Enlarge image

Reset Form

Form 80-315-22-8-1-000 (Rev. 10/22)

Mississippi Print Form

Reforestation Tax Credit

2022 SSN

Taxpayer Name FEIN

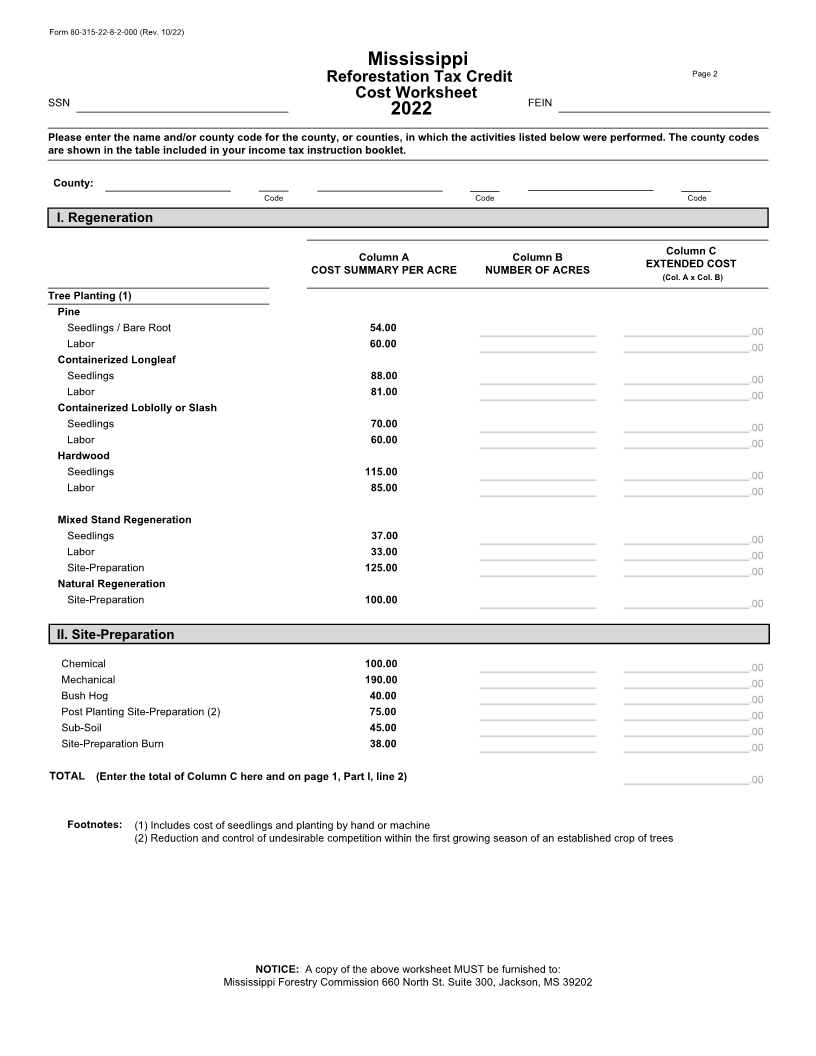

PART I: COMPUTATION OF REFORESTATION TAX CREDIT (RTC)

1 Total expenditures during the year 2022 for seedlings, seed/acorns, seeding, planting by hand or machine,

site preparation and post-planting site preparation on all eligible acres 1 00

.

