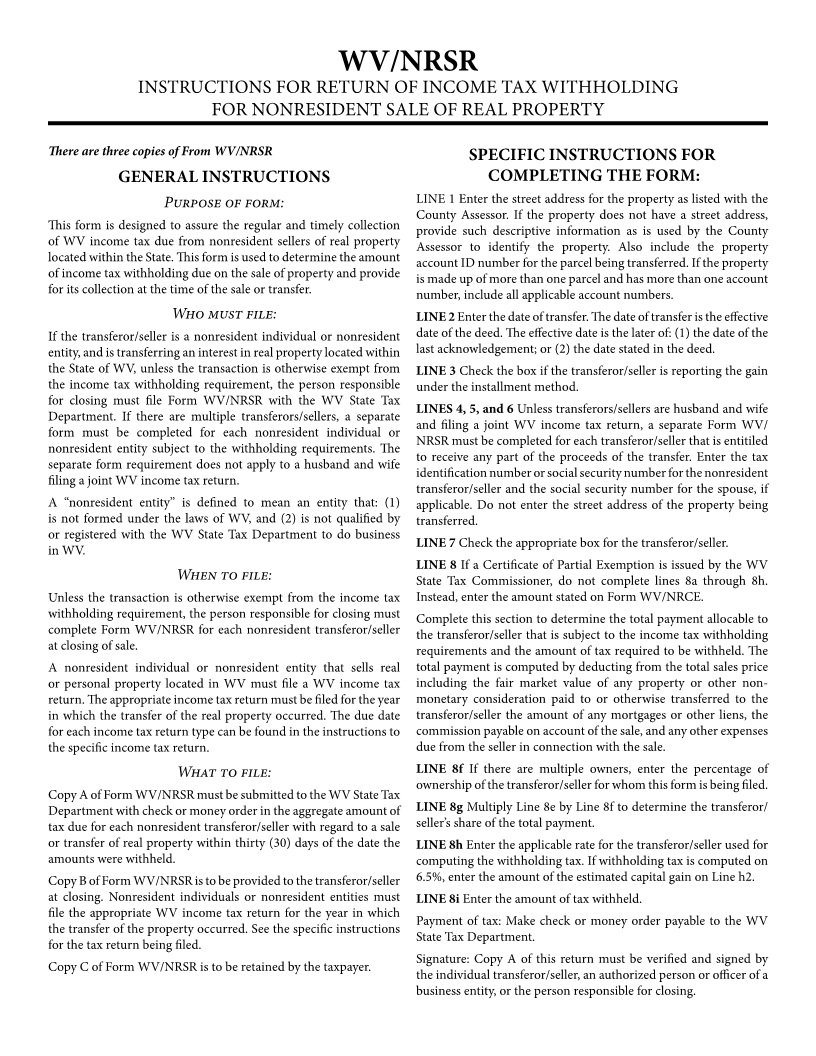

Enlarge image

West Virginia

RetuRN of iNcome tax WithholdiNg foR State Tax

WV/NRSR Department

Rev. 09-12 NoNReSideNt Sale of Real pRopeRty

1. Property account ID Number: 2. Date of transfer

Address and Description

MM DD YYYY

3. Check if the transferor/seller is reporting gain

under the installment method.

4. Transferor/Seller’s Identification number CheCk one 5. Spouse’s SSN Number 7. Transferor/Seller is:

SSn a. Individual

FeIn

b. Corporation

ITIn

c. Trust or Estate

6. Transferor/Seller’s name (Enter only one name, unless husband and wife are filing a joint return. If more d. Business Trust

than one transferor/seller, use separate forms for each.)

e. Partnership

Street Address including City, State and Zip Code f. S Corporation

g. Limited Liability Company

h. Limited Liability Partnership

8. Computation of total payment and tax to be withheld (see instructions)

a. Total sales price paid to transferor.................................................................................. a ●

b. Less selling expenses..................................................................................................... b ●

c. Less debts secured by mortgages or other liens on the property................................... c ●

d. Net proceeds................................................................................................................... d ●

e. Total payments (net proceeds paid to transferor)............................................................ e ●

f. Transferor/seller’s ownership percentage........................................................................ f %

g. Transferor/seller’s share of total payment (multiply line e by line f)................................ g ●

h. Enter applicable rate:

1) 2.5% of total payments, or

2) 6.5% of estimated capital gain $__________________........................................ h %

i. WV Income Tax withheld (multiply line g or amount of estimated capital gain by line h)

(If partial exemption granted, enter amount stated on Form WV/NRCE)........................... i ●

Under the penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is true, correct and complete.

If prepared by a person other than the transferor/seller, the declaration is based on all information to which the preparer has any knowledge.

Signature Date

Make check or Money order payable to and Mail to:

West Virginia state tax departMent

tax account adMinistration diVision

po box 784

charleston, WV 25323-0784

copy a – File With the West Virginia state tax departMent

*b56040801a*