Enlarge image

Glenn Hegar Texas Comptroller of Public Accounts TEXNET Payment Instructions Booklet Effective January 2024

Enlarge image | Glenn Hegar Texas Comptroller of Public Accounts TEXNET Payment Instructions Booklet Effective January 2024 |

Enlarge image | Glenn Hegar TEXAS COMPTROLLER OF PUBLIC ACCOUNTS |

Enlarge image |

CIFEF OOF THE COMPTRREOLL

TEX A S

Glenn Hegar TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

December 2023

Dear Taxpayer:

Our office strives to provide complete, easy-to-use information for all electronic funds transfer (EFT)

customers. This booklet provides an overview of our TEXNET system and explains how to transmit

payment information.

With this system, you can electronically transfer your payment from your bank account directly to

the Comptroller’s office. This saves time and ensures your payment is properly applied to your tax

account.

Taxpayers who paid $500,000 or more for a specific tax are required to transmit payments using the

TEXNET system.

Taxpayers who paid $10,000 or more are required by law to transmit payments to the Comptroller’s

office electronically. The taxes affected by this law are Sales and Use, Direct Pay, Natural Gas, Crude

Oil, Franchise, Gasoline, Diesel Fuel, Hotel Occupancy, Insurance Premium, Mixed Beverage Gross

Receipts, Mixed Beverage Sales and Motor Vehicle Rental. Sales and Use filers who remit less than

$500,000 for Sales Tax can make their electronic payments by credit card or electronic check via

Webfile.

For additional information on electronic payments, visit our website at comptroller.texas.gov/

webfile or please call us at 800-442-3453 or 512-463-3630.

Comptroller.Texas.Gov

|

Enlarge image | No text to extract. |

Enlarge image |

Table of Contents

General Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

TEXNET Enrollment Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Creating a TEXNET Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Adding an Account to Your User Dashboard . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Changing TEXNET Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Electronic Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Schedule of Due Dates for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

ACH Debit Options and Deadlines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

ACH Debit Payments via TEXNET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

TEXNET Internet Payment

TEXNET Website Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

TEXNET Website Menu Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

TEXNET Telephone Payment

Touch-Tone Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Touch-Tone Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Payment Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Tax Type Codes for Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

ACH Credit via TEXNET

Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Addenda Record Format for Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Addenda Record Format for Taxes Other Than Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Missed Your TEXNET Payment Deadline? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Penalty Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Proof of Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Electronic Funds Transfer i

|

Enlarge image | No text to extract. |

Enlarge image |

General Information

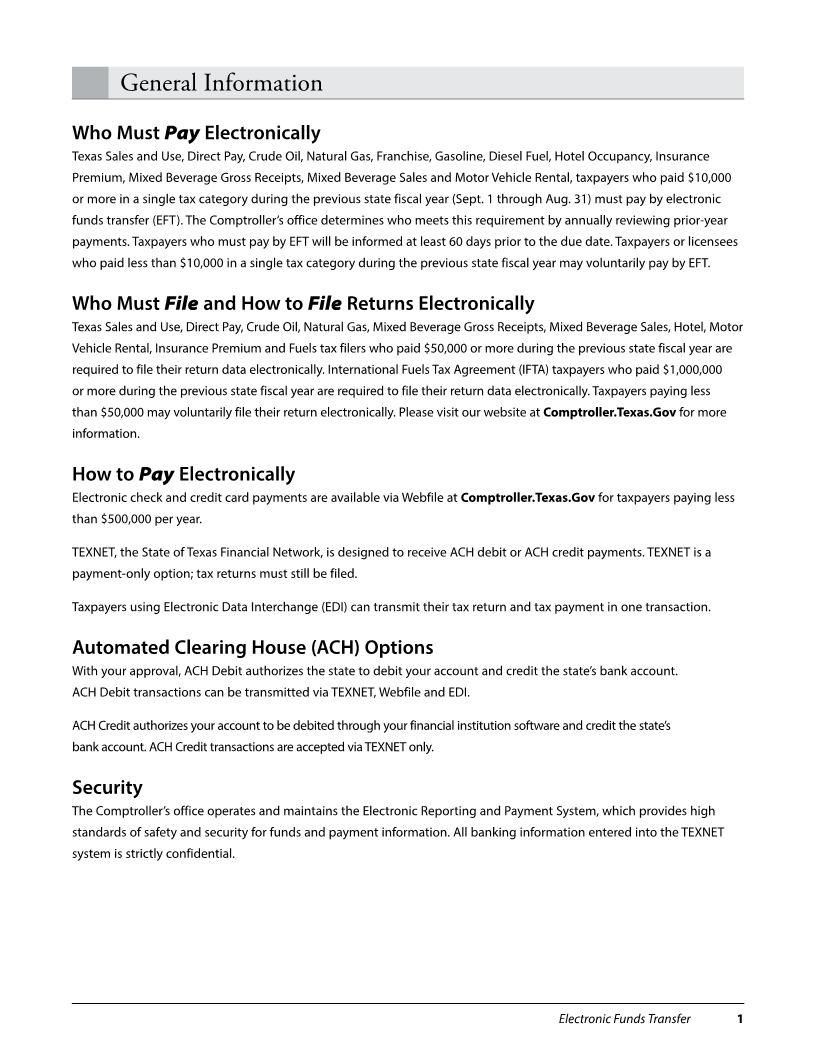

Who Must Pay Electronically

Texas Sales and Use, Direct Pay, Crude Oil, Natural Gas, Franchise, Gasoline, Diesel Fuel, Hotel Occupancy, Insurance

Premium, Mixed Beverage Gross Receipts, Mixed Beverage Sales and Motor Vehicle Rental, taxpayers who paid $10,000

or more in a single tax category during the previous state fiscal year (Sept . 1 through Aug . 31) must pay by electronic

funds transfer (EFT) . The Comptroller’s office determines who meets this requirement by annually reviewing prior-year

payments . Taxpayers who must pay by EFT will be informed at least 60 days prior to the due date . Taxpayers or licensees

who paid less than $10,000 in a single tax category during the previous state fiscal year may voluntarily pay by EFT .

Who Must File and How to File Returns Electronically

Texas Sales and Use, Direct Pay, Crude Oil, Natural Gas, Mixed Beverage Gross Receipts, Mixed Beverage Sales, Hotel, Motor

Vehicle Rental, Insurance Premium and Fuels tax filers who paid $50,000 or more during the previous state fiscal year are

required to file their return data electronically . International Fuels Tax Agreement (IFTA) taxpayers who paid $1,000,000

or more during the previous state fiscal year are required to file their return data electronically . Taxpayers paying less

than $50,000 may voluntarily file their return electronically . Please visit our website at Comptroller.Texas.Gov for more

information .

How to Pay Electronically

Electronic check and credit card payments are available via Webfile at Comptroller.Texas.Gov for taxpayers paying less

than $500,000 per year .

TEXNET, the State of Texas Financial Network, is designed to receive ACH debit or ACH credit payments . TEXNET is a

payment-only option; tax returns must still be filed .

Taxpayers using Electronic Data Interchange (EDI) can transmit their tax return and tax payment in one transaction .

Automated Clearing House (ACH) Options

With your approval, ACH Debit authorizes the state to debit your account and credit the state’s bank account .

ACH Debit transactions can be transmitted via TEXNET, Webfile and EDI .

ACH Credit authorizes your account to be debited through your financial institution software and credit the state’s

bank account . ACH Credit transactions are accepted via TEXNET only .

Security

The Comptroller’s office operates and maintains the Electronic Reporting and Payment System, which provides high

standards of safety and security for funds and payment information . All banking information entered into the TEXNET

system is strictly confidential .

Electronic Funds Transfer 1

|

Enlarge image |

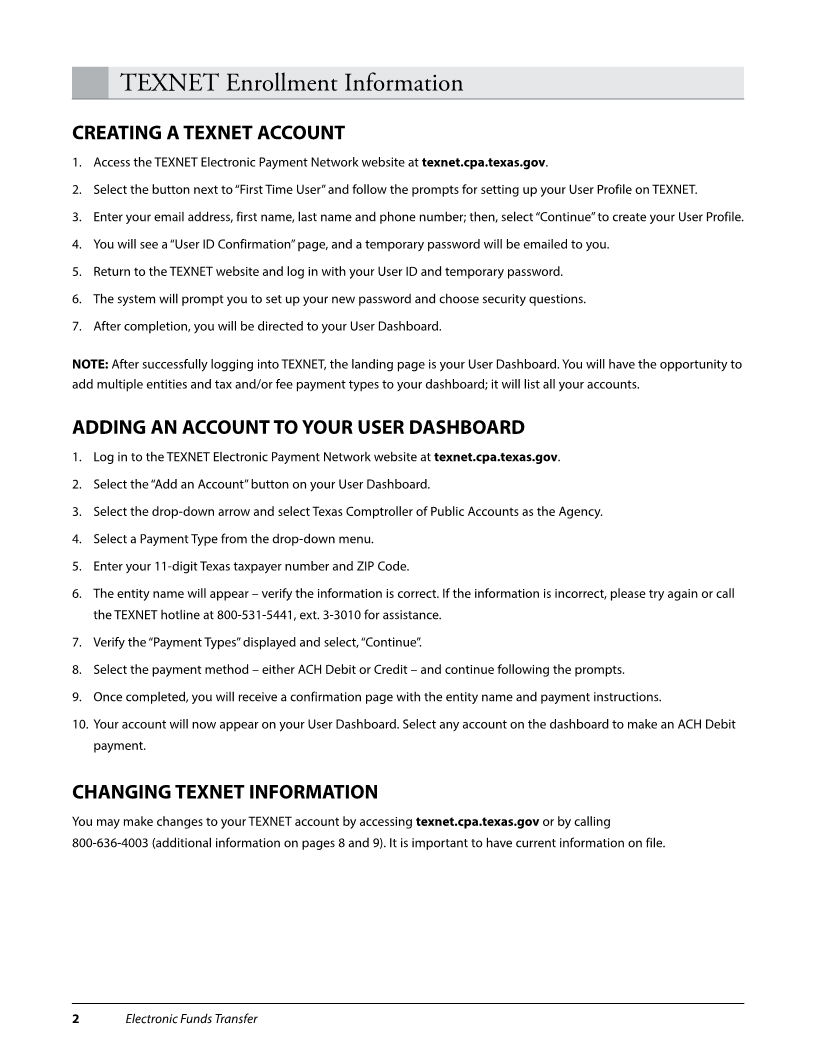

TEXNET Enrollment Information

CREATING A TEXNET ACCOUNT

1 . Access the TEXNET Electronic Payment Network website at texnet.cpa.texas.gov .

2 . Select the button next to “First Time User” and follow the prompts for setting up your User Profile on TEXNET .

3 . Enter your email address, first name, last name and phone number; then, select “Continue” to create your User Profile .

4 . You will see a “User ID Confirmation” page, and a temporary password will be emailed to you .

5 . Return to the TEXNET website and log in with your User ID and temporary password .

6 . The system will prompt you to set up your new password and choose security questions .

7 . After completion, you will be directed to your User Dashboard .

NOTE: After successfully logging into TEXNET, the landing page is your User Dashboard . You will have the opportunity to

add multiple entities and tax and/or fee payment types to your dashboard; it will list all your accounts .

ADDING AN ACCOUNT TO YOUR USER DASHBOARD

1 . Log in to the TEXNET Electronic Payment Network website at texnet.cpa.texas.gov .

2 . Select the “Add an Account” button on your User Dashboard .

3 . Select the drop-down arrow and select Texas Comptroller of Public Accounts as the Agency .

4 . Select a Payment Type from the drop-down menu .

5 . Enter your 11-digit Texas taxpayer number and ZIP Code .

6 . The entity name will appear – verify the information is correct . If the information is incorrect, please try again or call

the TEXNET hotline at 800-531-5441, ext . 3-3010 for assistance .

