Enlarge image

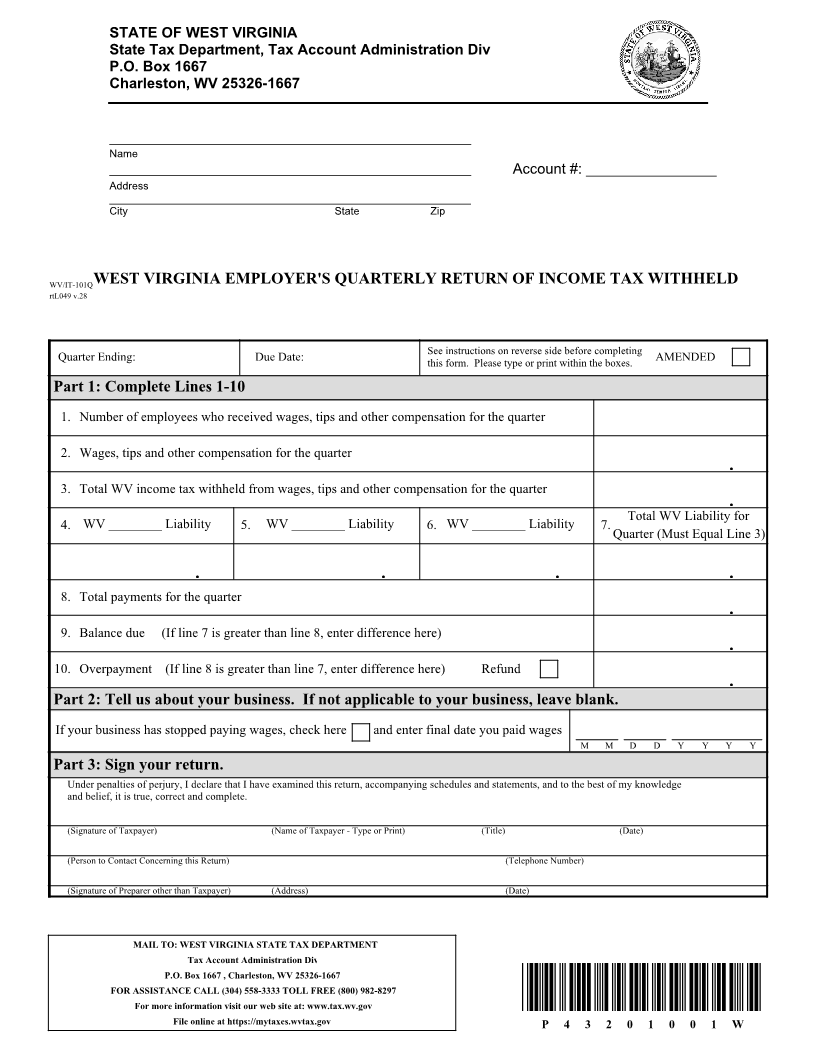

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1667

Charleston, WV 25326-1667

H & R BLOCK OF POINT PLEASANT_____________________________________________________________ Letter Id: L0028590080

Name

1312_____________________________________________________________EASTERN AVE AccountIssued:#: ________________01/08/2019

AddressGALLIPOLIS OH 45631-1731 Account #: 2188-4987

_____________________________________________________________ Period: 03/31/2019

City State Zip

WV/IT-101QWEST VIRGINIA EMPLOYER'S QUARTERLY RETURN OF INCOME TAX WITHHELD

rtL049 v.28

See instructions on reverse side before completing

Quarter Ending: Due Date: this form. Please type or print within the boxes. AMENDED

Part 1: Complete Lines 1-10

1. Number of employees who received wages, tips and other compensation for the quarter

2. Wages, tips and other compensation for the quarter

.

3. Total WV income tax withheld from wages, tips and other compensation for the quarter

.

Total WV Liability for

4. WV ________ Liability 5. WV ________ Liability 6. WV ________ Liability 7.

Quarter (Must Equal Line 3)

. . . .

8. Total payments for the quarter

.

9. Balance due (If line 7 is greater than line 8, enter difference here)

.

10. Overpayment (If line 8 is greater than line 7, enter difference here) Refund

.

Part 2: Tell us about your business. If not applicable to your business, leave blank.

If your business has stopped paying wages, check here and enter final date you paid wages

M M D D Y Y Y Y

Part 3: Sign your return.

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number)

(Signature of Preparer other than Taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 1667 , Charleston, WV 25326-1667

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov P 4 3 2 0 1 0 0 1 W