Enlarge image

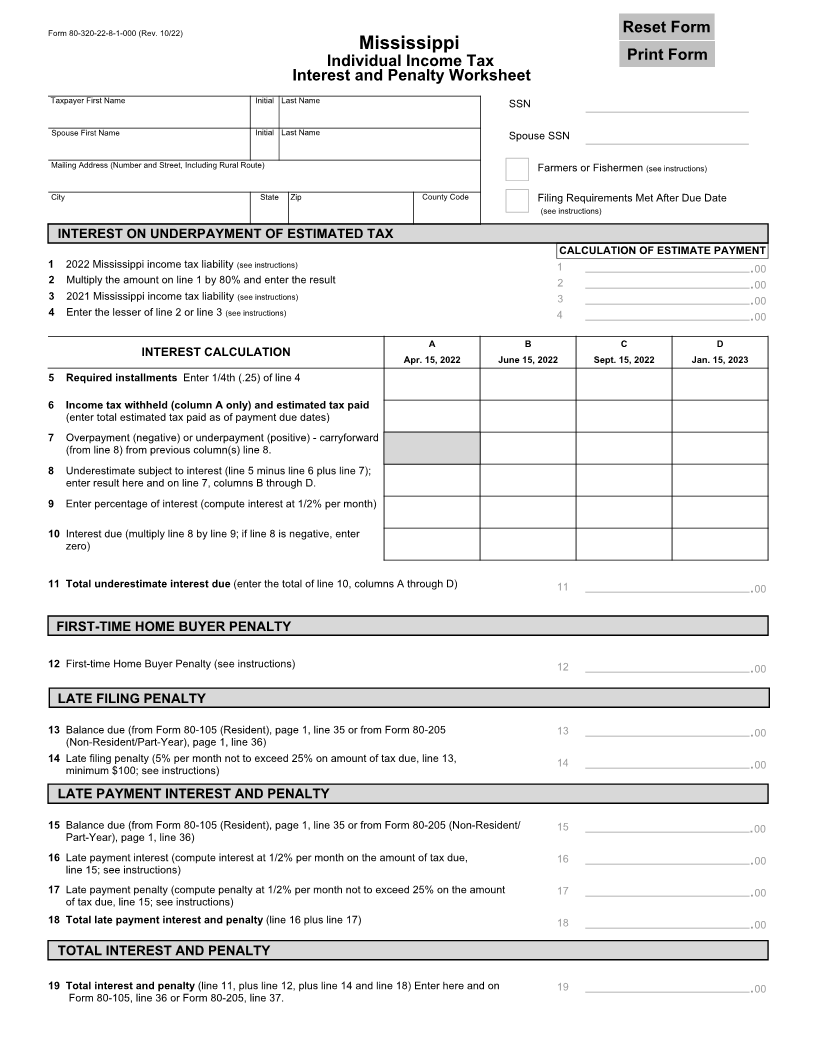

Form 80-320-22-8-1-000 (Rev. 10/22) Reset Form

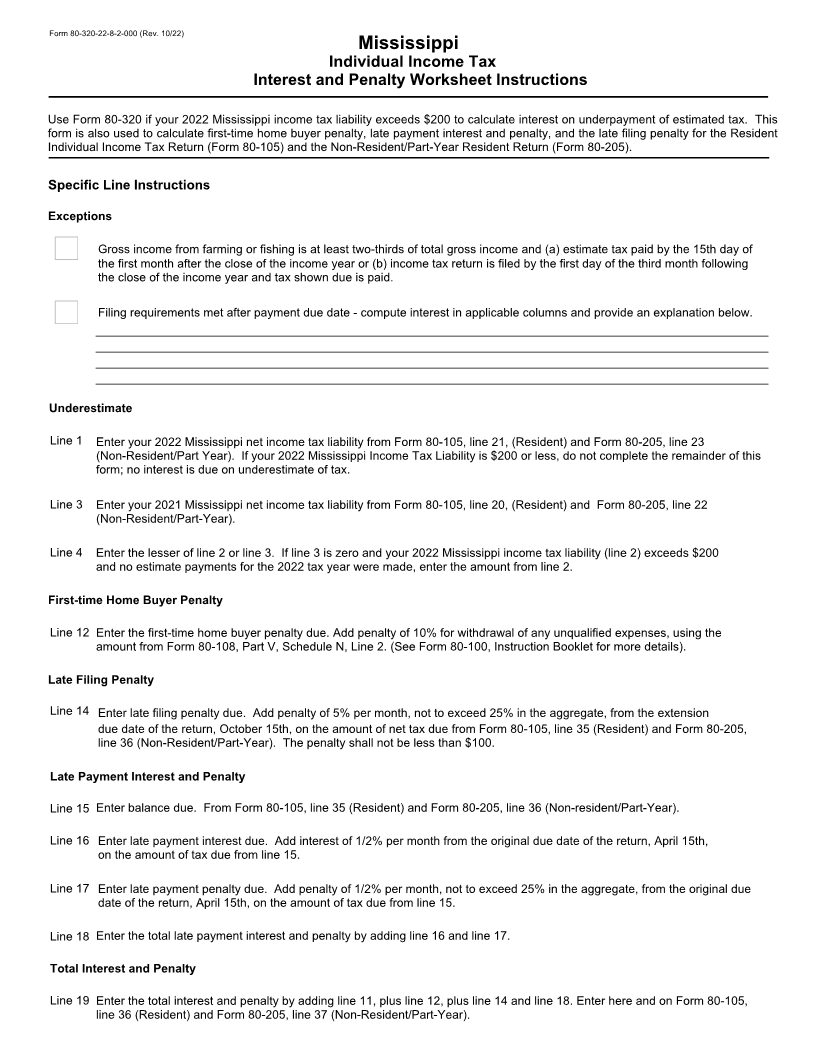

Mississippi

Individual Income Tax Print Form

Interest and Penalty Worksheet

Taxpayer First Name Initial Last Name SSN

Spouse First Name Initial Last Name Spouse SSN

Mailing Address (Number and Street, Including Rural Route) Farmers or Fishermen (see instructions)