7 . Verify the “Payment Types” displayed and select, “Continue” .

8 . Select the payment method – either ACH Debit or Credit – and continue following the prompts .

9 . Once completed, you will receive a confirmation page with the entity name and payment instructions .

10 . Your account will now appear on your User Dashboard . Select any account on the dashboard to make an ACH Debit

payment .

CHANGING TEXNET INFORMATION

You may make changes to your TEXNET account by accessing texnet.cpa.texas.gov or by calling

800-636-4003 (additional information on pages 8 and 9) . It is important to have current information on file .

2 Electronic Funds Transfer

|

Enlarge image |

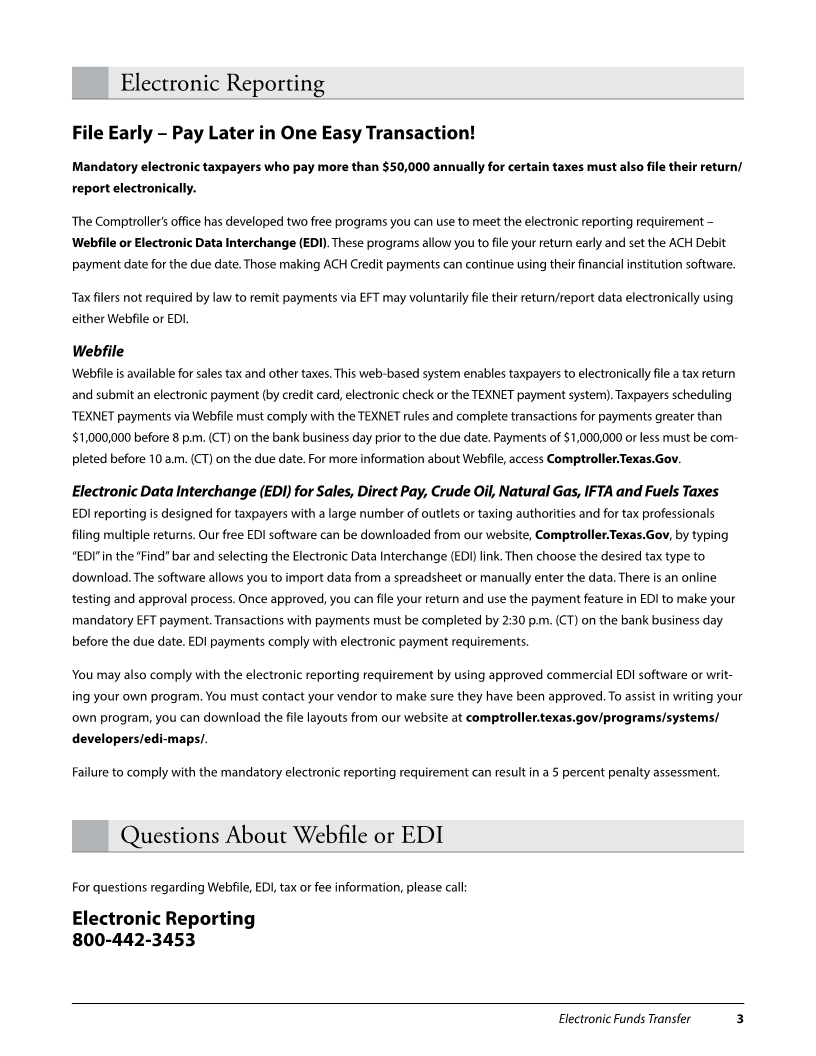

Electronic Reporting

File Early – Pay Later in One Easy Transaction!

Mandatory electronic taxpayers who pay more than $50,000 annually for certain taxes must also file their return/

report electronically.

The Comptroller’s office has developed two free programs you can use to meet the electronic reporting requirement –

Webfile or Electronic Data Interchange (EDI) . These programs allow you to file your return early and set the ACH Debit

payment date for the due date . Those making ACH Credit payments can continue using their financial institution software .

Tax filers not required by law to remit payments via EFT may voluntarily file their return/report data electronically using

either Webfile or EDI .

Webfile

Webfile is available for sales tax and other taxes . This web-based system enables taxpayers to electronically file a tax return

and submit an electronic payment (by credit card, electronic check or the TEXNET payment system) . Taxpayers scheduling

TEXNET payments via Webfile must comply with the TEXNET rules and complete transactions for payments greater than

$1,000,000 before 8 p .m . (CT) on the bank business day prior to the due date . Payments of $1,000,000 or less must be com-

pleted before 10 a .m . (CT) on the due date . For more information about Webfile, access Comptroller.Texas.Gov .

Electronic Data Interchange (EDI) for Sales, Direct Pay, Crude Oil, Natural Gas, IFTA and Fuels Taxes

EDI reporting is designed for taxpayers with a large number of outlets or taxing authorities and for tax professionals

filing multiple returns . Our free EDI software can be downloaded from our website, Comptroller.Texas.Gov, by typing

“EDI” in the “Find” bar and selecting the Electronic Data Interchange (EDI) link . Then choose the desired tax type to

download . The software allows you to import data from a spreadsheet or manually enter the data . There is an online

testing and approval process . Once approved, you can file your return and use the payment feature in EDI to make your

mandatory EFT payment . Transactions with payments must be completed by 2:30 p .m . (CT) on the bank business day

before the due date . EDI payments comply with electronic payment requirements .

You may also comply with the electronic reporting requirement by using approved commercial EDI software or writ-

ing your own program . You must contact your vendor to make sure they have been approved . To assist in writing your

own program, you can download the file layouts from our website at comptroller.texas.gov/programs/systems/

developers/edi-maps/ .

Failure to comply with the mandatory electronic reporting requirement can result in a 5 percent penalty assessment .

Questions About Webfile or EDI

For questions regarding Webfile, EDI, tax or fee information, please call:

Electronic Reporting

800-442-3453

Electronic Funds Transfer 3

|

Enlarge image |

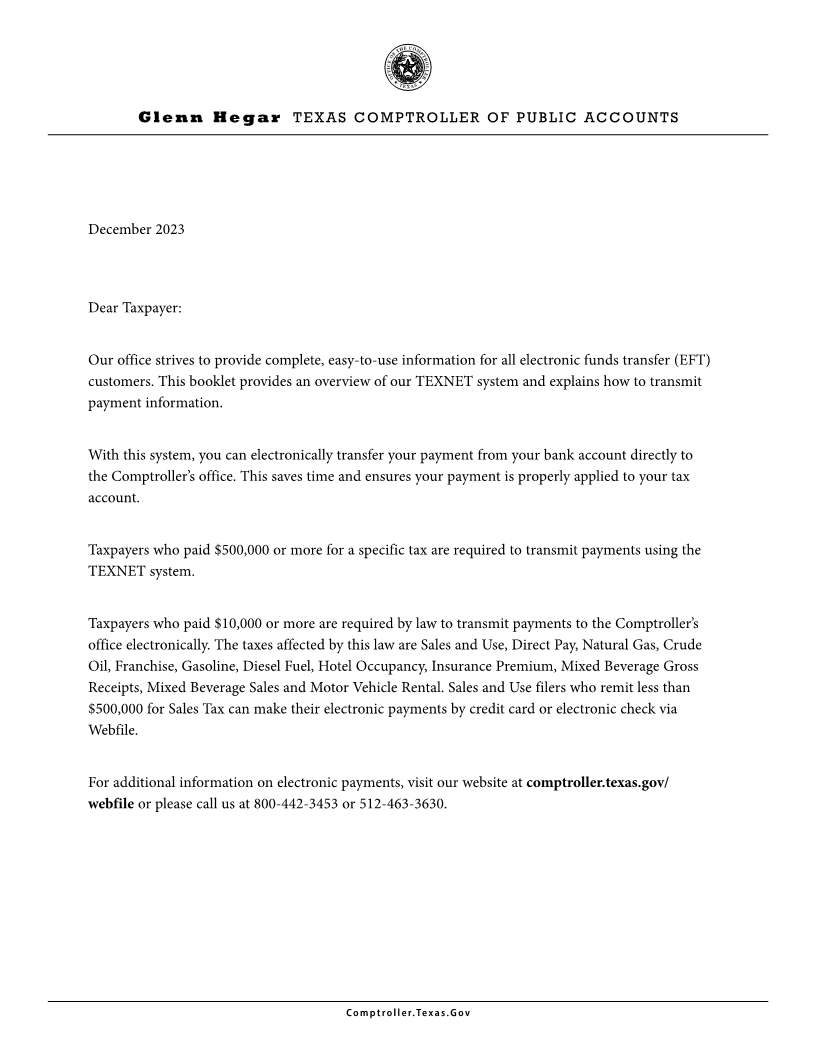

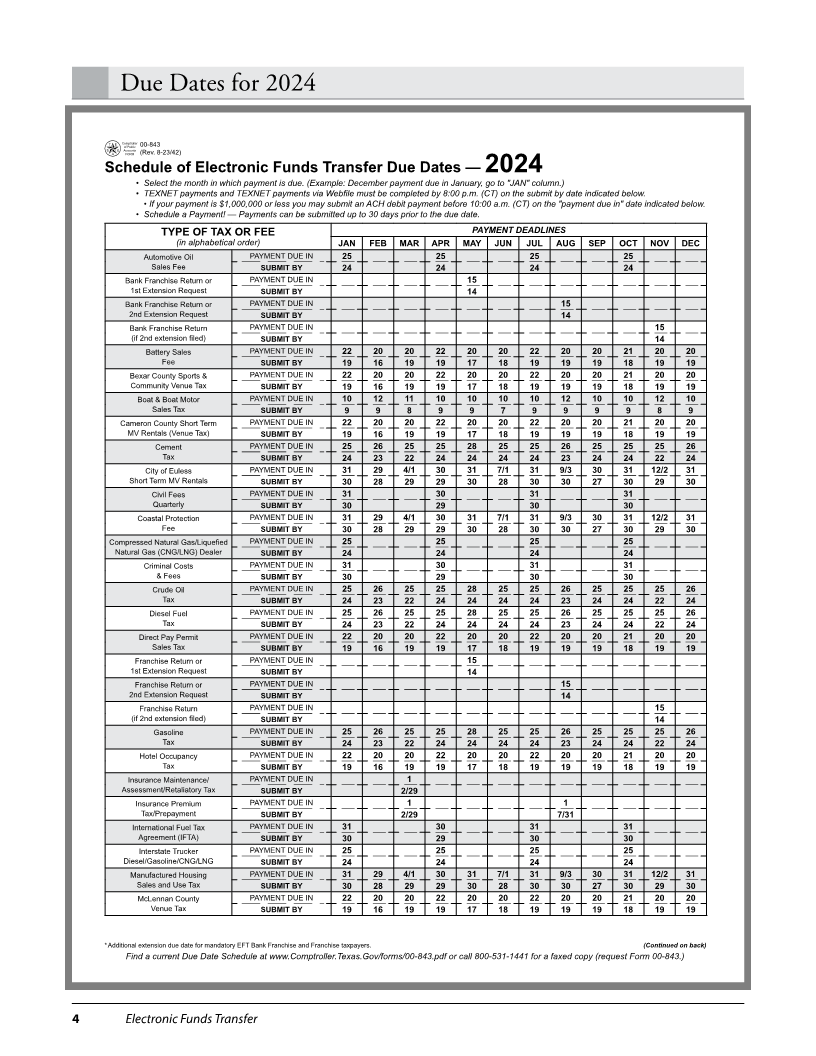

Due Dates for 2024

00-843

(Rev. 8-23/42)

Schedule of Electronic Funds Transfer Due Dates — 2024

• Select the month in which payment is due. (Example: December payment due in January, go to "JAN" column.)

