Enlarge image

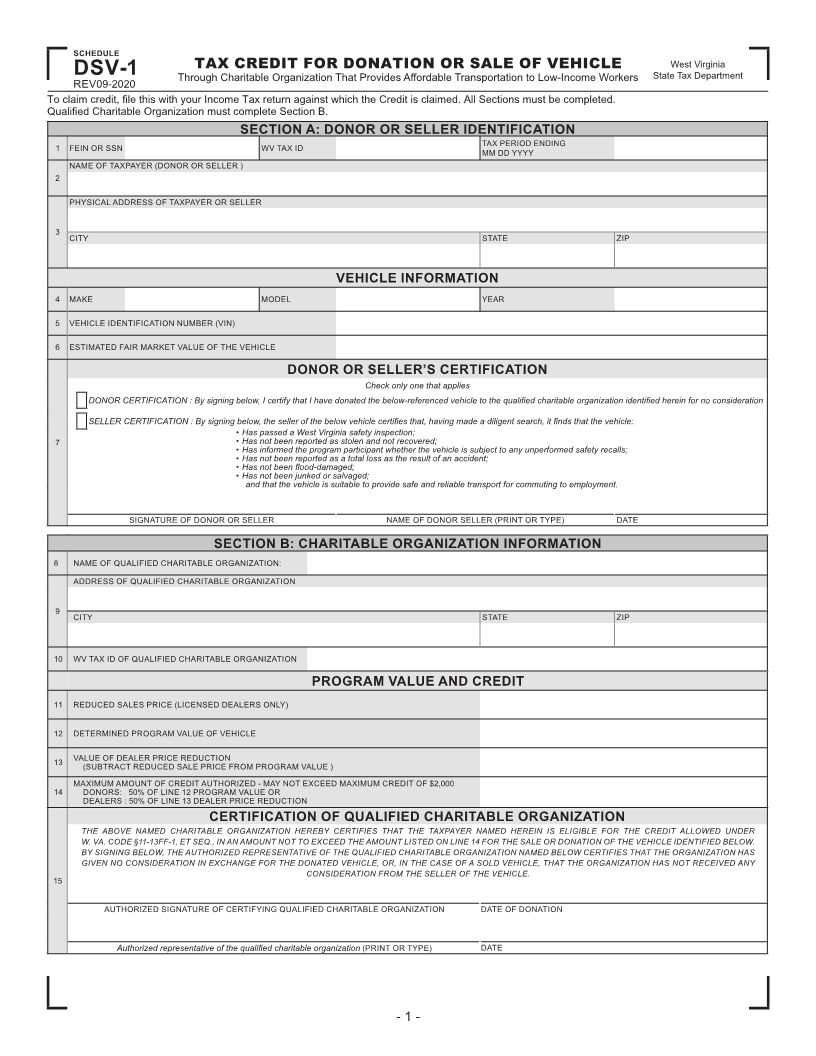

SCHEDULE

DSV-1 TAX CREDIT FOR DONATION OR SALE OF VEHICLE West Virginia

Through Charitable Organization That Provides A ffordable Transportation to Low-Income Workers State Tax Department

REV09-2020

To claim credit, file this with your Income Tax return against which the Credit is claimed. All Sections must be completed.

Qualified Charitable Organization must complete Section B.

SECTION A: DONOR OR SELLER IDENTIFICATION

1 FEIN OR SSN WV TAX ID TAX PERIOD ENDING

MM DD YYYY

NAME OF TAXPAYER (DONOR OR SELLER )

2

PHYSICAL ADDRESS OF TAXPAYER OR SELLER

3 CITY STATE ZIP

VEHICLE INFORMATION

4 MAKE MODEL YEAR

5 VEHICLE IDENTIFICATION NUMBER (VIN)

6 ESTIMATED FAIR MARKET VALUE OF THE VEHICLE

DONOR OR SELLER’S CERTIFICATION

Check only one that applies

DONOR CERTIFICATION : By signing below, I certify that I have donated the below-referenced vehicle to the quali fied charitable organization identi fied herein for no consideration

SELLER CERTIFICATION : By signing below, the seller of the below vehicle certi fies that, having made a diligent search, it finds that the vehicle:

• Has passed a West Virginia safety inspection;

7 • Has not been reported as stolen and not recovered;

• Has informed the program participant whether the vehicle is subject to any unperformed safety recalls;

• Has not been reported as a total loss as the result of an accident;

• Has not been flood-damaged;

• Has not been junked or salvaged;

and that the vehicle is suitable to provide safe and reliable transport for commuting to employment.

SIGNATURE OF DONOR OR SELLER NAME OF DONOR SELLER (PRINT OR TYPE) DATE

SECTION B: CHARITABLE ORGANIZATION INFORMATION

8 NAME OF QUALIFIED CHARITABLE ORGANIZATION:

ADDRESS OF QUALIFIED CHARITABLE ORGANIZATION

9 CITY STATE ZIP

10 WV TAX ID OF QUALIFIED CHARITABLE ORGANIZATION

PROGRAM VALUE AND CREDIT

11 REDUCED SALES PRICE (LICENSED DEALERS ONLY)

12 DETERMINED PROGRAM VALUE OF VEHICLE

13 VALUE OF DEALER PRICE REDUCTION

(SUBTRACT REDUCED SALE PRICE FROM PROGRAM VALUE )

MAXIMUM AMOUNT OF CREDIT AUTHORIZED - MAY NOT EXCEED MAXIMUM CREDIT OF $2,000

14 DONORS: 50% OF LINE 12 PROGRAM VALUE OR

DEALERS : 50% OF LINE 13 DEALER PRICE REDUCTION

CERTIFICATION OF QUALIFIED CHARITABLE ORGANIZATION

THE ABOVE NAMED CHARITABLE ORGANIZATION HEREBY CERTIFIES THAT THE TAXPAYER NAMED HEREIN IS ELIGIBLE FOR THE CREDIT ALLOWED UNDER

W. VA. CODE §11-13FF-1, ET SEQ., IN AN AMOUNT NOT TO EXCEED THE AMOUNT LISTED ON LINE 14 FOR THE SALE OR DONATION OF THE VEHICLE IDENTIFIED BELOW.

BY SIGNING BELOW, THE AUTHORIZED REPRESENTATIVE OF THE QUALIFIED CHARITABLE ORGANIZATION NAMED BELOW CERTIFIES THAT THE ORGANIZATION HAS

GIVEN NO CONSIDERATION IN EXCHANGE FOR THE DONATED VEHICLE, OR, IN THE CASE OF A SOLD VEHICLE, THAT THE ORGANIZATION HAS NOT RECEIVED ANY

CONSIDERATION FROM THE SELLER OF THE VEHICLE.

15

AUTHORIZED SIGNATURE OF CERTIFYING QUALIFIED CHARITABLE ORGANIZATION DATE OF DONATION

Authorized representative of the quali fied charitable organization (PRINT OR TYPE) DATE

- 1 -