Enlarge image

Employer’s Withholding Tax Tables

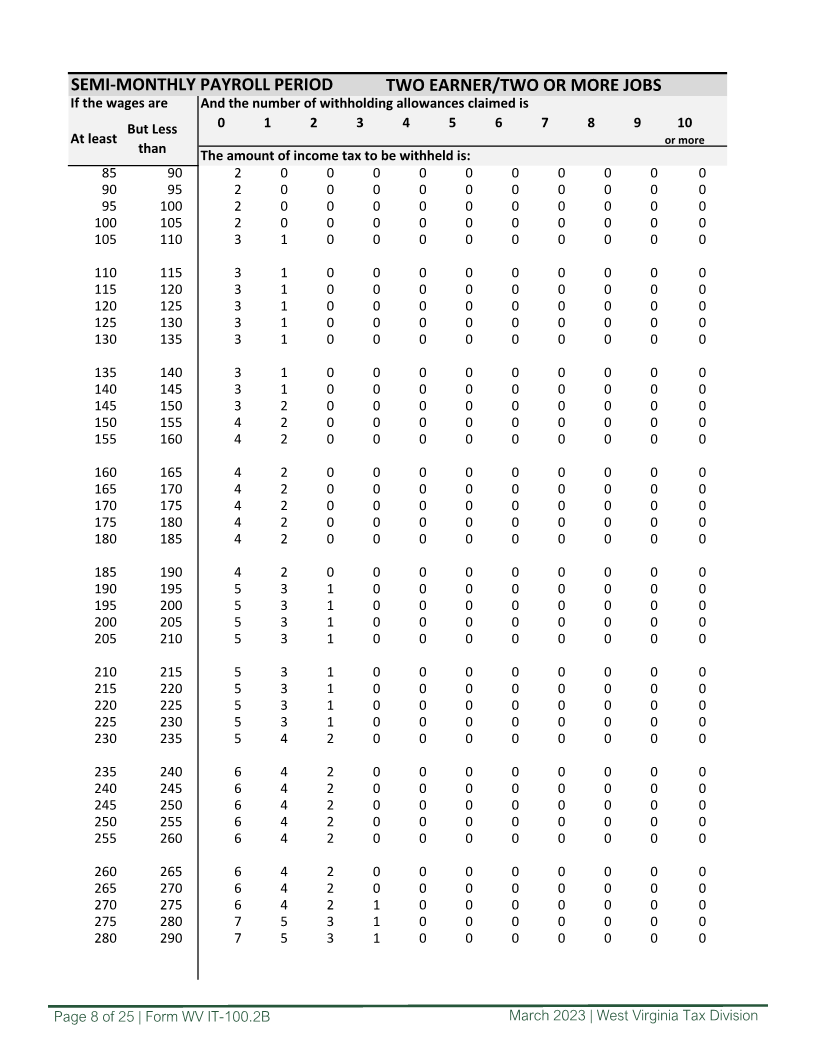

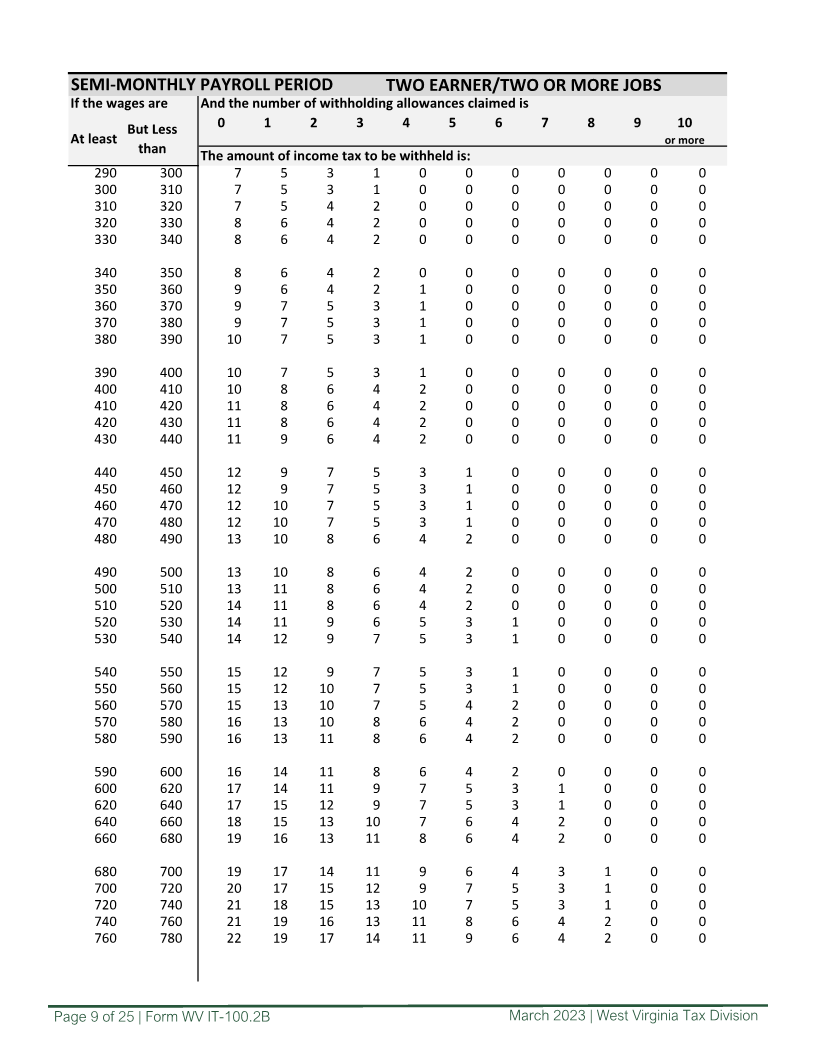

TWO EARNERS/TWO OR MORE JOBS

Married filing jointly, both working/individual earning wages from two jobs

Weekly .............................................................................. 2

Bi-Weekly .............................................................................. 5

Semi-monthly .............................................................................. 8

Monthly .............................................................................. 11