• TEXNET payments and TEXNET payments via Webfile must be completed by 8:00 p.m. (CT) on the submit by date indicated below.

• If your payment is $1,000,000 or less you may submit an ACH debit payment before 10:00 a.m. (CT) on the "payment due in" date indicated below.

• Schedule a Payment! — Payments can be submitted up to 30 days prior to the due date.

TYPE OF TAX OR FEE PAYMENT DEADLINES

(in alphabetical order) JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Automotive Oil PAYMENT DUE IN 25 25 25 25

Sales Fee SUBMIT BY 24 24 24 24

Bank Franchise Return or PAYMENT DUE IN 15

1st Extension Request SUBMIT BY 14

Bank Franchise Return or PAYMENT DUE IN 15

2nd Extension Request SUBMIT BY 14

Bank Franchise Return PAYMENT DUE IN 15

(if 2nd extension filed) SUBMIT BY 14

Battery Sales PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Fee SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Bexar County Sports & PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Community Venue Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Boat & Boat Motor PAYMENT DUE IN 10 12 11 10 10 10 10 12 10 10 12 10

Sales Tax SUBMIT BY 9 9 8 9 9 7 9 9 9 9 8 9

Cameron County Short Term PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

MV Rentals (Venue Tax) SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Cement PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Tax SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

City of Euless PAYMENT DUE IN 31 29 4/1 30 31 7/1 31 9/3 30 31 12/2 31

Short Term MV Rentals SUBMIT BY 30 28 29 29 30 28 30 30 27 30 29 30

Civil Fees PAYMENT DUE IN 31 30 31 31

Quarterly SUBMIT BY 30 29 30 30

Coastal Protection PAYMENT DUE IN 31 29 4/1 30 31 7/1 31 9/3 30 31 12/2 31

Fee SUBMIT BY 30 28 29 29 30 28 30 30 27 30 29 30

Compressed Natural Gas/Liquefied PAYMENT DUE IN 25 25 25 25

Natural Gas (CNG/LNG) Dealer SUBMIT BY 24 24 24 24

Criminal Costs PAYMENT DUE IN 31 30 31 31

& Fees SUBMIT BY 30 29 30 30

Crude Oil PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Tax SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

Diesel Fuel PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Tax SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

Direct Pay Permit PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Sales Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Franchise Return or PAYMENT DUE IN 15

1st Extension Request SUBMIT BY 14

Franchise Return or PAYMENT DUE IN 15

2nd Extension Request SUBMIT BY 14

Franchise Return PAYMENT DUE IN 15

(if 2nd extension filed) SUBMIT BY 14

Gasoline PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Tax SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

Hotel Occupancy PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Insurance Maintenance/ PAYMENT DUE IN 1

Assessment/Retaliatory Tax SUBMIT BY 2/29

Insurance Premium PAYMENT DUE IN 1 1

Tax/Prepayment SUBMIT BY 2/29 7/31

International Fuel Tax PAYMENT DUE IN 31 30 31 31

Agreement (IFTA) SUBMIT BY 30 29 30 30

Interstate Trucker PAYMENT DUE IN 25 25 25 25

Diesel/Gasoline/CNG/LNG SUBMIT BY 24 24 24 24

Manufactured Housing PAYMENT DUE IN 31 29 4/1 30 31 7/1 31 9/3 30 31 12/2 31

Sales and Use Tax SUBMIT BY 30 28 29 29 30 28 30 30 27 30 29 30

McLennan County PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Venue Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

* Additional extension due date for mandatory EFT Bank Franchise and Franchise taxpayers. (Continued on back)

Find a current Due Date Schedule at www.Comptroller.Texas.Gov/forms/00-843.pdf or call 800-531-1441 for a faxed copy (request Form 00-843.)

4 Electronic Funds Transfer

|

Enlarge image |

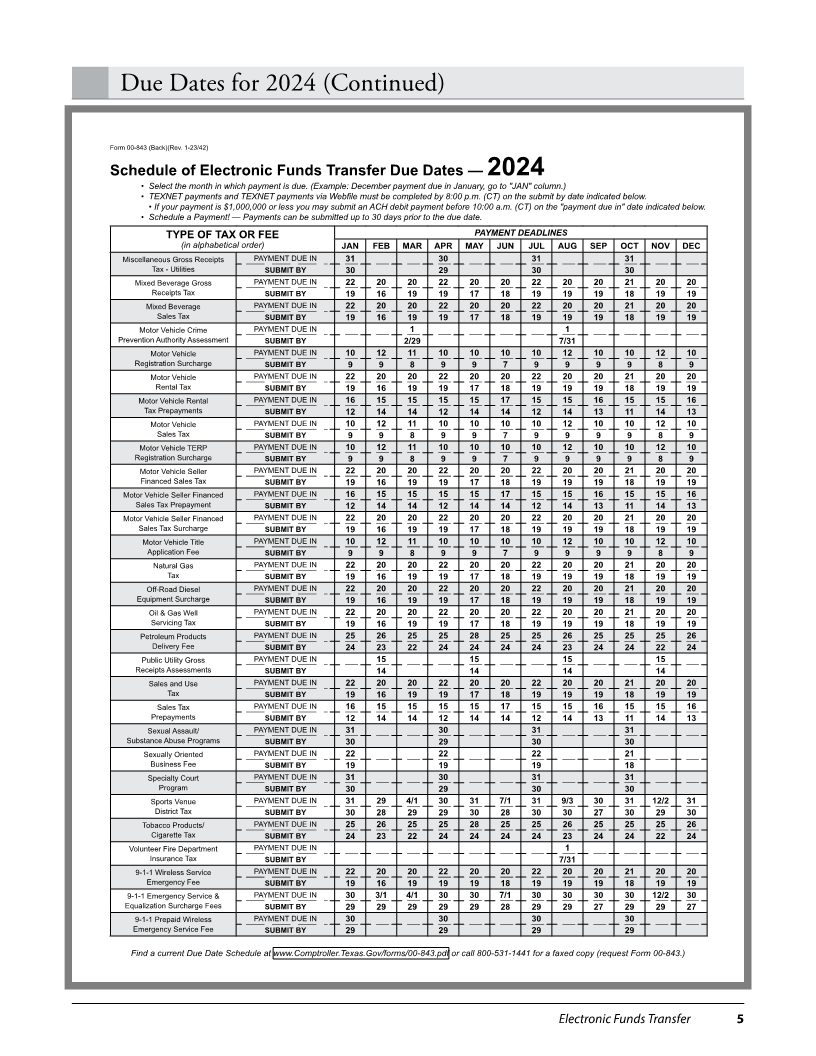

Due Dates for 2024 (Continued)

Form 00-843 (Back)(Rev. 1-23/42)

Schedule• Select theofmonthElectronicin which paymentFundsis due. (Example:TransferDecember paymentDuedueDatesin January, go— to "JAN"2024column.)

• TEXNET payments and TEXNET payments via W ebfile must be completed by 8:00 p.m. (CT) on the submit by date indicated below.

• If your payment is $1,000,000 or less you may submit an ACH debit payment before 10:00 a.m. (CT) on the "payment due in" date indicated below.

• Schedule a Payment! — Payments can be submitted up to 30 days prior to the due date.

TYPE OF TAX OR FEE PAYMENT DEADLINES

(in alphabetical order) JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Miscellaneous Gross Receipts PAYMENT DUE IN 31 30 31 31

Tax - Utilities SUBMIT BY 30 29 30 30

Mixed Beverage Gross PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Receipts Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Mixed Beverage PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Sales Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Motor Vehicle Crime PAYMENT DUE IN 1 1

Prevention Authority Assessment SUBMIT BY 2/29 7/31

Motor Vehicle PAYMENT DUE IN 10 12 11 10 10 10 10 12 10 10 12 10

Registration Surcharge SUBMIT BY 9 9 8 9 9 7 9 9 9 9 8 9

Motor Vehicle PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Rental Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Motor Vehicle Rental PAYMENT DUE IN 16 15 15 15 15 17 15 15 16 15 15 16

Tax Prepayments SUBMIT BY 12 14 14 12 14 14 12 14 13 11 14 13

Motor Vehicle PAYMENT DUE IN 10 12 11 10 10 10 10 12 10 10 12 10

Sales Tax SUBMIT BY 9 9 8 9 9 7 9 9 9 9 8 9

Motor Vehicle TERP PAYMENT DUE IN 10 12 11 10 10 10 10 12 10 10 12 10

Registration Surcharge SUBMIT BY 9 9 8 9 9 7 9 9 9 9 8 9

Motor Vehicle Seller PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Financed Sales Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Motor Vehicle Seller Financed PAYMENT DUE IN 16 15 15 15 15 17 15 15 16 15 15 16

Sales Tax Prepayment SUBMIT BY 12 14 14 12 14 14 12 14 13 11 14 13

Motor Vehicle Seller Financed PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Sales Tax Surcharge SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Motor Vehicle Title PAYMENT DUE IN 10 12 11 10 10 10 10 12 10 10 12 10

Application Fee SUBMIT BY 9 9 8 9 9 7 9 9 9 9 8 9

Natural Gas PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Off-Road Diesel PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Equipment Surcharge SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Oil & Gas Well PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Servicing Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Petroleum Products PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Delivery Fee SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

Public Utility Gross PAYMENT DUE IN 15 15 15 15

Receipts Assessments SUBMIT BY 14 14 14 14

Sales and Use PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Tax SUBMIT BY 19 16 19 19 17 18 19 19 19 18 19 19

Sales Tax PAYMENT DUE IN 16 15 15 15 15 17 15 15 16 15 15 16

Prepayments SUBMIT BY 12 14 14 12 14 14 12 14 13 11 14 13

Sexual Assault/ PAYMENT DUE IN 31 30 31 31

Substance Abuse Programs SUBMIT BY 30 29 30 30

Sexually Oriented PAYMENT DUE IN 22 22 22 21

Business Fee SUBMIT BY 19 19 19 18

Specialty Court PAYMENT DUE IN 31 30 31 31

Program SUBMIT BY 30 29 30 30

Sports Venue PAYMENT DUE IN 31 29 4/1 30 31 7/1 31 9/3 30 31 12/2 31

District Tax SUBMIT BY 30 28 29 29 30 28 30 30 27 30 29 30

Tobacco Products/ PAYMENT DUE IN 25 26 25 25 28 25 25 26 25 25 25 26

Cigarette Tax SUBMIT BY 24 23 22 24 24 24 24 23 24 24 22 24

Volunteer Fire Department PAYMENT DUE IN 1

Insurance Tax SUBMIT BY 7/31

9-1-1 Wireless Service PAYMENT DUE IN 22 20 20 22 20 20 22 20 20 21 20 20

Emergency Fee SUBMIT BY 19 16 19 19 19 18 19 19 19 18 19 19

9-1-1 Emergency Service & PAYMENT DUE IN 30 3/1 4/1 30 30 7/1 30 30 30 30 12/2 30

Equalization Surcharge Fees SUBMIT BY 29 29 29 29 29 28 29 29 27 29 29 27

9-1-1 Prepaid Wireless PAYMENT DUE IN 30 30 30 30

Emergency Service Fee SUBMIT BY 29 29 29 29

Find a current Due Date Schedule at www.Comptroller.Texas.Gov/forms/00-843.pdf or call 800-531-1441 for a faxed copy (request Form 00-843.)