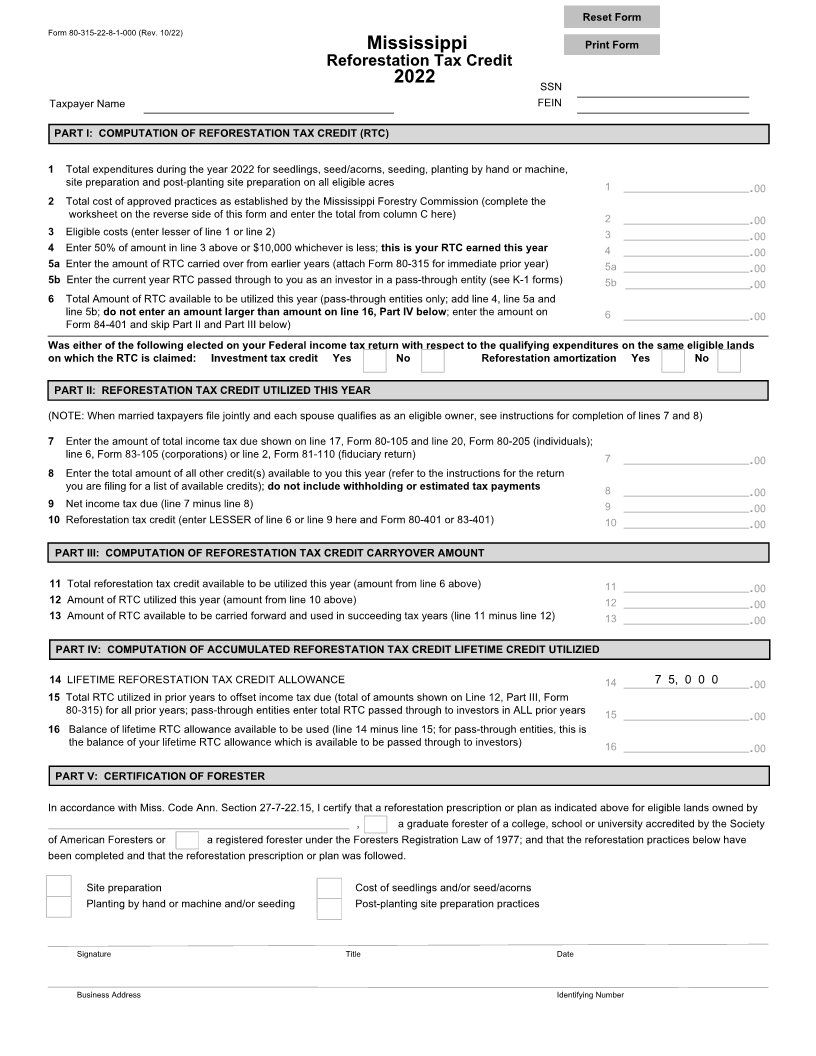

2 Total cost of approved practices as established by the Mississippi Forestry Commission (complete the

worksheet on the reverse side of this form and enter the total from column C here) 2 00

.

3 Eligible costs (enter lesser of line 1 or line 2) 3 .00

4 Enter 50% of amount in line 3 above or $10,000 whichever is less; this is your RTC earned this year 4 .00

5a Enter the amount of RTC carried over from earlier years (attach Form 80-315 for immediate prior year) 5a .00

5b Enter the current year RTC passed through to you as an investor in a pass-through entity (see K-1 forms) 5b .00

6 Total Amount of RTC available to be utilized this year (pass-through entities only; add line 4, line 5a and

line 5b; do not enter an amount larger than amount on line 16, Part IV below; enter the amount on 6 .00

Form 84-401 and skip Part II and Part III below)

Was either of the following elected on your Federal income tax return with respect to the qualifying expenditures on the same eligible lands

on which the RTC is claimed: Investment tax credit Yes No Reforestation amortization Yes No

PART II: REFORESTATION TAX CREDIT UTILIZED THIS YEAR

(NOTE: When married taxpayers file jointly and each spouse qualifies as an eligible owner, see instructions for completion of lines 7 and 8)

7 Enter the amount of total income tax due shown on line 17, Form 80-105 and line 20, Form 80-205 (individuals);

line 6, Form 83-105 (corporations) or line 2, Form 81-110 (fiduciary return) 7 00

.

8 Enter the total amount of all other credit(s) available to you this year (refer to the instructions for the return

you are filing for a list of available credits); do not include withholding or estimated tax payments 8 00

.

9 Net income tax due (line 7 minus line 8) 9 .00

10 Reforestation tax credit (enter LESSER of line 6 or line 9 here and Form 80-401 or 83-401) 10 .00

PART III: COMPUTATION OF REFORESTATION TAX CREDIT CARRYOVER AMOUNT

11 Total reforestation tax credit available to be utilized this year (amount from line 6 above) 11 .00

12 Amount of RTC utilized this year (amount from line 10 above) 12 .00

13 Amount of RTC available to be carried forward and used in succeeding tax years (line 11 minus line 12) 13 .00

PART IV: COMPUTATION OF ACCUMULATED REFORESTATION TAX CREDIT LIFETIME CREDIT UTILIZIED

14 LIFETIME REFORESTATION TAX CREDIT ALLOWANCE 14 7 5, 0 0 0 .00

15 Total RTC utilized in prior years to offset income tax due (total of amounts shown on Line 12, Part III, Form

80-315) for all prior years; pass-through entities enter total RTC passed through to investors in ALL prior years 15 00

.

16 Balance of lifetime RTC allowance available to be used (line 14 minus line 15; for pass-through entities, this is

the balance of your lifetime RTC allowance which is available to be passed through to investors) 16 00

.

PART V: CERTIFICATION OF FORESTER

In accordance with Miss. Code Ann. Section 27-7-22.15, I certify that a reforestation prescription or plan as indicated above for eligible lands owned by

, a graduate forester of a college, school or university accredited by the Society

of American Foresters or a registered forester under the Foresters Registration Law of 1977; and that the reforestation practices below have

been completed and that the reforestation prescription or plan was followed.

Site preparation Cost of seedlings and/or seed/acorns

Planting by hand or machine and/or seeding Post-planting site preparation practices

Signature Title Date

Business Address Identifying Number