Enlarge image

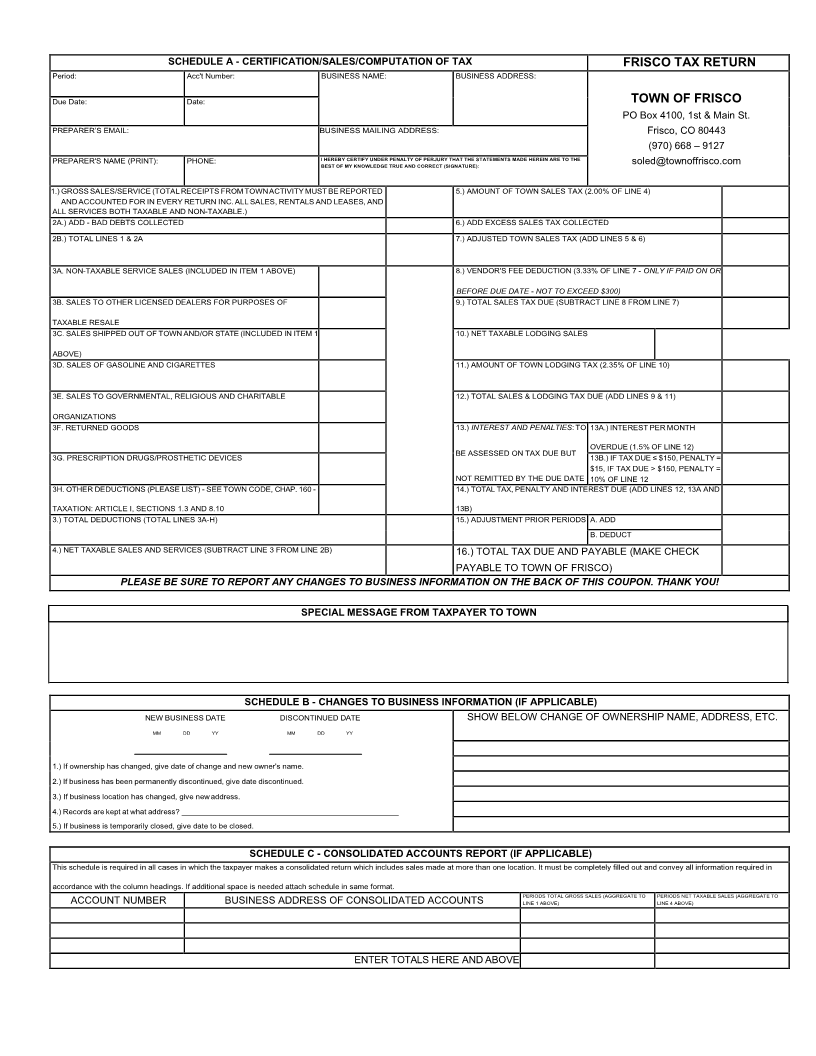

SCHEDULE A - CERTIFICATION/SALES/COMPUTATION OF TAX FRISCO TAX RETURN

Period: Acc't Number: BUSINESS NAME: BUSINESS ADDRESS:

Due Date: Date: TOWN OF FRISCO

PO Box 4100, 1st & Main St.

PREPARER’S EMAIL: BUSINESS MAILING ADDRESS: Frisco, CO 80443

(970) 668 – 9127

PREPARER'S NAME (PRINT): PHONE: I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE STATEMENTS MADE HEREIN ARE TO THE soled@townoffrisco.com

BEST OF MY KNOWLEDGE TRUE AND CORRECT (SIGNATURE):

1.) GROSS SALES/SERVICE (TOTAL RECEIPTS FROM TOWN ACTIVITY MUST BE REPORTED 5.) AMOUNT OF TOWN SALES TAX (2.00% OF LINE 4)

AND ACCOUNTED FOR IN EVERY RETURN INC. ALL SALES, RENTALS AND LEASES, AND

ALL SERVICES BOTH TAXABLE AND NON-TAXABLE.)