Electronic Funds Transfer 5

|

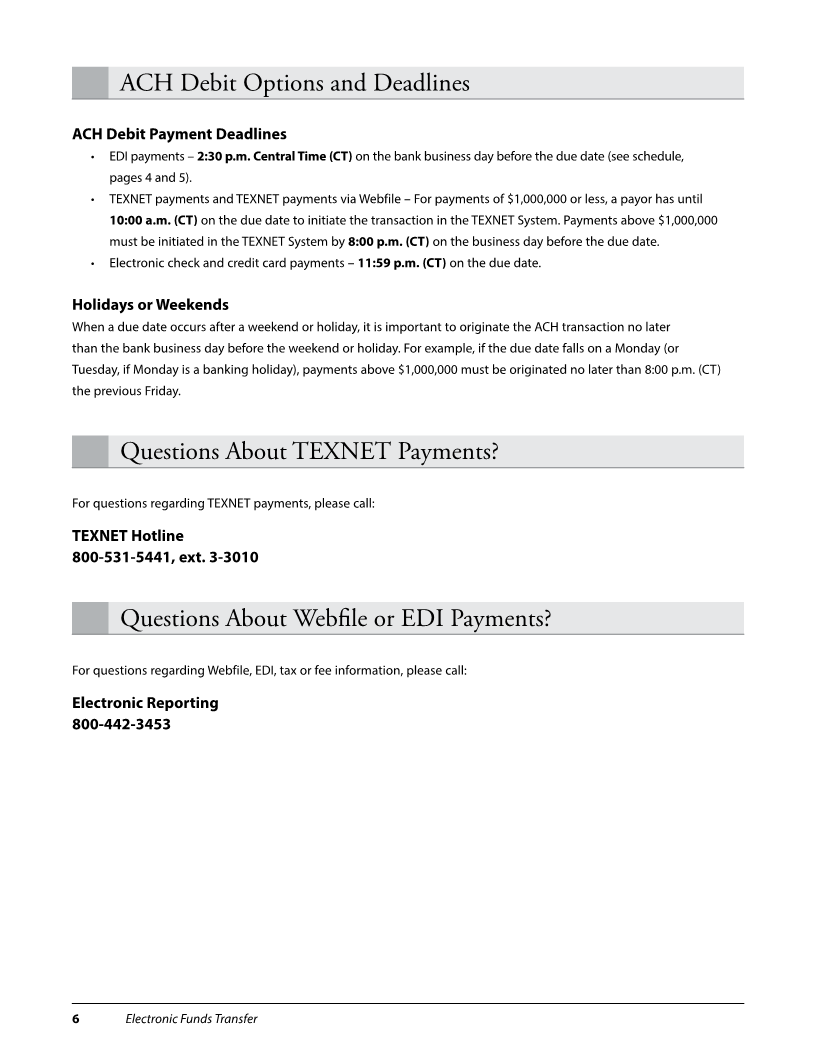

Enlarge image | ACH Debit Options and Deadlines ACH Debit Payment Deadlines • EDI payments – 2:30 p.m. Central Time (CT) on the bank business day before the due date (see schedule, pages 4 and 5) . • TEXNET payments and TEXNET payments via Webfile – For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on the due date to initiate the transaction in the TEXNET System . Payments above $1,000,000 must be initiated in the TEXNET System by 8:00 p.m. (CT) on the business day before the due date . • Electronic check and credit card payments – 11:59 p.m. (CT) on the due date . Holidays or Weekends When a due date occurs after a weekend or holiday, it is important to originate the ACH transaction no later than the bank business day before the weekend or holiday . For example, if the due date falls on a Monday (or Tuesday, if Monday is a banking holiday), payments above $1,000,000 must be originated no later than 8:00 p .m . (CT) the previous Friday . Questions About TEXNET Payments? For questions regarding TEXNET payments, please call: TEXNET Hotline 800-531-5441, ext. 3-3010 Questions About Webfile or EDI Payments? For questions regarding Webfile, EDI, tax or fee information, please call: Electronic Reporting 800-442-3453 6 Electronic Funds Transfer |

Enlarge image |

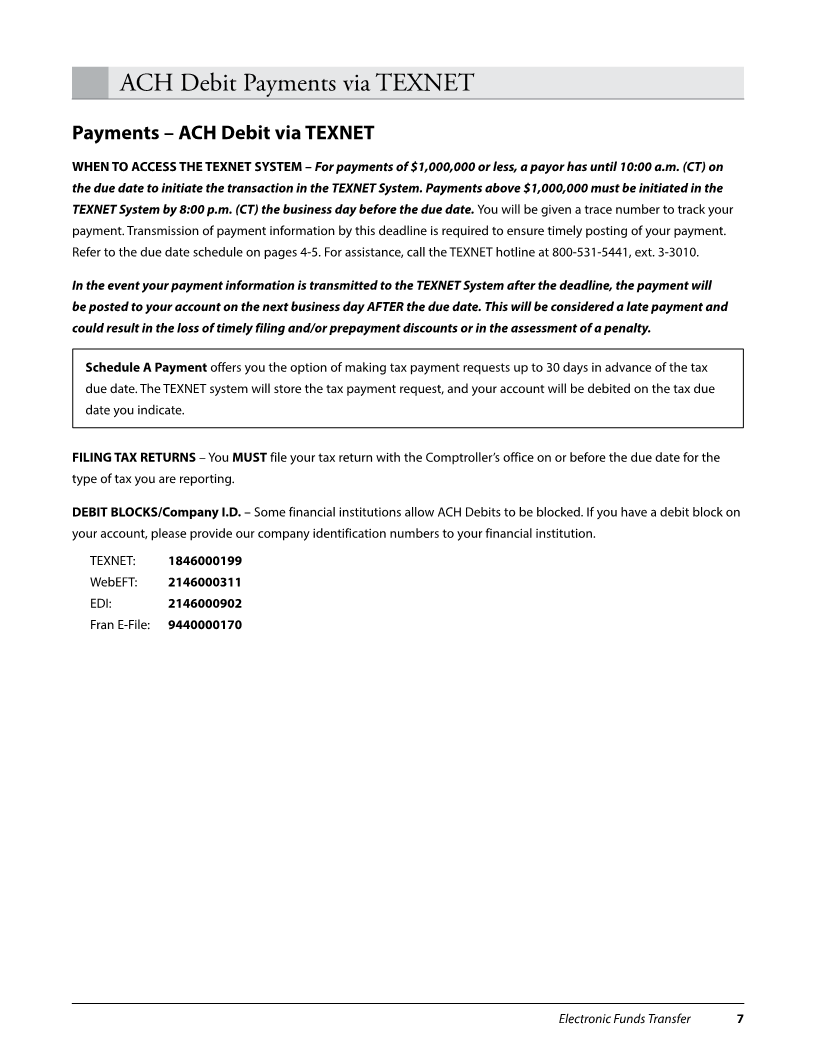

ACH Debit Payments via TEXNET

Payments – ACH Debit via TEXNET

WHEN TO ACCESS THE TEXNET SYSTEM – For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on

the due date to initiate the transaction in the TEXNET System. Payments above $1,000,000 must be initiated in the

TEXNET System by 8:00 p.m. (CT) the business day before the due date. You will be given a trace number to track your

payment . Transmission of payment information by this deadline is required to ensure timely posting of your payment .

Refer to the due date schedule on pages 4-5 . For assistance, call the TEXNET hotline at 800-531-5441, ext . 3-3010 .

In the event your payment information is transmitted to the TEXNET System after the deadline, the payment will

be posted to your account on the next business day AFTER the due date. This will be considered a late payment and

could result in the loss of timely filing and/or prepayment discounts or in the assessment of a penalty.

Schedule A Payment offers you the option of making tax payment requests up to 30 days in advance of the tax

due date . The TEXNET system will store the tax payment request, and your account will be debited on the tax due

date you indicate .

FILING TAX RETURNS – You MUST file your tax return with the Comptroller’s office on or before the due date for the

type of tax you are reporting .

DEBIT BLOCKS/Company I.D. – Some financial institutions allow ACH Debits to be blocked . If you have a debit block on

your account, please provide our company identification numbers to your financial institution .

TEXNET: 1846000199

WebEFT: 2146000311

EDI: 2146000902

Fran E-File: 9440000170

Electronic Funds Transfer 7

|

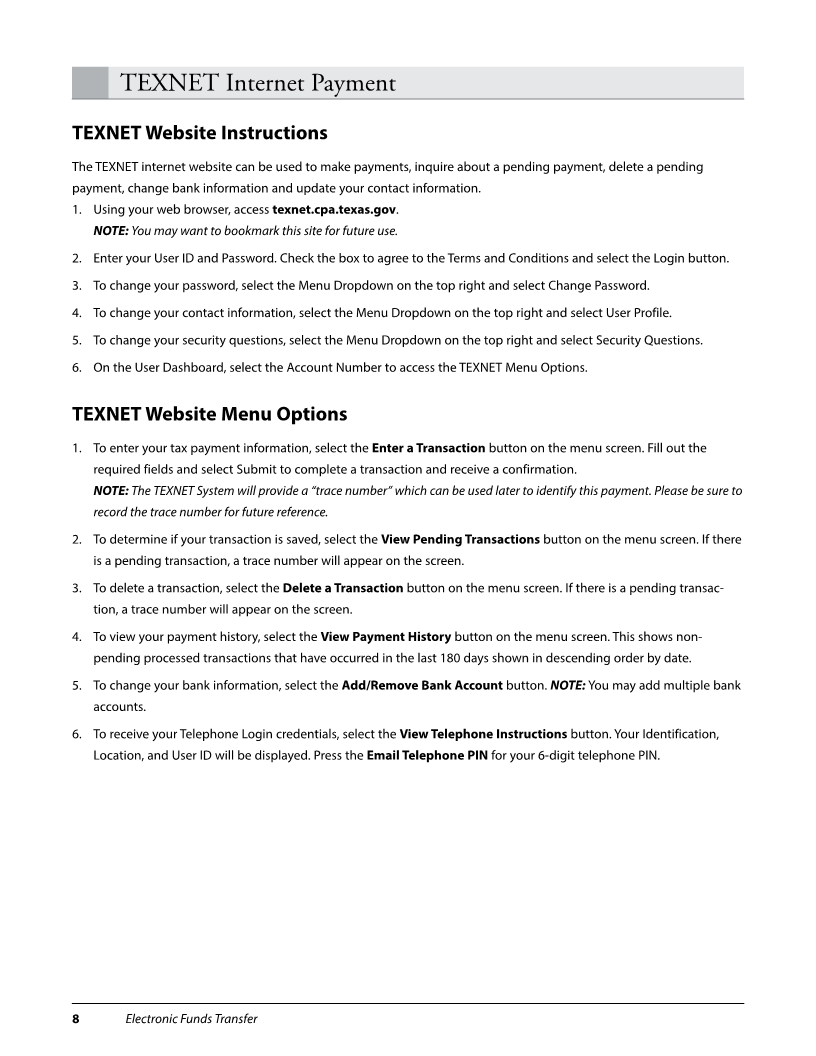

Enlarge image | TEXNET Internet Payment TEXNET Website Instructions The TEXNET internet website can be used to make payments, inquire about a pending payment, delete a pending payment, change bank information and update your contact information . 1 . Using your web browser, access texnet.cpa.texas.gov . NOTE: You may want to bookmark this site for future use. 2 . Enter your User ID and Password . Check the box to agree to the Terms and Conditions and select the Login button . 3 . To change your password, select the Menu Dropdown on the top right and select Change Password . 4 . To change your contact information, select the Menu Dropdown on the top right and select User Profile . 5 . To change your security questions, select the Menu Dropdown on the top right and select Security Questions . 6 . On the User Dashboard, select the Account Number to access the TEXNET Menu Options . TEXNET Website Menu Options 1 . To enter your tax payment information, select the Enter a Transaction button on the menu screen . Fill out the required fields and select Submit to complete a transaction and receive a confirmation . NOTE: The TEXNET System will provide a “trace number” which can be used later to identify this payment. Please be sure to record the trace number for future reference. 2 . To determine if your transaction is saved, select the View Pending Transactions button on the menu screen . If there is a pending transaction, a trace number will appear on the screen . 3 . To delete a transaction, select the Delete a Transaction button on the menu screen . If there is a pending transac- tion, a trace number will appear on the screen . 4 . To view your payment history, select the View Payment History button on the menu screen . This shows non- pending processed transactions that have occurred in the last 180 days shown in descending order by date . 5 . To change your bank information, select the Add/Remove Bank Account button . NOTE: You may add multiple bank accounts . 6 . To receive your Telephone Login credentials, select the View Telephone Instructions button . Your Identification, Location, and User ID will be displayed . Press the Email Telephone PIN for your 6-digit telephone PIN . 8 Electronic Funds Transfer |

