Enlarge image

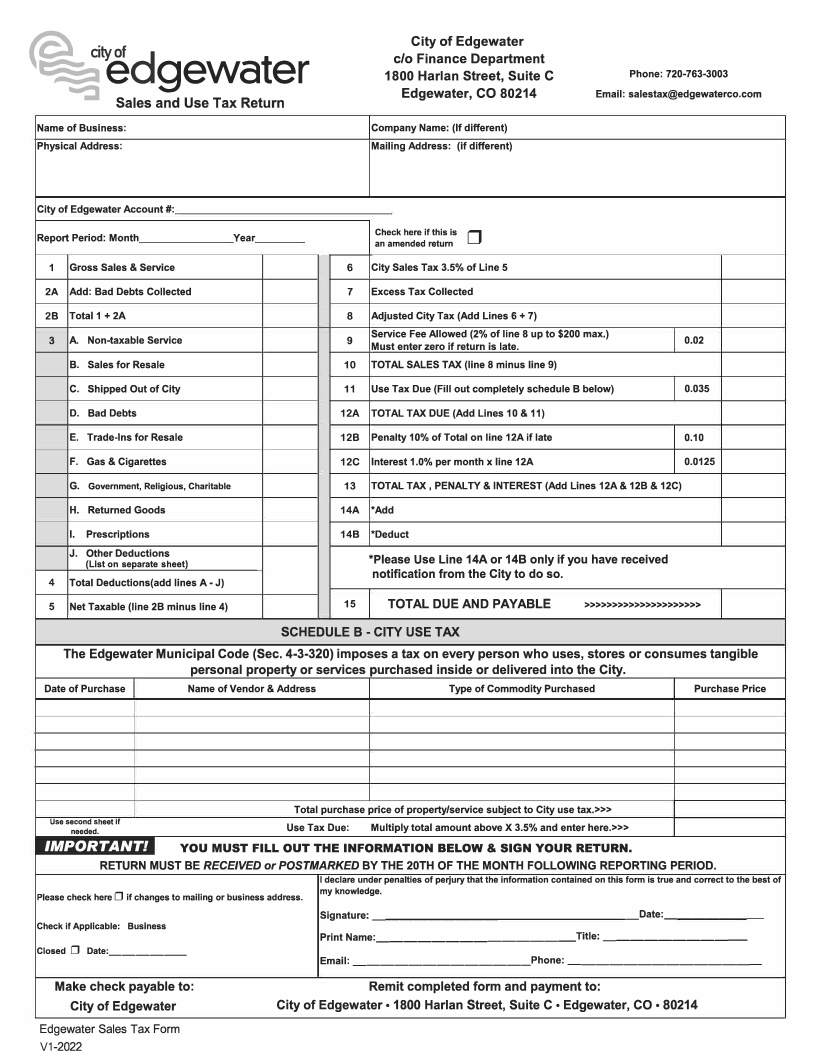

City of Edgewater

@ cityofd c/o Finance Department

1800 Harlan Street, Suite C Phone: 720-763-3003

�e gewater Edgewater, CO 80214 Email: salestax@edgewaterco.com

--:I Sales and Use Tax Return

Name of Business: Company Name: (If different)

Physical Address: Mailing Address: (if different)

City of Edgewater Account#:

Report Period: Month Year Check here if this is

an amended return □

1 Gross Sales & Service 6 City Sales Tax 3.5% of Line 5

2A Add: Bad Debts Collected 7 Excess Tax Collected

2B Total 1 + 2A 8 Adjusted City Tax (Add Lines 6 + 7)

Service Fee Allowed (2% of line 8 up to $200 max.)

3 A. Non-taxable Service 9 Must enter zero if return is late. 0.02

B. Sales for Resale 10 TOTAL SALES TAX (line 8 minus line 9)

C. Shipped Out of City 11 Use Tax Due (Fill out completely schedule B below) 0.035

D. Bad Debts 12A TOTAL TAX DUE (Add Lines 10 & 11)

E. Trade-Ins for Resale 12B Penalty 10% of Total on line 12A if late 0.10

F. Gas & Cigarettes 12C Interest 1.0% per month x line 12A 0.0125

G. Government, Religious, Charitable 13 TOTAL TAX, PENALTY & INTEREST (Add Lines 12A & 12B & 12C)

H. Returned Goods 14A *Add

I. Prescriptions 14B *Deduct

J. Other Deductions

(List on separate sheet) *Please Use Line 14A or 148 only if you have received

notification from the City to do so.

4 Total Deductions(add lines A - J )

5 Net Taxable (line 2B minus line 4) 15 TOTAL DUE AND PAYABLE >>>>>>>>>>>>>>>>>>>>>

SCHEDULE B -CITY USE TAX

The Edgewater Municipal Code (Sec. 4-3-320) imposes a tax on every person who uses, stores or consumes tangible

personal property or services purchased inside or delivered into the City.

Date of Purchase Name of Vendor & Address Type of Commodity Purchased Purchase Price

Total purchase price of property/service subject to City use tax.»>

Use second sheet If »>

needed. Use Tax Due: Multiply total amount above X 3.5% and enter here.

IMPORTANT! YOU MUST FILL OUT THE INFORMATION BELOW & SIGN YOUR RETURN.

RETURN MUST BE RECEIVED or POSTMARKED BY THE 20TH OF THE MONTH FOLLOWING REPORTING PERIOD.

I declare under penalties of perjury that the information contained on this form is true and correct to the best of

Please check here D if changes to mailing or business address. my knowledge.

Signature: ___________________ Date: ______ _

Check if Applicable: Business

Print Name: ______________ Title: _________ _

Closed D Date:. _____ _

Email: _____________ Phone: _____________ _

Make check payable to: Remit completed form and payment to:

City of Edgewater City of Edgewater• 1800 Harlan Street, Suite C • Edgewater, CO• 80214

Edgewater Sales Tax Form

V1-2022