Enlarge image

West Virginia

WV-PTEV Income Tax for S Corporations & Partnerships

REV. 07-20

Electronic Payment Voucher & Instructions

Do I need to use a payment voucher?

1. If your partnership or S corporation owes tax on its return, send the payment voucher to us with your payment. You

must pay the amount owed by the 15th day of the third month after your year end to avoid interest and penalties.

2. If your return shows a refund or no tax due, there is no need to use the payment voucher.

3. You may be required to submit this payment electronically. To see if you are required to pay electronically, please visit

our website at tax.wv.gov.

How do I prepare my payment?

1. Make your check or money order payable to the West Virginia State Tax Department. Do not send cash!

2. If your name and address are not printed on your check or money order, write them on it.

3. Write your FEIN, daytime phone number, and “Form WV-PTEV” on your payment.

How do I prepare my payment voucher?

1. Enter your FEIN in the rstfi block.

2. Enter the period ending date in the second box.

3. Enter your name(s) and address on the last three lines.

4. Mark the Amended box if payment is associated with an amended tax return to ensure the proper direction and

processing. Failure to do so could result in the assessment of late payment penalties.

How do I send my payment and the payment voucher?

1. Detach the payment voucher by cutting along the dotted line.

2. DO NOT attach the payment voucher or your payment to your return or to each other.

3. Mail your payment and payment voucher to the following address:

West Virginia State Tax Department

Tax Account Administration Division

PO Box 3839

Charleston, WV 25338-3839

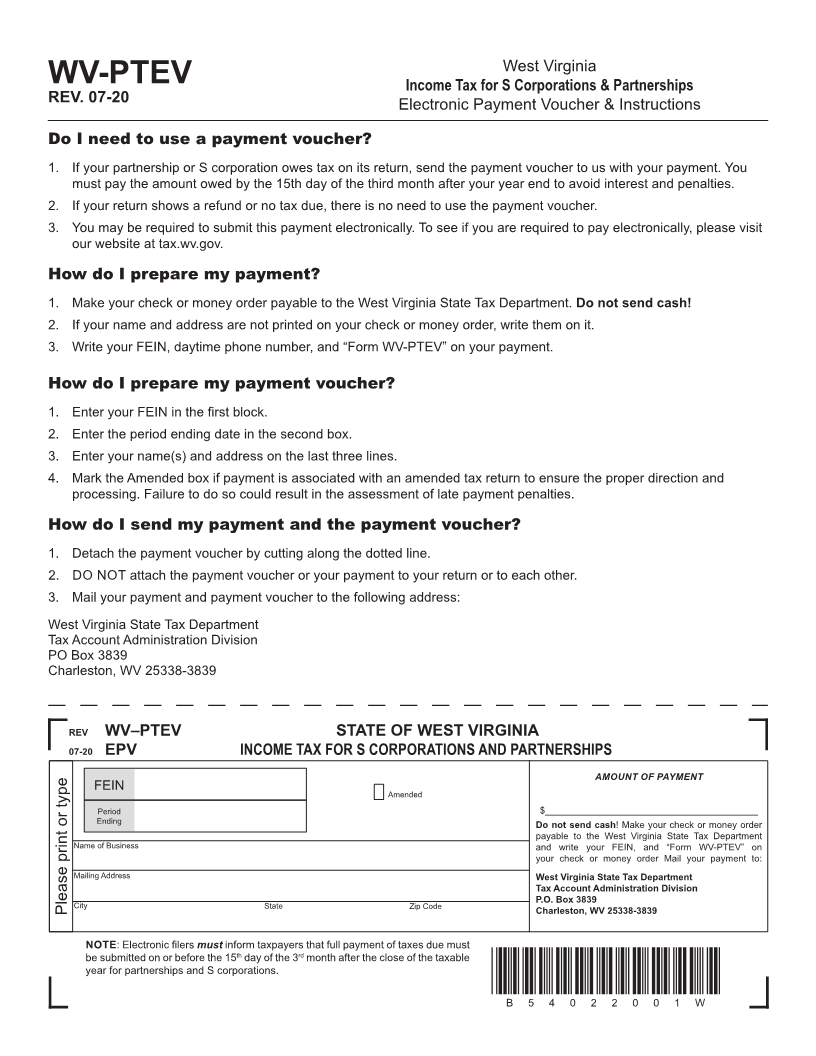

REV WV–PTEV STATE OF WEST VIRGINIA

07-20 EPV INCOME TAX FOR S CORPORATIONS AND PARTNERSHIPS

AMOUNT OF PAYMENT

FEIN Amended

Period $_________________________________________

Ending Do not send cash! Make your check or money order

payable to the West Virginia State Tax Department

Name of Business and write your FEIN, and “Form WV-PTEV” on

your check or money order Mail your payment to:

Mailing Address West Virginia State Tax Department

Tax Account Administration Division

Please print or type City State Zip Code P.O. Box 3839

Charleston, WV 25338-3839

NOTE: Electronic filersmust inform taxpayers that full payment of taxes due must

be submitted on or before the 15 thday of the 3 rdmonth after the close of the taxable

year for partnerships and S corporations.

*B54022001W*

B54022001W