Enlarge image |

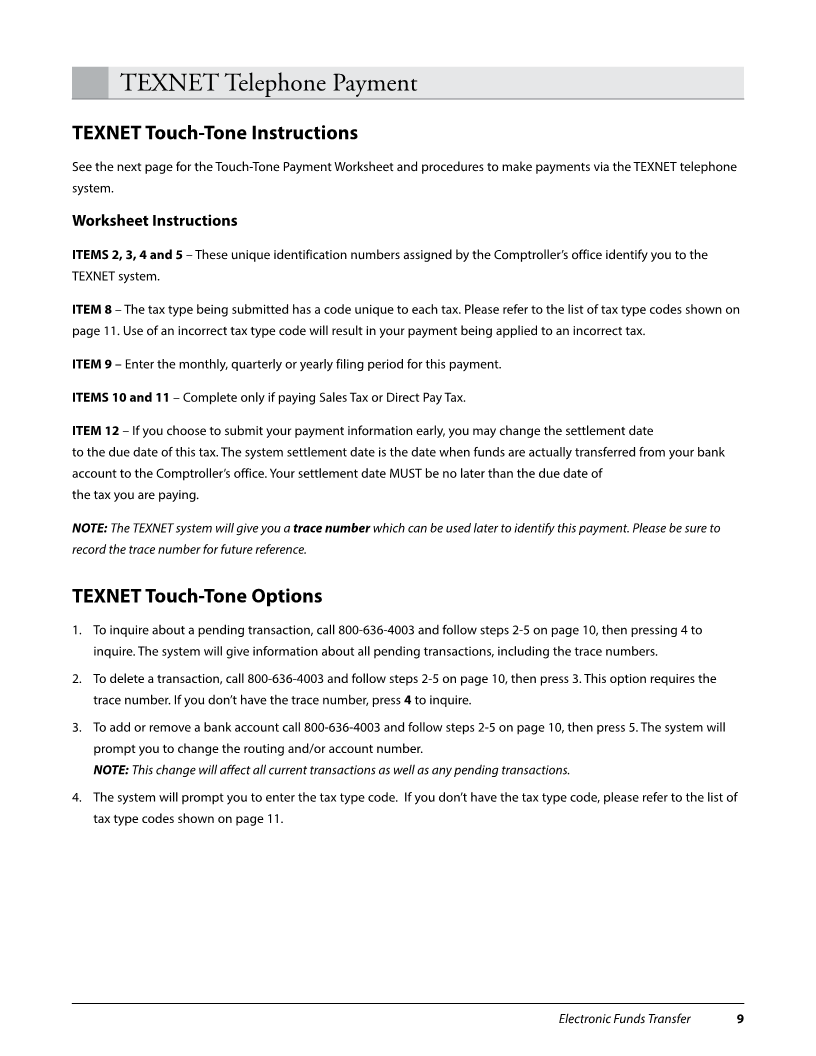

TEXNET Telephone Payment

TEXNET Touch-Tone Instructions

See the next page for the Touch-Tone Payment Worksheet and procedures to make payments via the TEXNET telephone

system .

Worksheet Instructions

ITEMS 2, 3, 4 and 5 – These unique identification numbers assigned by the Comptroller’s office identify you to the

TEXNET system .

ITEM 8 – The tax type being submitted has a code unique to each tax . Please refer to the list of tax type codes shown on

page 11 . Use of an incorrect tax type code will result in your payment being applied to an incorrect tax .

ITEM 9 – Enter the monthly, quarterly or yearly filing period for this payment .

ITEMS 10 and 11 – Complete only if paying Sales Tax or Direct Pay Tax .

ITEM 12 – If you choose to submit your payment information early, you may change the settlement date

to the due date of this tax . The system settlement date is the date when funds are actually transferred from your bank

account to the Comptroller’s office . Your settlement date MUST be no later than the due date of

the tax you are paying .

NOTE: The TEXNET system will give you a trace number which can be used later to identify this payment. Please be sure to

record the trace number for future reference.

TEXNET Touch-Tone Options

1 . To inquire about a pending transaction, call 800-636-4003 and follow steps 2-5 on page 10, then pressing 4 to

inquire . The system will give information about all pending transactions, including the trace numbers .

2 . To delete a transaction, call 800-636-4003 and follow steps 2-5 on page 10, then press 3 . This option requires the

trace number . If you don’t have the trace number, press 4to inquire .

3 . To add or remove a bank account call 800-636-4003 and follow steps 2-5 on page 10, then press 5 . The system will

prompt you to change the routing and/or account number .

NOTE: This change will affect all current transactions as well as any pending transactions.

4 . The system will prompt you to enter the tax type code . If you don’t have the tax type code, please refer to the list of

tax type codes shown on page 11 .

Electronic Funds Transfer 9

|

Enlarge image |

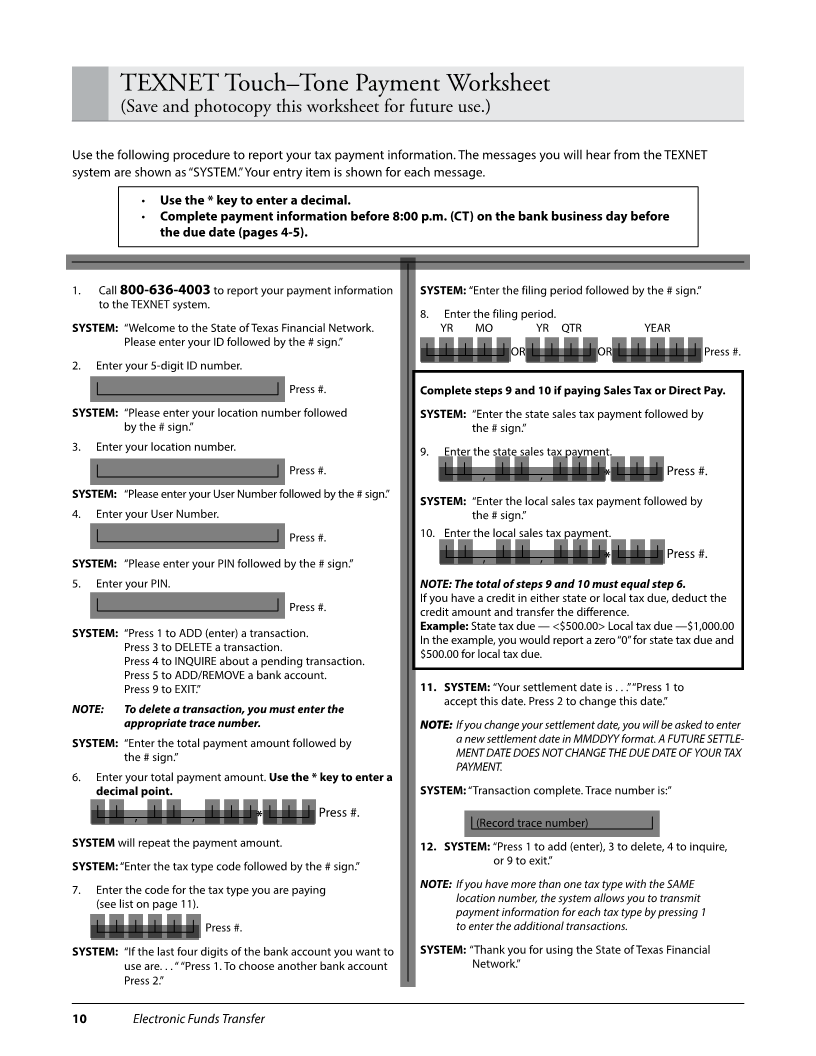

TEXNET Touch–Tone Payment Worksheet

(Save and photocopy this worksheet for future use.)

Use the following procedure to report your tax payment information . The messages you will hear from the TEXNET

system are shown as “SYSTEM .” Your entry item is shown for each message .

• Use the * key to enter a decimal.

• Complete payment information before 8:00 p.m. (CT) on the bank business day before

the due date (pages 4-5).

1 . Call 800-636-4003 to report your payment information SYSTEM: “Enter the filing period followed by the # sign .”

to the TEXNET system .

8 . Enter the filing period .

SYSTEM: “Welcome to the State of Texas Financial Network . YR MO YR QTR YEAR

Please enter your ID followed by the # sign .”

OR OR Press # .

2 . Enter your 5-digit ID number .

Press # . Complete steps 9 and 10 if paying Sales Tax or Direct Pay.

SYSTEM: “Please enter your location number followed SYSTEM: “Enter the state sales tax payment followed by

by the # sign .” the # sign .”

3 . Enter your location number . 9 . Enter the state sales tax payment .

Press # . , , * Press # .

SYSTEM: “Please enter your User Number followed by the # sign .”

SYSTEM: “Enter the local sales tax payment followed by

4 . Enter your User Number . the # sign .”

Press # . 10 . Enter the local sales tax payment .

SYSTEM: “Please enter your PIN followed by the # sign .” , , * Press # .

5 . Enter your PIN . NOTE: The total of steps 9 and 10 must equal step 6.

If you have a credit in either state or local tax due, deduct the

Press # . credit amount and transfer the difference .

Example: State tax due — <$500 .00> Local tax due —$1,000 .00

SYSTEM: “Press 1 to ADD (enter) a transaction .

In the example, you would report a zero “0” for state tax due and

Press 3 to DELETE a transaction .

$500 .00 for local tax due .

Press 4 to INQUIRE about a pending transaction .

Press 5 to ADD/REMOVE a bank account .

Press 9 to EXIT .” 11. SYSTEM: “Your settlement date is . . .” “Press 1 to

accept this date . Press 2 to change this date .”

NOTE: To delete a transaction, you must enter the

appropriate trace number. NOTE: If you change your settlement date, you will be asked to enter

SYSTEM: “Enter the total payment amount followed by a new settlement date in MMDDYY format. A FUTURE SETTLE-

the # sign .” MENT DATE DOES NOT CHANGE THE DUE DATE OF YOUR TAX

PAYMENT.

6 . Enter your total payment amount . Use the * key to enter a

decimal point. SYSTEM: “Transaction complete . Trace number is:”

, , * Press # .

(Record trace number)

SYSTEM will repeat the payment amount . 12. SYSTEM: “Press 1 to add (enter), 3 to delete, 4 to inquire,

SYSTEM: “Enter the tax type code followed by the # sign .” or 9 to exit .”

7 . Enter the code for the tax type you are paying NOTE: If you have more than one tax type with the SAME

(see list on page 11) . location number, the system allows you to transmit

payment information for each tax type by pressing 1

Press # . to enter the additional transactions.

SYSTEM: “If the last four digits of the bank account you want to SYSTEM: “Thank you for using the State of Texas Financial

use are . . . “ “Press 1 . To choose another bank account Network .”

Press 2 .”

