Enlarge image

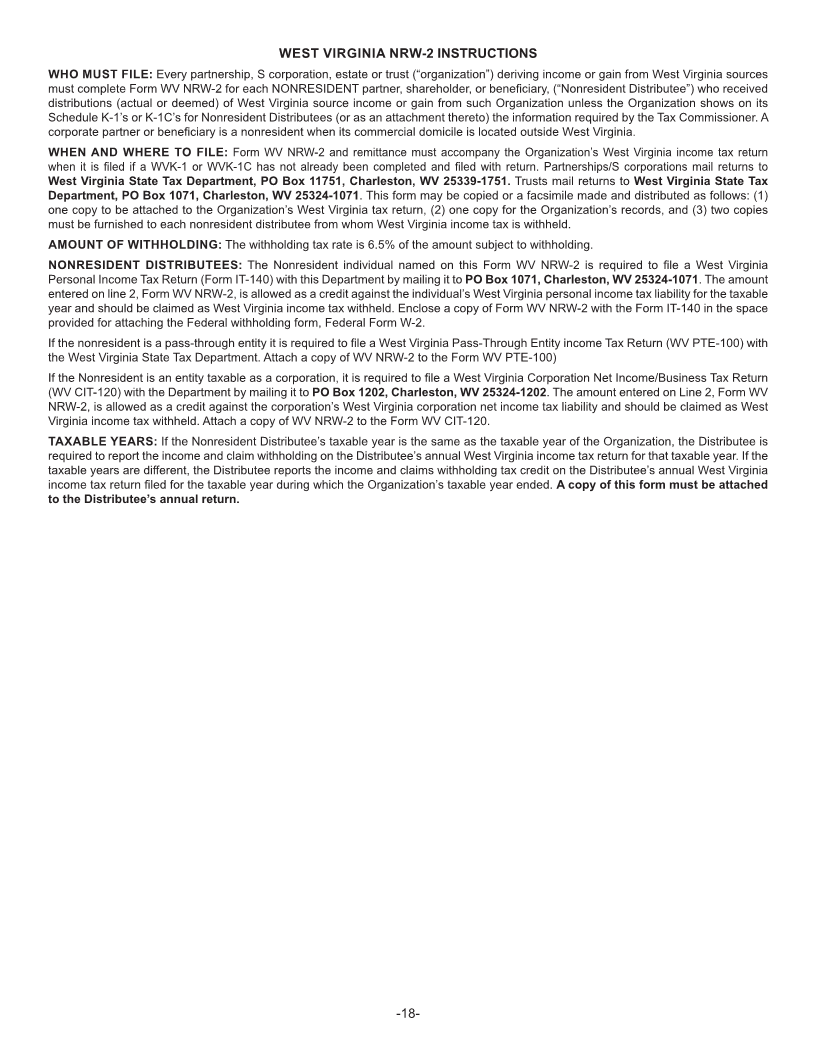

NRW-2 FROM SP Statement of West Virginia Income Tax

REV 7-20 Withheld for Nonresident Individual or Organization 2020

Read Instructions

ORGANIZATION NAME AND MAILING ADDRESS NONRESIDENT’S NAME AND MAILING ADDRESS

Name (please type or print) Name (please type or print)

Street or Post O ffice Box Street or Post O ffi ce Box

City State Zip City State Zip

West Virginia Identi fication NumberFederal Identi fication Number Social Security Number West Virginia Identi fication Number

Check one: 1. Income subject to withholding for nonresident as reported on

organization’s S Corporation, Partnership or Fiduciary Return $

Trust Estate S-Corp Partnership 2. Amount of West Virginia income tax withheld and refunded

(see instructions) $

Taxable Year of Organization

Beginning Ending

MM DD YYYY MM DD YYYY

TO BE FILED IN THE ABSENCE OF FORM WV NRW-4, WEST VIRGINIA NONRESIDENT INCOME TAX AGREEMENT

*P35202006W*

P35202006W

-17-