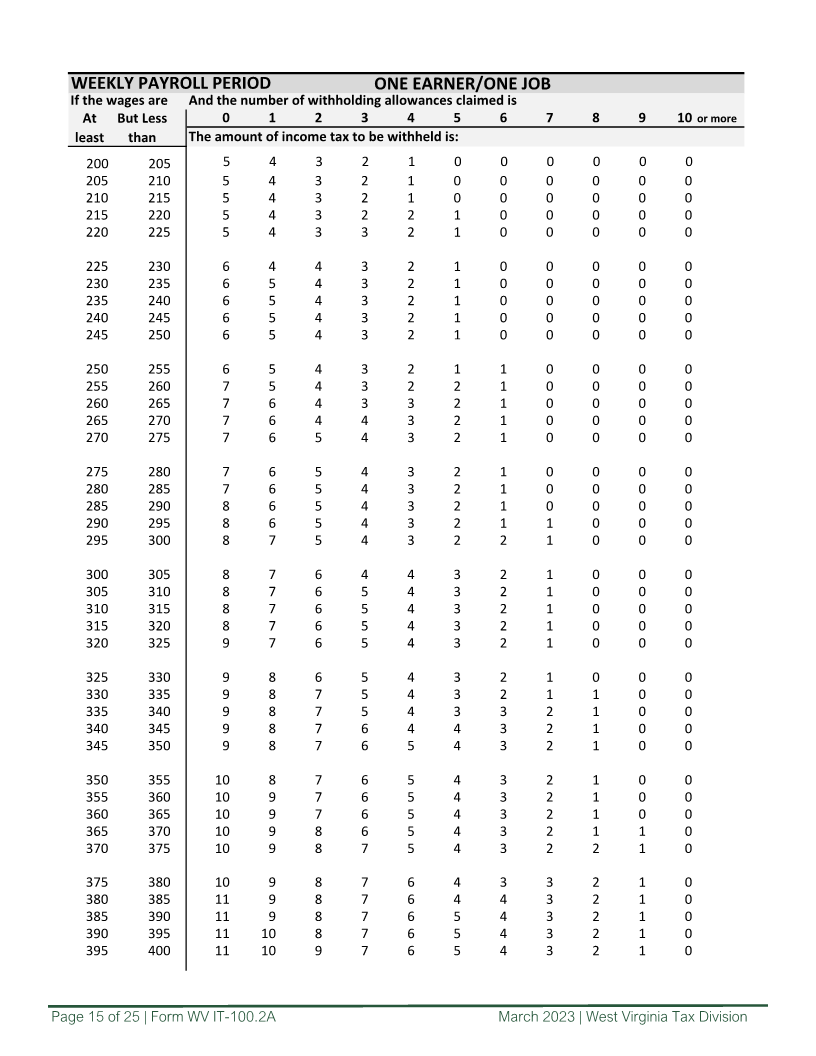

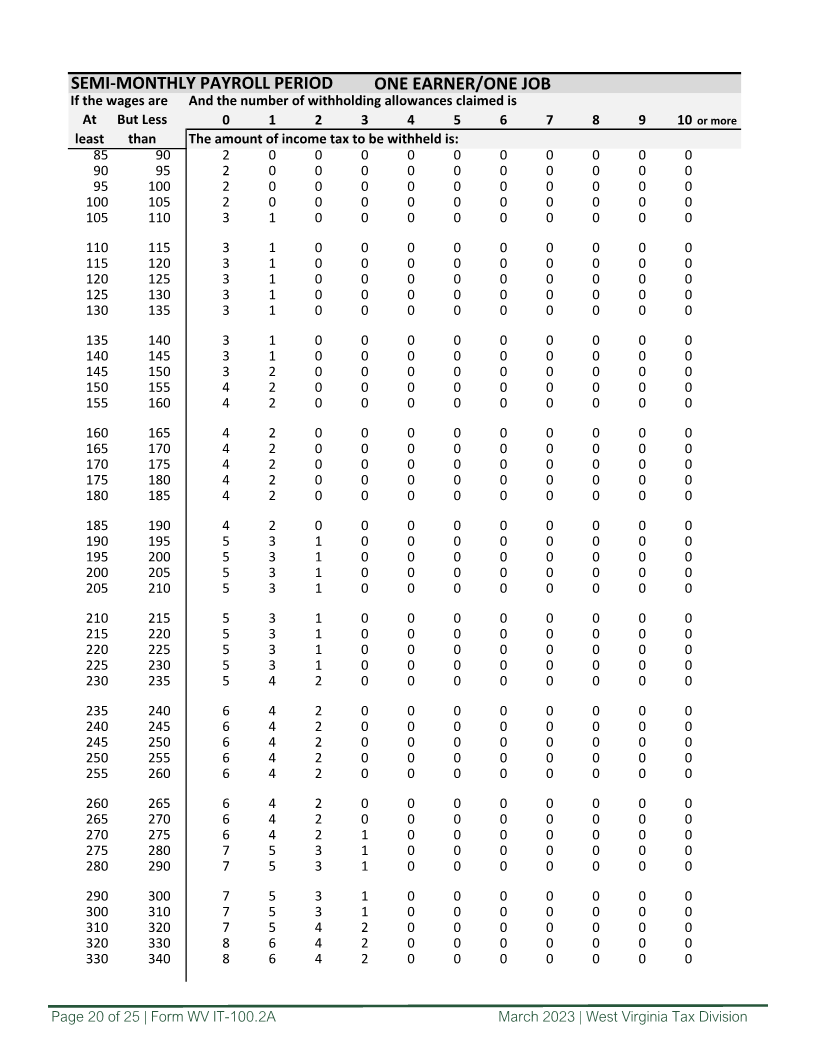

ONE EARNER/ONE JOB

Single, head of household or married with nonemployed spouse

Weekly .............................................................................. 14

Bi-Weekly .............................................................................. 17

Semi-monthly .............................................................................. 20

Monthly .............................................................................. 23

Page 1 of 25 | Form WV IT-100.2B March 2023 | West Virginia Tax Division