10 Electronic Funds Transfer

|

Enlarge image |

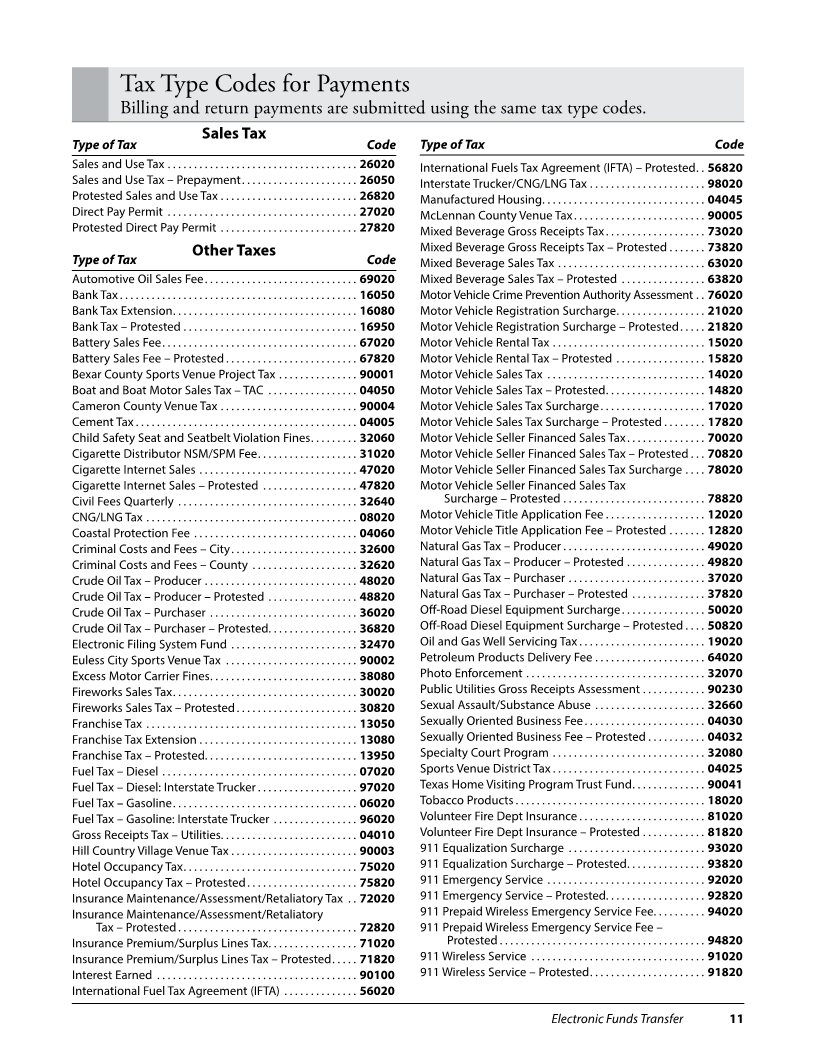

Tax Type Codes for Payments

Billing and return payments are submitted using the same tax type codes.

Sales Tax

Type of Tax Code Type of Tax Code

Sales and Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26020 International Fuels Tax Agreement (IFTA) – Protested . . 56820

Sales and Use Tax – Prepayment . . . . . . . . . . . . . . . . . . . . . . 26050 Interstate Trucker/CNG/LNG Tax . . . . . . . . . . . . . . . . . . . . . . 98020

Protested Sales and Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . 26820 Manufactured Housing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 04045

Direct Pay Permit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27020 McLennan County Venue Tax . . . . . . . . . . . . . . . . . . . . . . . . . 90005

Protested Direct Pay Permit . . . . . . . . . . . . . . . . . . . . . . . . . . 27820 Mixed Beverage Gross Receipts Tax . . . . . . . . . . . . . . . . . . . 73020

Other Taxes Mixed Beverage Gross Receipts Tax – Protested . . . . . . . 73820

Type of Tax Code Mixed Beverage Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63020

Automotive Oil Sales Fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69020 Mixed Beverage Sales Tax – Protested . . . . . . . . . . . . . . . . 63820

Bank Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16050 Motor Vehicle Crime Prevention Authority Assessment . . 76020

Bank Tax Extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16080 Motor Vehicle Registration Surcharge . . . . . . . . . . . . . . . . . 21020

Bank Tax – Protested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16950 Motor Vehicle Registration Surcharge – Protested . . . . . 21820

Battery Sales Fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67020 Motor Vehicle Rental Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15020

Battery Sales Fee – Protested . . . . . . . . . . . . . . . . . . . . . . . . . 67820 Motor Vehicle Rental Tax – Protested . . . . . . . . . . . . . . . . . 15820

Bexar County Sports Venue Project Tax . . . . . . . . . . . . . . . 90001 Motor Vehicle Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14020

Boat and Boat Motor Sales Tax – TAC . . . . . . . . . . . . . . . . . 04050 Motor Vehicle Sales Tax – Protested . . . . . . . . . . . . . . . . . . . 14820

Cameron County Venue Tax . . . . . . . . . . . . . . . . . . . . . . . . . . 90004 Motor Vehicle Sales Tax Surcharge . . . . . . . . . . . . . . . . . . . . 17020

Cement Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 04005 Motor Vehicle Sales Tax Surcharge – Protested . . . . . . . . 17820

Child Safety Seat and Seatbelt Violation Fines . . . . . . . . . 32060 Motor Vehicle Seller Financed Sales Tax . . . . . . . . . . . . . . . 70020

Cigarette Distributor NSM/SPM Fee . . . . . . . . . . . . . . . . . . . 31020 Motor Vehicle Seller Financed Sales Tax – Protested . . . 70820

Cigarette Internet Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47020 Motor Vehicle Seller Financed Sales Tax Surcharge . . . . 78020

Cigarette Internet Sales – Protested . . . . . . . . . . . . . . . . . . 47820 Motor Vehicle Seller Financed Sales Tax

Civil Fees Quarterly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32640 Surcharge – Protested . . . . . . . . . . . . . . . . . . . . . . . . . . . 78820

CNG/LNG Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 08020 Motor Vehicle Title Application Fee . . . . . . . . . . . . . . . . . . . 12020

Coastal Protection Fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 04060 Motor Vehicle Title Application Fee – Protested . . . . . . . 12820

Criminal Costs and Fees – City . . . . . . . . . . . . . . . . . . . . . . . . 32600 Natural Gas Tax – Producer . . . . . . . . . . . . . . . . . . . . . . . . . . . 49020

Criminal Costs and Fees – County . . . . . . . . . . . . . . . . . . . . 32620 Natural Gas Tax – Producer – Protested . . . . . . . . . . . . . . . 49820

Crude Oil Tax – Producer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48020 Natural Gas Tax – Purchaser . . . . . . . . . . . . . . . . . . . . . . . . . . 37020

Crude Oil Tax – Producer – Protested . . . . . . . . . . . . . . . . . 48820 Natural Gas Tax – Purchaser – Protested . . . . . . . . . . . . . . 37820

Crude Oil Tax – Purchaser . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36020 Off-Road Diesel Equipment Surcharge . . . . . . . . . . . . . . . . 50020

Crude Oil Tax – Purchaser – Protested . . . . . . . . . . . . . . . . . 36820 Off-Road Diesel Equipment Surcharge – Protested . . . . 50820

Electronic Filing System Fund . . . . . . . . . . . . . . . . . . . . . . . . 32470 Oil and Gas Well Servicing Tax . . . . . . . . . . . . . . . . . . . . . . . . 19020

Euless City Sports Venue Tax . . . . . . . . . . . . . . . . . . . . . . . . . 90002 Petroleum Products Delivery Fee . . . . . . . . . . . . . . . . . . . . . 64020

Excess Motor Carrier Fines . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38080 Photo Enforcement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32070

Fireworks Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30020 Public Utilities Gross Receipts Assessment . . . . . . . . . . . . 90230

Fireworks Sales Tax – Protested . . . . . . . . . . . . . . . . . . . . . . . 30820 Sexual Assault/Substance Abuse . . . . . . . . . . . . . . . . . . . . . 32660

Franchise Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13050 Sexually Oriented Business Fee . . . . . . . . . . . . . . . . . . . . . . . 04030

Franchise Tax Extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13080 Sexually Oriented Business Fee – Protested . . . . . . . . . . . 04032

Franchise Tax – Protested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13950 Specialty Court Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32080

Fuel Tax – Diesel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 07020 Sports Venue District Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 04025

Fuel Tax – Diesel: Interstate Trucker . . . . . . . . . . . . . . . . . . . 97020 Texas Home Visiting Program Trust Fund . . . . . . . . . . . . . . 90041

Fuel Tax – Gasoline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 06020 Tobacco Products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18020

Fuel Tax – Gasoline: Interstate Trucker . . . . . . . . . . . . . . . . 96020 Volunteer Fire Dept Insurance . . . . . . . . . . . . . . . . . . . . . . . . 81020

Gross Receipts Tax – Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . 04010 Volunteer Fire Dept Insurance – Protested . . . . . . . . . . . . 81820

Hill Country Village Venue Tax . . . . . . . . . . . . . . . . . . . . . . . . 90003 911 Equalization Surcharge . . . . . . . . . . . . . . . . . . . . . . . . . . 93020

Hotel Occupancy Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75020 911 Equalization Surcharge – Protested . . . . . . . . . . . . . . . 93820

Hotel Occupancy Tax – Protested . . . . . . . . . . . . . . . . . . . . . 75820 911 Emergency Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92020

Insurance Maintenance/Assessment/Retaliatory Tax . . 72020 911 Emergency Service – Protested . . . . . . . . . . . . . . . . . . . 92820

Insurance Maintenance/Assessment/Retaliatory 911 Prepaid Wireless Emergency Service Fee . . . . . . . . . . 94020

Tax – Protested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72820 911 Prepaid Wireless Emergency Service Fee –

Insurance Premium/Surplus Lines Tax . . . . . . . . . . . . . . . . . 71020 Protested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94820

Insurance Premium/Surplus Lines Tax – Protested . . . . . 71820 911 Wireless Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91020

Interest Earned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90100 911 Wireless Service – Protested . . . . . . . . . . . . . . . . . . . . . . 91820

International Fuel Tax Agreement (IFTA) . . . . . . . . . . . . . . 56020

Electronic Funds Transfer 11

|

Enlarge image |

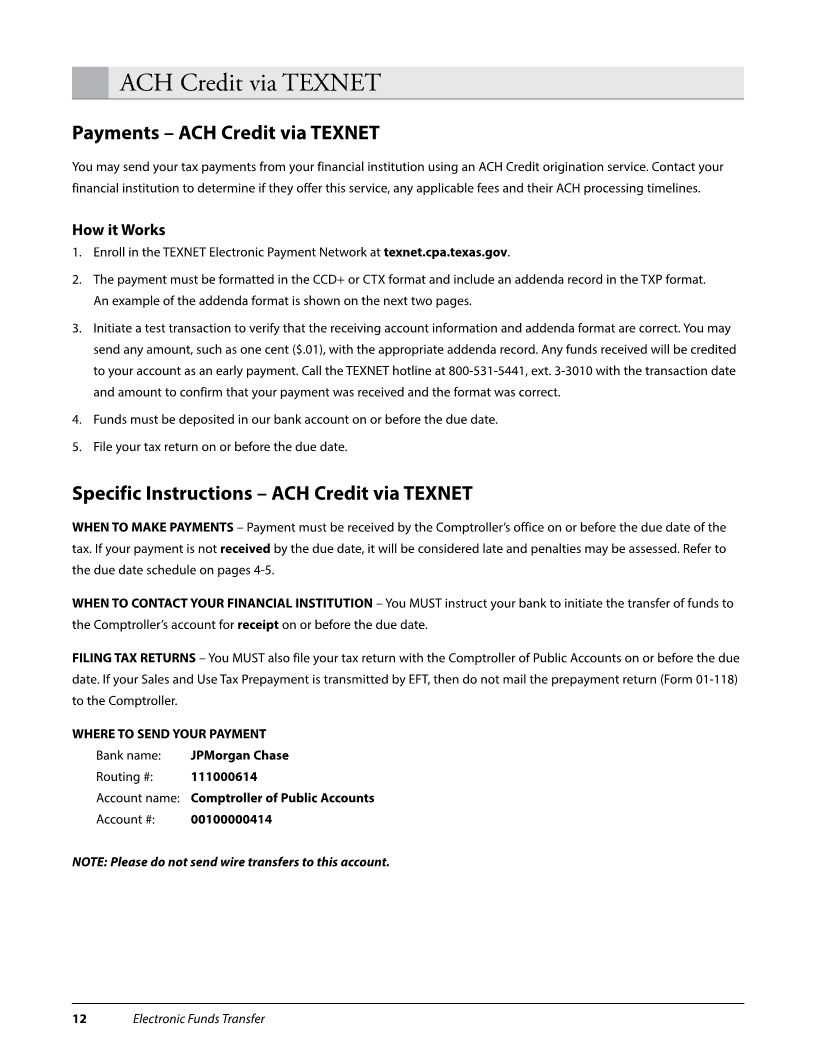

ACH Credit via TEXNET

Payments – ACH Credit via TEXNET

You may send your tax payments from your financial institution using an ACH Credit origination service . Contact your

financial institution to determine if they offer this service, any applicable fees and their ACH processing timelines .