2A.) ADD - BAD DEBTS COLLECTED 6.) ADD EXCESS SALES TAX COLLECTED

2B.) TOTAL LINES 1 & 2A 7.) ADJUSTED TOWN SALES TAX (ADD LINES 5 & 6)

3A. NON-TAXABLE SERVICE SALES (INCLUDED IN ITEM 1 ABOVE) 8.) VENDOR'S FEE DEDUCTION (3.33% OF LINE 7 - ONLY IF PAID ON OR

BEFORE DUE DATE - NOT TO EXCEED $300)

3B. SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF 9.) TOTAL SALES TAX DUE (SUBTRACT LINE 8 FROM LINE 7)

TAXABLE RESALE

3C. SALES SHIPPED OUT OF TOWN AND/OR STATE (INCLUDED IN ITEM 1 10.) NET TAXABLE LODGING SALES

ABOVE)

3D. SALES OF GASOLINE AND CIGARETTES 11.) AMOUNT OF TOWN LODGING TAX (2.35% OF LINE 10)

3E. SALES TO GOVERNMENTAL, RELIGIOUS AND CHARITABLE 12.) TOTAL SALES & LODGING TAX DUE (ADD LINES 9 & 11)

ORGANIZATIONS

3F. RETURNED GOODS 13.) INTEREST AND PENALTIES : TO 13A.) INTEREST PER MONTH

BE ASSESSED ON TAX DUE BUT OVERDUE (1.5% OF LINE 12)

3G. PRESCRIPTION DRUGS/PROSTHETIC DEVICES 13B.) IF TAX DUE ≤$150, PENALTY =

$15, IF TAX DUE > $150, PENALTY =

NOT REMITTED BY THE DUE DATE 10% OF LINE 12

3H. OTHER DEDUCTIONS (PLEASE LIST) - SEE TOWN CODE, CHAP. 160 - 14.) TOTAL TAX, PENALTY AND INTEREST DUE (ADD LINES 12, 13A AND

TAXATION: ARTICLE I, SECTIONS 1.3 AND 8.10 13B)

3.) TOTAL DEDUCTIONS (TOTAL LINES 3A-H) 15.) ADJUSTMENT PRIOR PERIODS A. ADD

B. DEDUCT

4.) NET TAXABLE SALES AND SERVICES (SUBTRACT LINE 3 FROM LINE 2B) 16.) TOTAL TAX DUE AND PAYABLE (MAKE CHECK

PAYABLE TO TOWN OF FRISCO)

PLEASE BE SURE TO REPORT ANY CHANGES TO BUSINESS INFORMATION ON THE BACK OF THIS COUPON. THANK YOU!

SPECIAL MESSAGE FROM TAXPAYER TO TOWN

SCHEDULE B - CHANGES TO BUSINESS INFORMATION (IF APPLICABLE)

NEW BUSINESS DATE DISCONTINUED DATE SHOW BELOW CHANGE OF OWNERSHIP NAME, ADDRESS, ETC.

MM DD YY MM DD YY

1.) If ownership has changed, give date of change and new owner's name.

2.) If business has been permanently discontinued, give date discontinued.

3.) If business location has changed, give new address.

4.) Records are kept at what address?

5.) If business is temporarily closed, give date to be closed.

SCHEDULE C - CONSOLIDATED ACCOUNTS REPORT (IF APPLICABLE)

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location. It must be completely filled out and convey all information required in

accordance with the column headings. If additional space is needed attach schedule in same format.

PERIODS TOTAL GROSS SALES (AGGREGATE TO PERIODS NET TAXABLE SALES (AGGREGATE TO

ACCOUNT NUMBER BUSINESS ADDRESS OF CONSOLIDATED ACCOUNTS LINE 1 ABOVE) LINE 4 ABOVE)

ENTER TOTALS HERE AND ABOVE