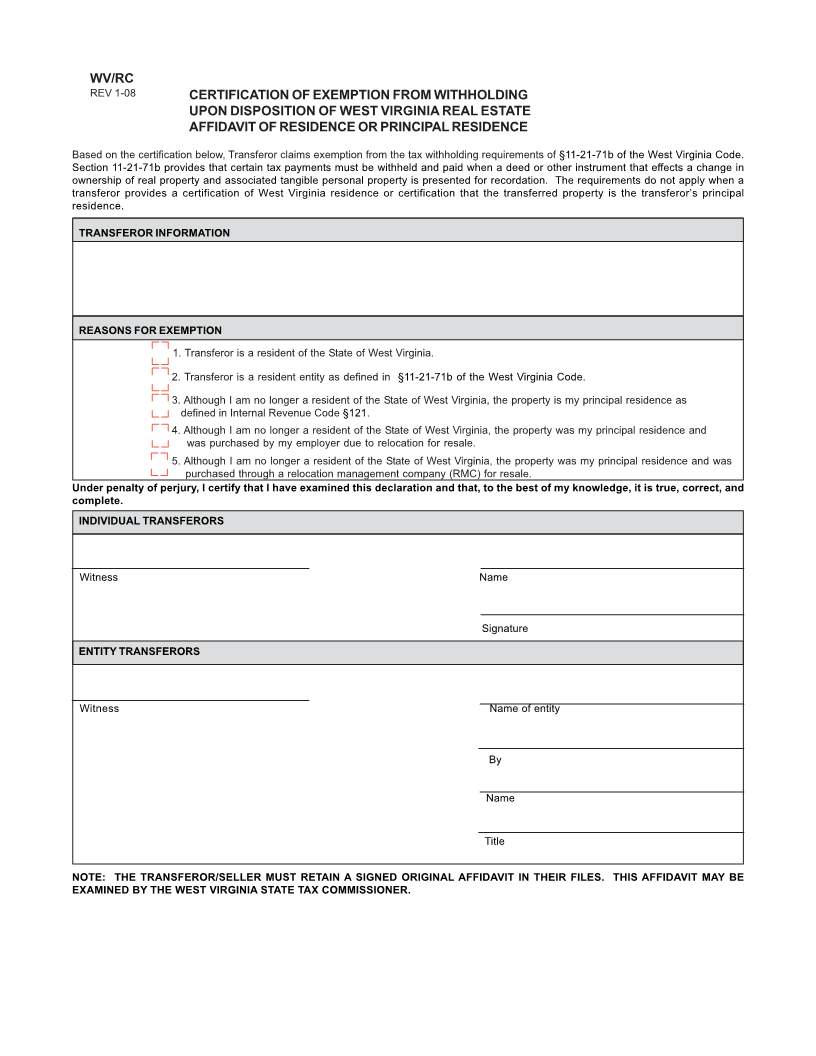

WV/RC

REV 1-08 CERTIFICATION OF EXEMPTION FROM WITHHOLDING

UPON DISPOSITION OF WEST VIRGINIA REAL ESTATE

AFFIDAVIT OF RESIDENCE OR PRINCIPAL RESIDENCE

Based on the certification below, Transferor claims exemption from the tax withholding requirements of §11-21-71b of the West Virginia Code.

Section 11-21-71b provides that certain tax payments must be withheld and paid when a deed or other instrument that effects a change in

ownership of real property and associated tangible personal property is presented for recordation. The requirements do not apply when a

transferor provides a certification of West Virginia residence or certification that the transferred property is the transferor’s principal

residence.

TRANSFERORTRANSFERORINFORMATIONINFORMATION(NAME)

REASONS FOR EXEMPTION

1. Transferor is a resident of the State of West Virginia.

2. Transferor is a resident entity as defined in §11-21-71b of the West Virginia Code.

3. Although I am no longer a resident of the State of West Virginia, the property is my principal residence as

defined in Internal Revenue Code §121.

4. Although I am no longer a resident of the State of West Virginia, the property was my principal residence and

was purchased by my employer due to relocation for resale.

5. Although I am no longer a resident of the State of West Virginia, the property was my principal residence and was

purchased through a relocation management company (RMC) for resale.

Under penalty of perjury, I certify that I have examined this declaration and that, to the best of my knowledge, it is true, correct, and

complete.

INDIVIDUAL TRANSFERORS

Witness Name

Signature

ENTITY TRANSFERORS

Witness Name of entity

By

Name

Title

NOTE: THE TRANSFEROR/SELLER MUST RETAIN A SIGNED ORIGINAL AFFIDAVIT IN THEIR FILES. THIS AFFIDAVIT MAY BE

EXAMINED BY THE WEST VIRGINIA STATE TAX COMMISSIONER.