How it Works

1 . Enroll in the TEXNET Electronic Payment Network at texnet.cpa.texas.gov .

2 . The payment must be formatted in the CCD+ or CTX format and include an addenda record in the TXP format .

An example of the addenda format is shown on the next two pages .

3 . Initiate a test transaction to verify that the receiving account information and addenda format are correct . You may

send any amount, such as one cent ($ .01), with the appropriate addenda record . Any funds received will be credited

to your account as an early payment . Call the TEXNET hotline at 800-531-5441, ext . 3-3010 with the transaction date

and amount to confirm that your payment was received and the format was correct .

4 . Funds must be deposited in our bank account on or before the due date .

5 . File your tax return on or before the due date .

Specific Instructions – ACH Credit via TEXNET

WHEN TO MAKE PAYMENTS – Payment must be received by the Comptroller’s office on or before the due date of the

tax . If your payment is not received by the due date, it will be considered late and penalties may be assessed . Refer to

the due date schedule on pages 4-5 .

WHEN TO CONTACT YOUR FINANCIAL INSTITUTION – You MUST instruct your bank to initiate the transfer of funds to

the Comptroller’s account for receipt on or before the due date .

FILING TAX RETURNS – You MUST also file your tax return with the Comptroller of Public Accounts on or before the due

date . If your Sales and Use Tax Prepayment is transmitted by EFT, then do not mail the prepayment return (Form 01-118)

to the Comptroller .

WHERE TO SEND YOUR PAYMENT

Bank name: JPMorgan Chase

Routing #: 111000614

Account name: Comptroller of Public Accounts

Account #: 00100000414

NOTE: Please do not send wire transfers to this account.

12 Electronic Funds Transfer

|

Enlarge image |

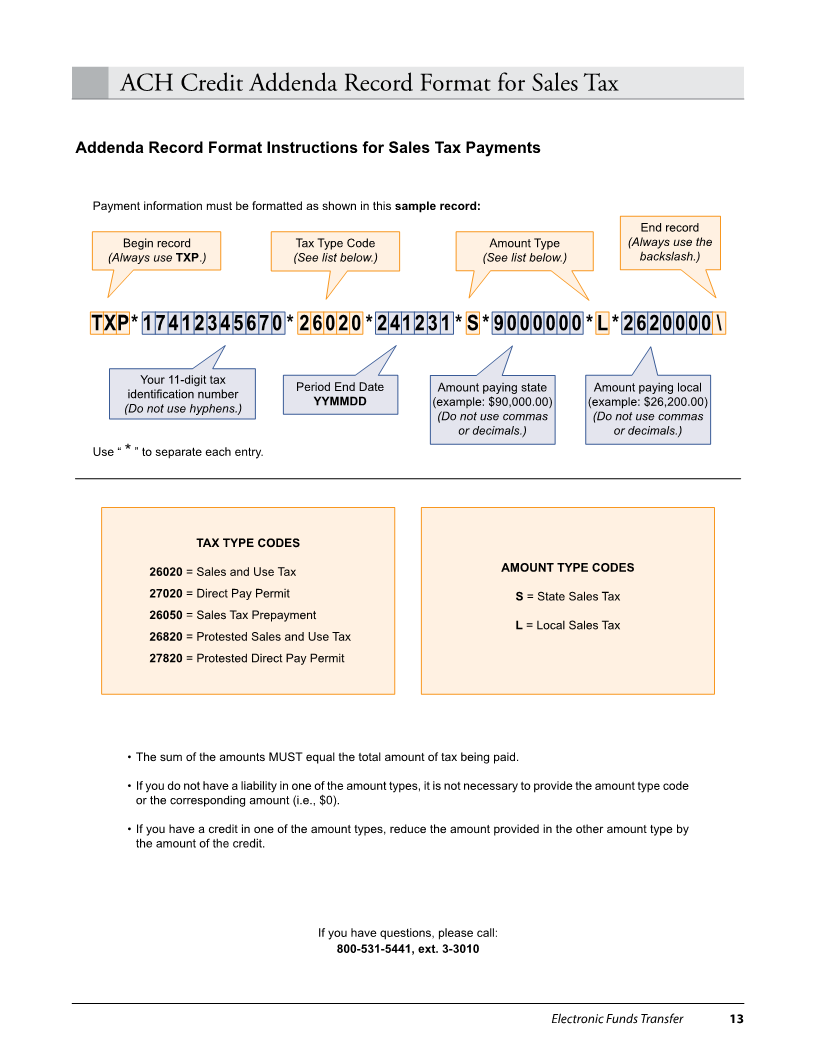

ACH Credit Addenda Record Format for Sales Tax

Addenda Record Format Instructions for Sales Tax Payments

Payment information must be formatted as shown in this sample record:

End record

Begin record Tax Type Code Amount Type (Always use the

(Always use TXP.) (See list below.) (See list below.) backslash.)

T X P * 1 7 4 1 2 3 4 5 6 7 0 * 2 6 0 2 0 * 2 4 1 2 3 1 * S * 9 0 0 0 0 0 0 * L * 2 6 2 0 0 0 0 \

Your 11-digit tax

Period End Date Amount paying state Amount paying local

identification number

(Do not use hyphens.) YYMMDD (example: $90,000.00) (example: $26,200.00)

(Do not use commas (Do not use commas

or decimals.) or decimals.)

Use “ *” to separate each entry.

TAX TYPE CODES

26020 = Sales and Use Tax AMOUNT TYPE CODES

27020 = Direct Pay Permit S = State Sales Tax

26050 = Sales Tax Prepayment

L = Local Sales Tax

26820 = Protested Sales and Use Tax

27820 = Protested Direct Pay Permit

• The sum of the amounts MUST equal the total amount of tax being paid.

• If you do not have a liability in one of the amount types, it is not necessary to provide the amount type code

or the corresponding amount (i.e., $0).

• If you have a credit in one of the amount types, reduce the amount provided in the other amount type by

the amount of the credit.

If you have questions, please call:

800-531-5441, ext. 3-3010

Electronic Funds Transfer 13

|

Enlarge image |

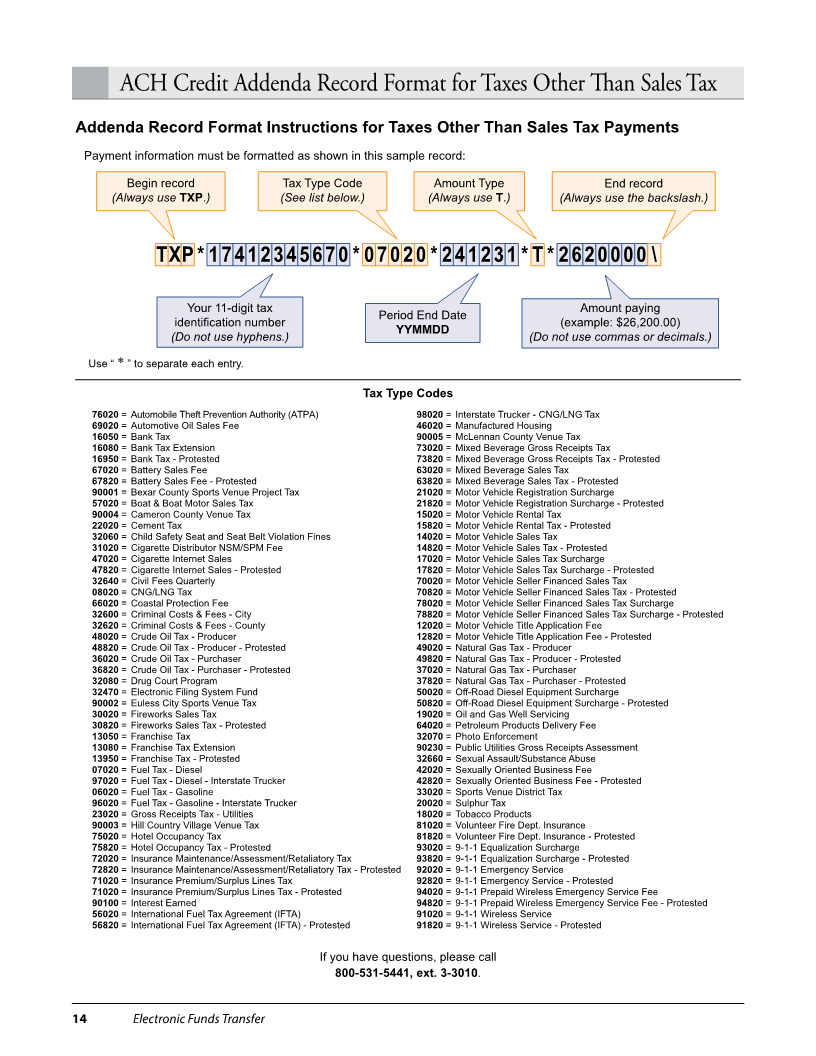

ACH Credit Addenda Record Format for Taxes Other Than Sales Tax

Addenda Record Format Instructions for Taxes Other Than Sales Tax Payments

Payment information must be formatted as shown in this sample record:

Begin record Tax Type Code Amount Type End record

(Always use TXP.) (See list below.) (Always use T). (Always use the backslash.)

T X P * 1 7 4 1 2 3 4 5 6 7 0 * 0 7 0 2 0 * 2 4 1 2 3 1 * T * 2 6 2 0 0 0 0 \

Your 11-digit tax Amount paying

Period End Date

identification number (example: $26,200.00)

(Do not use hyphens.) YYMMDD (Do not use commas or decimals.)

Use “ *” to separate each entry.

