Enlarge image

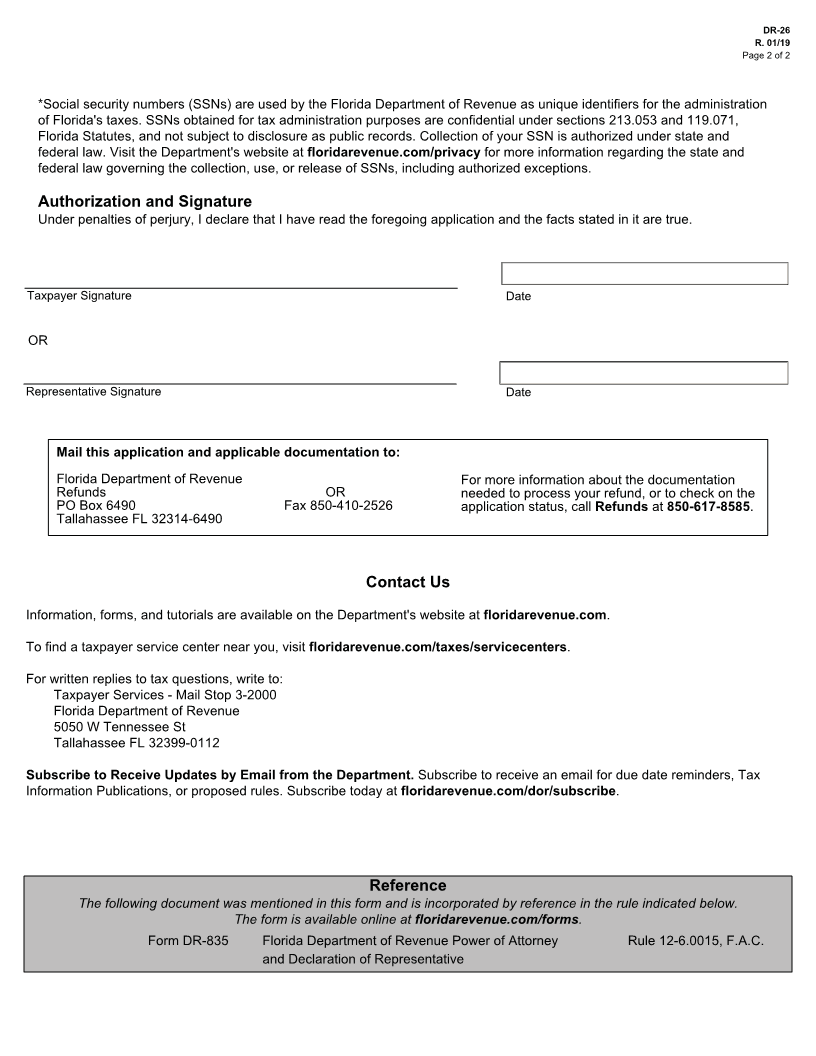

DR-26

Florida Department of Revenue

R. 01/19

Rule 12-26.008, F.A.C.

Effective 01/19

Application for Refund Page 1 of 2

Section 1: Taxpayer Information

Taxpayer Name:

Federal Employer Identification Number

Business Partner Number: Social Security Number (SSN) *:

(FEIN):

Mailing Street Address:

Mailing City: State: ZIP:

Location Street Address:

Location City: State: ZIP:

Telephone Number (include area code): Fax Number (include area code): Email Address (optional):

Section 2: Taxpayer Representative - This section is to be completed when a taxpayer representative is requesting the

refund. A signed Florida Department of Revenue Power of Attorney and Declaration of Representative (Form DR-835) must be

attached.

Representative Name:

Street or Mailing Address:

City: State: ZIP:

Telephone Number: Fax Number: Email Address (optional):

Section 3: Collection or Reporting Period(s) - Enter the date the tax was paid and the collection or reporting period(s).

Date Paid (MM / DD / YY): Collection or Reporting Dates (MM / DD / YY to MM / DD / YY):

Section 4: Tax Categories - Check the box next to the type of tax you paid. A separate application must be completed for

each tax type.

Communications Services Estate Insurance Premium Other (Please Specify):

Corporate Income Fuel Nonrecurring Intangible

Documentary Stamp Governmental Leasehold Pollutant

Section 5: Refund Amount - Enter the refund amount. Provide a brief explanation for the refund claim.

Refund Amount: Brief Explanation for Refund: