Enlarge image

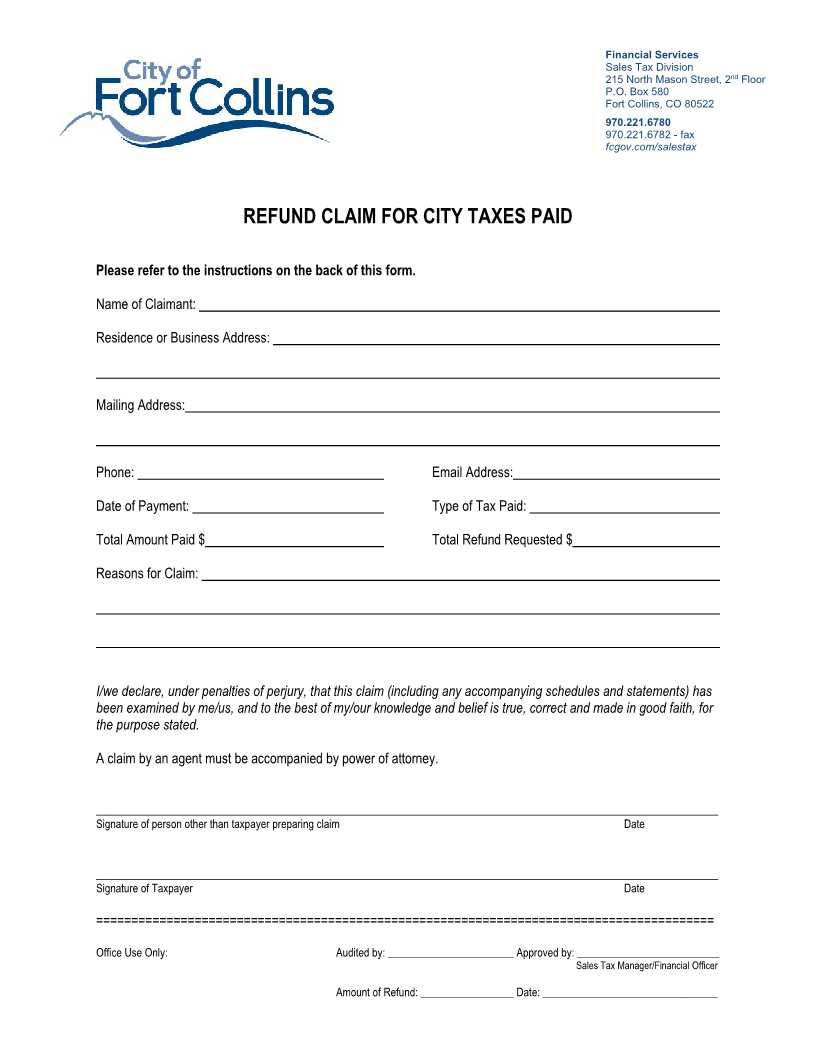

Financial Services

Sales Tax Division

215 North Mason Street, 2 ndFloor

P.O. Box 580

Fort Collins, CO 80522

970.221.6780

970.221.6782 - fax

fcgov.com/salestax

REFUND CLAIM FOR CITY TAXES PAID

Please refer to the instructions on the back of this form.

Name of Claimant:

Residence or Business Address:

Mailing Address:

Phone: Email Address:

Date of Payment: Type of Tax Paid:

Total Amount Paid $ Total Refund Requested $

Reasons for Claim:

I/we declare, under penalties of perjury, that this claim (including any accompanying schedules and statements) has

been examined by me/us, and to the best of my/our knowledge and belief is true, correct and made in good faith, for

the purpose stated.

A claim by an agent must be accompanied by power of attorney.

_____________________________________________________________________________________________

Signature of person other than taxpayer preparing claim Date

_____________________________________________________________________________________________

Signature of Taxpayer Date

========================================================================================

Office Use Only: Audited by: _______________________ Approved by: __________________________

Sales Tax Manager/Financial Officer

Amount of Refund: _________________ Date: ________________________________