Tax Type Codes

76020 = Automobile Theft Prevention Authority (ATPA) 98020 = Interstate Trucker - CNG/LNG Tax

69020 = Automotive Oil Sales Fee 46020 = Manufactured Housing

16050 = Bank Tax 90005 = McLennan County Venue Tax

16080 = Bank Tax Extension 73020 = Mixed Beverage Gross Receipts Tax

16950 = Bank Tax - Protested 73820 = Mixed Beverage Gross Receipts Tax - Protested

67020 = Battery Sales Fee 63020 = Mixed Beverage Sales Tax

67820 = Battery Sales Fee - Protested 63820 = Mixed Beverage Sales Tax - Protested

90001 = Bexar County Sports Venue Project Tax 21020 = Motor Vehicle Registration Surcharge

57020 = Boat & Boat Motor Sales Tax 21820 = Motor Vehicle Registration Surcharge - Protested

90004 = Cameron County Venue Tax 15020 = Motor Vehicle Rental Tax

22020 = Cement Tax 15820 = Motor Vehicle Rental Tax - Protested

32060 = Child Safety Seat and Seat Belt Violation Fines 14020 = Motor Vehicle Sales Tax

31020 = Cigarette Distributor NSM/SPM Fee 14820 = Motor Vehicle Sales Tax - Protested

47020 = Cigarette Internet Sales 17020 = Motor Vehicle Sales Tax Surcharge

47820 = Cigarette Internet Sales - Protested 17820 = Motor Vehicle Sales Tax Surcharge - Protested

32640 = Civil Fees Quarterly 70020 = Motor Vehicle Seller Financed Sales Tax

08020 = CNG/LNG Tax 70820 = Motor Vehicle Seller Financed Sales Tax - Protested

66020 = Coastal Protection Fee 78020 = Motor Vehicle Seller Financed Sales Tax Surcharge

32600 = Criminal Costs & Fees - City 78820 = Motor Vehicle Seller Financed Sales Tax Surcharge - Protested

32620 = Criminal Costs & Fees - County 12020 = Motor Vehicle Title Application Fee

48020 = Crude Oil Tax - Producer 12820 = Motor Vehicle Title Application Fee - Protested

48820 = Crude Oil Tax - Producer - Protested 49020 = Natural Gas Tax - Producer

36020 = Crude Oil Tax - Purchaser 49820 = Natural Gas Tax - Producer - Protested

36820 = Crude Oil Tax - Purchaser - Protested 37020 = Natural Gas Tax - Purchaser

32080 = Drug Court Program 37820 = Natural Gas Tax - Purchaser - Protested

32470 = Electronic Filing System Fund 50020 = Off-Road Diesel Equipment Surcharge

90002 = Euless City Sports Venue Tax 50820 = Off-Road Diesel Equipment Surcharge - Protested

30020 = Fireworks Sales Tax 19020 = Oil and Gas Well Servicing

30820 = Fireworks Sales Tax - Protested 64020 = Petroleum Products Delivery Fee

13050 = Franchise Tax 32070 = Photo Enforcement

13080 = Franchise Tax Extension 90230 = Public Utilities Gross Receipts Assessment

13950 = Franchise Tax - Protested 32660 = Sexual Assault/Substance Abuse

07020 = Fuel Tax - Diesel 42020 = Sexually Oriented Business Fee

97020 = Fuel Tax - Diesel - Interstate Trucker 42820 = Sexually Oriented Business Fee - Protested

06020 = Fuel Tax - Gasoline 33020 = Sports Venue District Tax

96020 = Fuel Tax - Gasoline - Interstate Trucker 20020 = Sulphur Tax

23020 = Gross Receipts Tax - Utilities 18020 = Tobacco Products

90003 = Hill Country Village Venue Tax 81020 = Volunteer Fire Dept. Insurance

75020 = Hotel Occupancy Tax 81820 = Volunteer Fire Dept. Insurance - Protested

75820 = Hotel Occupancy Tax - Protested 93020 = 9-1-1 Equalization Surcharge

72020 = Insurance Maintenance/Assessment/Retaliatory Tax 93820 = 9-1-1 Equalization Surcharge - Protested

72820 = Insurance Maintenance/Assessment/Retaliatory Tax - Protested 92020 = 9-1-1 Emergency Service

71020 = Insurance Premium/Surplus Lines Tax 92820 = 9-1-1 Emergency Service - Protested

71020 = Insurance Premium/Surplus Lines Tax - Protested 94020 = 9-1-1 Prepaid Wireless Emergency Service Fee

90100 = Interest Earned 94820 = 9-1-1 Prepaid Wireless Emergency Service Fee - Protested

56020 = International Fuel Tax Agreement (IFTA) 91020 = 9-1-1 Wireless Service

56820 = International Fuel Tax Agreement (IFTA) - Protested 91820 = 9-1-1 Wireless Service - Protested

If you have questions, please call

800-531-5441, ext. 3-3010.

14 Electronic Funds Transfer

|

Enlarge image |

Missed Your TEXNET Payment Deadline?

When ACH Debit transactions cannot be submitted by the deadline (pg . 4-5), you have the following options to ensure a

timely payment:

• Webfile – Available for taxpayers not required to pay via TEXNET . This option includes electronic check and credit

card that can be submitted before 11:59 p .m . (CT) on the due date . To see the list of filing and payment methods

available by tax type, refer to our website at comptroller.texas.gov/taxes/file-pay/ .

• If you miss the 10:00 a .m . (CT) deadline or if your payment is more than $1,000,000, you must use the following

procedure to ensure timely payment:

• Wire Transfer – IMPORTANT: This procedure is to be used ONLY in the case of a missed TEXNET payment deadline

(refer to pg . 4-5) . Failure to comply with TEXNET rules may result in the assessment of a penalty equal to 5 percent

of the payment amount . You must be enrolled in the TEXNET Electronic Payment Network to be eligible to send a

wire transfer payment .

1 . Contact the Comptroller’s office to report payment information as early as possible on the payment

due date by calling the TEXNET hotline at 800-531-5441, ext . 3-3010 . This call is very important – without it, we

will not have the necessary information to apply the payment to your tax account. Check with your bank for wire

transfer cutoff time .

2 . Instruct your financial institution to wire transfer your payment to:

Bank name: Texas Comptroller of Public Accounts

Routing #: 114900164

Account name: Texas Comptroller of Public Accounts

Account #: 883083001

The Comptroller of Public Accounts is the receiving bank and is located in Austin, Texas . You must include your 11-digit

Comptroller taxpayer identification number in the wire, as well as the company name, tax type, filing period, con-

tact person and phone number.

Electronic Funds Transfer 15

|

Enlarge image |

Penalty Information

Penalties

Late EFT payments are subject to the same penalties and loss of timely filing and/or prepayment discounts as any other

late payment . Also, failure to follow the EFT requirements could result in an additional 5 percent penalty assessment .

Note: See pages 4 and 5 for TEXNET payments Due Date Schedule .

Proof of Payment

If a payment is received after the due date, and the taxpayer and the financial institution do not think they are

responsible for the delay, one of the following items must be furnished:

• the trace number provided by the TEXNET system when using ACH Debit;

• the bank-assigned ACH trace number when using ACH Credit with addenda; or

• the Federal Reserve Bank wire transfer reference number when using the missed TEXNET payment deadline

procedure .

If the Comptroller’s office determines that the taxpayer did attempt to transfer the payment in a timely manner, payment

records may be corrected upon receipt of appropriate documentation . Please call the TEXNET hotline at 800-531-5441,

ext . 3-3010 for assistance .

16 Electronic Funds Transfer

|

Enlarge image | No text to extract. |

Enlarge image |

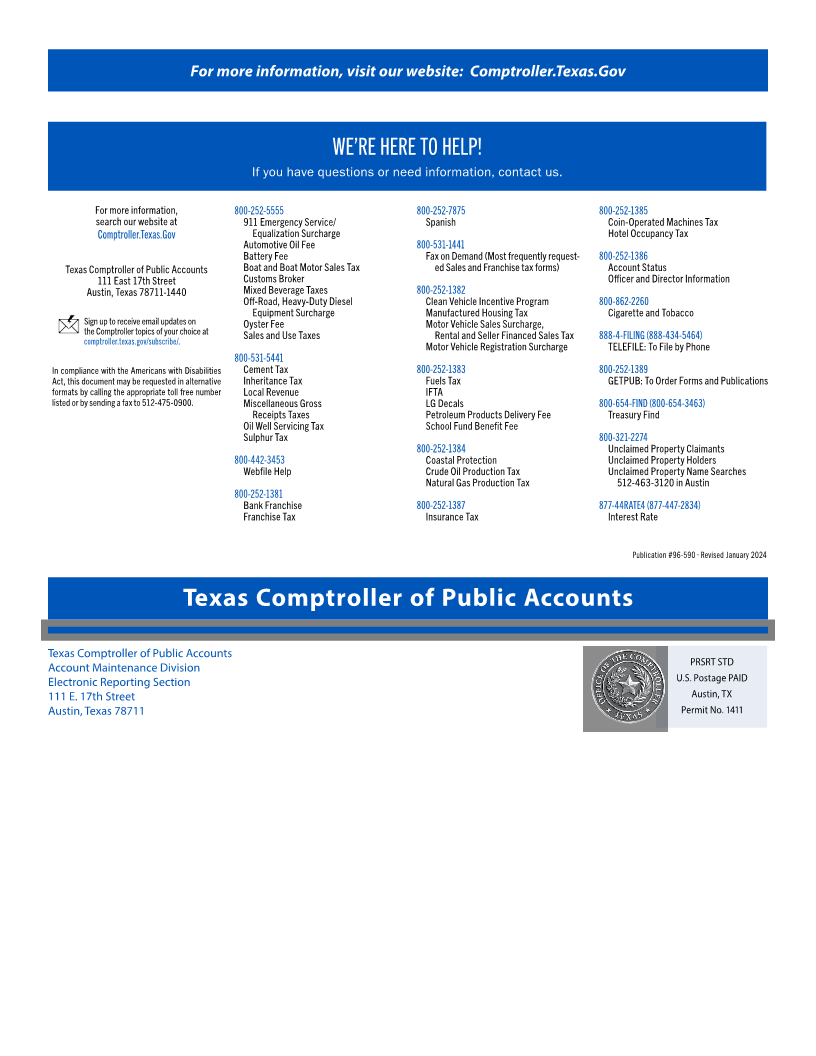

For more information, visit our website: Comptroller.Texas.Gov

WE’RE HERE TO HELP!

If you have questions or need information, contact us.

For more information, 800-252-5555 800-252-7875 800-252-1385

search our website at 911 Emergency Service/ Spanish Coin-Operated Machines Tax

Comptroller.Texas.Gov Equalization Surcharge Hotel Occupancy Tax

Automotive Oil Fee 800-531-1441

Battery Fee Fax on Demand (Most frequently request- 800-252-1386

Texas Comptroller of Public Accounts Boat and Boat Motor Sales Tax ed Sales and Franchise tax forms) Account Status

111 East 17th Street Customs Broker Officer and Director Information

Austin, Texas 78711-1440 Mixed Beverage Taxes 800-252-1382

Off-Road, Heavy-Duty Diesel Clean Vehicle Incentive Program 800-862-2260

Equipment Surcharge Manufactured Housing Tax Cigarette and Tobacco

Sign up to receive email updates on

the Comptroller topics of your choice at Oyster Fee Motor Vehicle Sales Surcharge,

comptroller.texas.gov/subscribe/. Sales and Use Taxes Rental and Seller Financed Sales Tax 888-4-FILING (888-434-5464)

Motor Vehicle Registration Surcharge TELEFILE: To File by Phone

800-531-5441

In compliance with the Americans with Disabilities Cement Tax 800-252-1383 800-252-1389

Act, this document may be requested in alternative Inheritance Tax Fuels Tax GETPUB: To Order Forms and Publications

formats by calling the appropriate toll free number Local Revenue IFTA

listed or by sending a fax to 512-475-0900. Miscellaneous Gross LG Decals 800-654-FIND (800-654-3463)

Receipts Taxes Petroleum Products Delivery Fee Treasury Find

Oil Well Servicing Tax School Fund Benefit Fee

Sulphur Tax 800-321-2274

800-252-1384 Unclaimed Property Claimants

800-442-3453 Coastal Protection Unclaimed Property Holders

Webfile Help Crude Oil Production Tax Unclaimed Property Name Searches

Natural Gas Production Tax 512-463-3120 in Austin

800-252-1381

Bank Franchise 800-252-1387 877-44RATE4 (877-447-2834)

Franchise Tax Insurance Tax Interest Rate

Publication #96-590 • Revised January 2024

Texas Comptroller of Public Accounts

Texas Comptroller of Public Accounts

Account Maintenance Division PRSRT STD

Electronic Reporting Section U .S . Postage PAID

111 E . 17th Street Austin, TX

Austin, Texas 78711 Permit No . 1411

|