Enlarge image

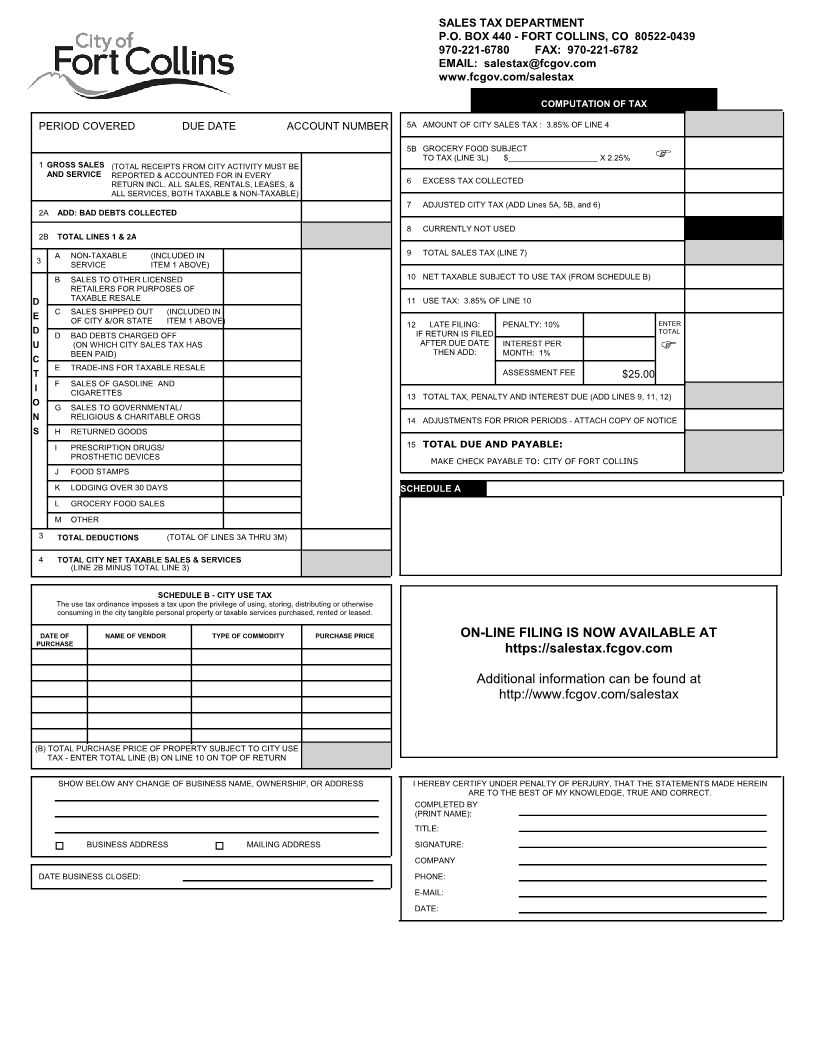

SALES TAX DEPARTMENT

P.O. BOX 440 - FORT COLLINS, CO 80522-0439

970-221-6780 FAX: 970-221-6782

EMAIL: salestax@fcgov.com

www.fcgov.com/salestax

COMPUTATION OF TAX

PERIOD COVERED DUE DATE ACCOUNT NUMBER 5A AMOUNT OF CITY SALES TAX : 3.85% OF LINE 4

5B GROCERY FOOD SUBJECT

TO TAX (LINE 3L) $____________________ X 2.25%

1 GROSS SALES (TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE

AND SERVICE REPORTED & ACCOUNTED FOR IN EVERY 6 EXCESS TAX COLLECTED

RETURN INCL. ALL SALES, RENTALS, LEASES, &

ALL SERVICES, BOTH TAXABLE & NON-TAXABLE)

7 ADJUSTED CITY TAX (ADD Lines 5A, 5B, and 6)

2A ADD: BAD DEBTS COLLECTED

8 CURRENTLY NOT USED

2B TOTAL LINES 1 & 2A

A NON-TAXABLE (INCLUDED IN 9 TOTAL SALES TAX (LINE 7)

3 SERVICE ITEM 1 ABOVE)

B SALES TO OTHER LICENSED 10 NET TAXABLE SUBJECT TO USE TAX (FROM SCHEDULE B)

RETAILERS FOR PURPOSES OF

D TAXABLE RESALE 11 USE TAX: 3.85% OF LINE 10

E C SALES SHIPPED OUT (INCLUDED IN

OF CITY &/OR STATE ITEM 1 ABOVE) 12 LATE FILING: PENALTY: 10% ENTER

D D BAD DEBTS CHARGED OFF IF RETURN IS FILED TOTAL

U (ON WHICH CITY SALES TAX HAS AFTER DUE DATE INTEREST PER

C BEEN PAID) THEN ADD: MONTH: 1%

E TRADE-INS FOR TAXABLE RESALE

T ASSESSMENT FEE $25.00

I F SALES OF GASOLINE AND

CIGARETTES 13 TOTAL TAX, PENALTY AND INTEREST DUE (ADD LINES 9, 11, 12)

O G SALES TO GOVERNMENTAL/

N RELIGIOUS & CHARITABLE ORGS 14 ADJUSTMENTS FOR PRIOR PERIODS - ATTACH COPY OF NOTICE

S H RETURNED GOODS

I PRESCRIPTION DRUGS/ 15 TOTAL DUE AND PAYABLE:

PROSTHETIC DEVICES MAKE CHECK PAYABLE TO: CITY OF FORT COLLINS

J FOOD STAMPS

K LODGING OVER 30 DAYS SCHEDULE A

L GROCERY FOOD SALES

MOTHER

3 TOTAL DEDUCTIONS (TOTAL OF LINES 3A THRU 3M)

4 TOTAL CITY NET TAXABLE SALES & SERVICES

(LINE 2B MINUS TOTAL LINE 3)

SCHEDULE B - CITY USE TAX

The use tax ordinance imposes a tax upon the privilege of using, storing, distributing or otherwise

consuming in the city tangible personal property or taxable services purchased, rented or leased.

DATE OF NAME OF VENDOR TYPE OF COMMODITY PURCHASE PRICE ON-LINE FILING IS NOW AVAILABLE AT

PURCHASE

https://salestax.fcgov.com

Additional information can be found at

http://www.fcgov.com/salestax

(B) TOTAL PURCHASE PRICE OF PROPERTY SUBJECT TO CITY USE

TAX - ENTER TOTAL LINE (B) ON LINE 10 ON TOP OF RETURN

SHOW BELOW ANY CHANGE OF BUSINESS NAME, OWNERSHIP, OR ADDRESS I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE STATEMENTS MADE HEREIN

ARE TO THE BEST OF MY KNOWLEDGE, TRUE AND CORRECT.

COMPLETED BY

(PRINT NAME):

TITLE:

BUSINESS ADDRESS MAILING ADDRESS SIGNATURE:

COMPANY

DATE BUSINESS CLOSED: PHONE:

E-MAIL:

DATE: