Enlarge image

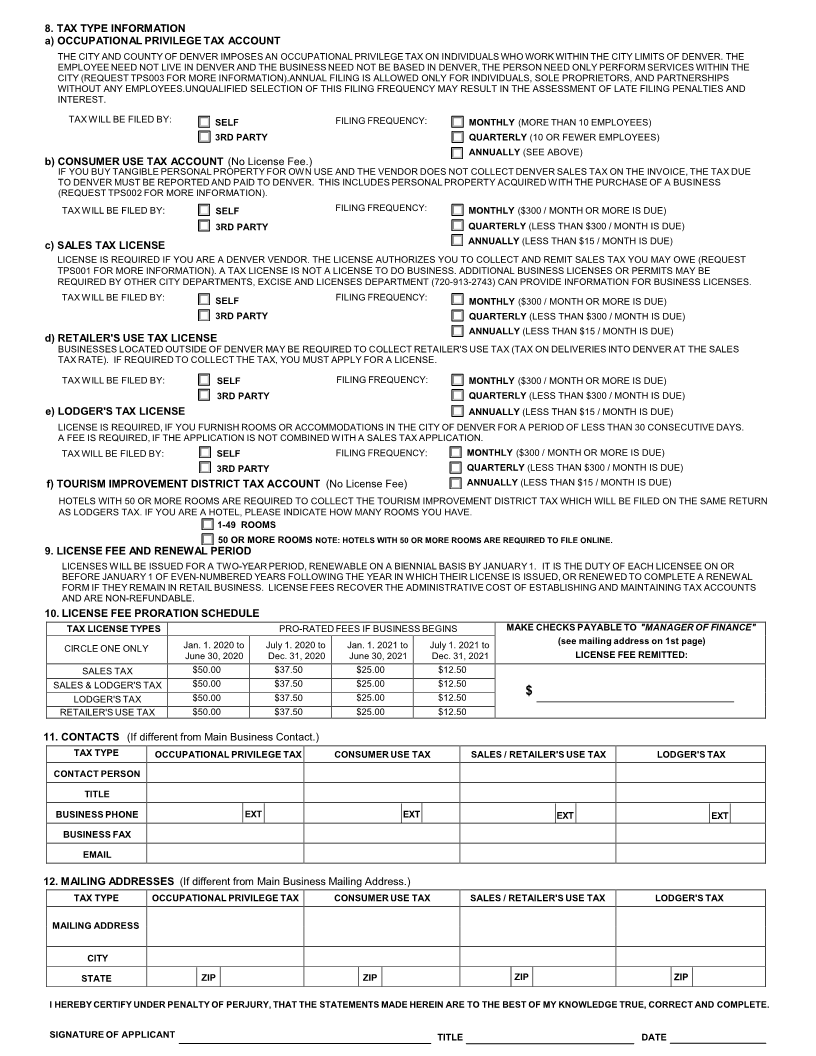

Mailing Address:

City and County of Denver

APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE Treasury Division

Wellington Webb Bldg.

AND/OR OCCUPATIONAL TAX REGISTRATION 201 W Colfax Ave., Dept 403

Denver, CO 80202-5329

THIS APPLICATION MUST BE COMPLETED IN FULL (THIS FORM HAS 2 SIDES). INCOMPLETE APPLICATIONS WILL BE RETURNED. A

SEPARATE APPLICATION IS REQUIRED FOR EACH PLACE OF BUSINESS. IF YOU NEED A SSISTANCE, CALL 720-913-9400, OR VISIT OUR

WEBSITE AT WWW.DENVERGOV.ORG/TREASURY FOR HELPFUL TAX INFORMATION.

1.BUSINESS INFORMATION

TRADE NAME FEIN #

LEGAL NAME STATE SALES TAX #

WEBSITE NAICS #

(N. American Industry Classification System)

2.OWNERSHIP INFORMATION

CORPORATION S-CORPORATION SOLE PROPR TIE OR PARTNERSHIP NON PROFIT GOVERNMENT

LLC (How do you declare with the IRS for Federal Income Tax filing ?) Corporation Partnership Disregarded Entity

HAS THIS BUSINESS BEEN LICENSED OR REGISTERED IN DENVER UNDER YOUR OWNERSHIP IN THE PAST? YES NO

ACCOUNT #:

3.OWNER / OFFICER INFORMATION (If needed, please list additional Owner / Officer Information on separate sheet.)

NAME BUSINESS PHONE #1 EXT

TITLE BUSINESS PHONE #2 EXT

ADDRESS BUSINESS FAX

CITY HOME PHONE

STATE ZIP CODE EMAIL

NAME BUSINESS PHONE #1 EXT

TITLE BUSINESS PHONE #2 EXT

ADDRESS BUSINESS FAX

CITY HOME PHONE

STATE ZIP CODE EMAIL

4.BUSINESS LOCATION INFORMATION (Do not use P.O. Box.)

ADDRESS BUSINESS PHONE EXT

CITY BUSINESS FAX

STATE ZIPCODE EMAIL

5.BUSINESS MAILING INFORMATION (If different from Business Location Address.)

ADDRESS

CITY

STATE ZIP CODE

6. TYPE OF BUSINESS

RETAIL SALES WHOLESALE SALES MANUFACTURING CONSTRUCTION GOVERNMENT SERVICE ONLY OTHER

DESCRIBE THE NATURE OF BUSINESS

(PRODUCTS SOLD, SERVICES PROVIDED)

NUMBER OF EMPLOYEES WORKING IN DENVER BUSINESS START DATE IN DENVER _____/_______/_____ _

7. BUSINESS START UP INFORMATION (Business purchasers refer to bulletin TPS037 for important information regarding outstanding taxes due.)

ACQUISITION (the purchase of an existing business' sassets ). The following information is required:

Date of Sale: ______/______/______ Total Purchase Amount: $ _____________ Furniture, Fixtures & Equipment Purchase Price: $_____ _____

RELOCATION (existing business relocating into Denver) City and State relocating from:_______________________, _______________________

NEW START UP (new business not pre-existing in Denver)

OTHER –Please Explain ________________________________________________________________________________________________

OFFICIAL USE BELOW THIS LINE:

Reviewer Notes:

Entered into System By: _________________

______________________

Account Number

System Entry Date: ______ / ______ / ______