City State Zip County Code Filing Requirements Met After Due Date

(see instructions)

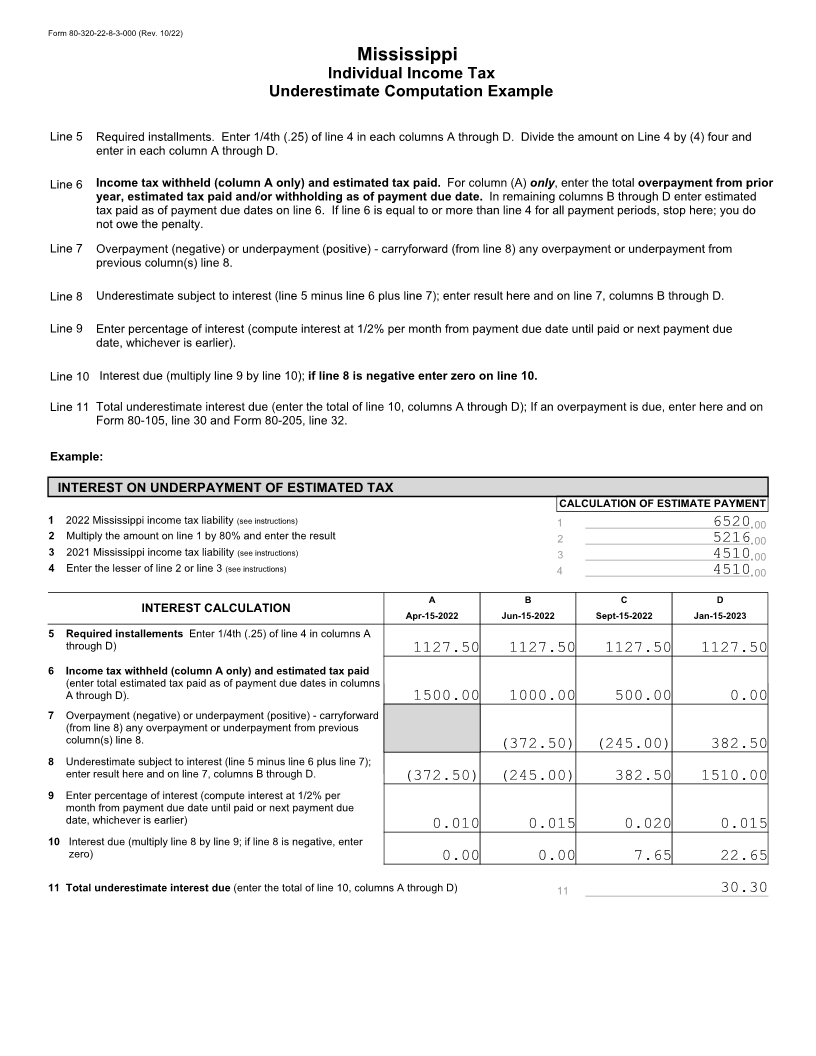

INTEREST ON UNDERPAYMENT OF ESTIMATED TAX

CALCULATION OF ESTIMATE PAYMENT

1 2022 Mississippi income tax liability (see instructions) 1 .00

2 Multiply the amount on line 1 by 80% and enter the result 2 00

.

3 2021 Mississippi income tax liability (see instructions) 3 00

.

4 Enter the lesser of line 2 or line 3 (see instructions) 4 .00

A B C D

INTEREST CALCULATION Apr. 15, 2022 June 15, 2022 Sept. 15, 2022 Jan. 15, 2023

5 Required installments Enter 1/4th (.25) of line 4

6 Income tax withheld (column A only) and estimated tax paid

(enter total estimated tax paid as of payment due dates)

7 Overpayment (negative) or underpayment (positive) - carryforward

(from line 8) from previous column(s) line 8.

8 Underestimate subject to interest (line 5 minus line 6 plus line 7);

enter result here and on line 7, columns B through D.

9 Enter percentage of interest (compute interest at 1/2% per month)

10 Interest due (multiply line 8 by line 9; if line 8 is negative, enter

zero)

11 Total underestimate interest due (enter the total of line 10, columns A through D) 11 .00

FIRST-TIME HOME BUYER PENALTY

12 First-time Home Buyer Penalty (see instructions) 12 .00

LATE FILING PENALTY

13 Balance due (from Form 80-105 (Resident), page 1, line 35 or from Form 80-205 13 .00

(Non-Resident/Part-Year), page 1, line 36)

14 Late filing penalty (5% per month not to exceed 25% on amount of tax due, line 13, 14 .00

minimum $100; see instructions)

LATE PAYMENT INTEREST AND PENALTY

15 Balance due (from Form 80-105 (Resident), page 1, line 35 or from Form 80-205 (Non-Resident/ 15 .00

Part-Year), page 1, line 36)

16 Late payment interest (compute interest at 1/2% per month on the amount of tax due, 16 .00

line 15; see instructions)

17 Late payment penalty (compute penalty at 1/2% per month not to exceed 25% on the amount 17 .00

of tax due, line 15; see instructions)

18 Total late payment interest and penalty (line 16 plus line 17) 18 .00

TOTAL INTEREST AND PENALTY

19 Total interest and penalty (line 11, plus line 12, plus line 14 and line 18) Enter here and on 19 .00

Form 80-105, line 36 or Form 80-205, line 37.