Enlarge image

Form 80-205-22-8-1-000 (Rev. 10/22) Reset Form

Mississippi

Print Form

Non-Resident / Part-Year Resident

802052281000 Individual Income2022 Tax Return Amended

Non-Resident Part-Year, Tax Year Beginning and Ending

Taxpayer First Name Initial Last Name SSN

Spouse SSN

Spouse First Name Initial Last Name

1 Married - Combined or Joint Return ($12,000)

Mailing Address (Number and Street, Including Rural Route) 2 Married - Spouse Died in Tax Year ($12,000)

3 Married - Filing Separate Returns ($12,000)

City State Zip County Code 4 Head of Family ($8,000)

5 Single ($6,000)

EXEMPTIONS

Dependents (in column B, enter "C" for child, "P" for parent or "R" for relative) 8 Taxpayer Age 65 or Over Spouse Age 65 or Over

6 (A) Name (B) (C) Dependent SSN Taxpayer Blind Spouse Blind

9 Total dependents line 7 plus number of boxes checked line 8

10 Line 9 x $1,500 10 00

.

11 Enter filing status exemption 11 00

.

7 Total number of dependents (from line 6 and Form 80-491) 12 Total (line 10 plus line 11) 12 00

.

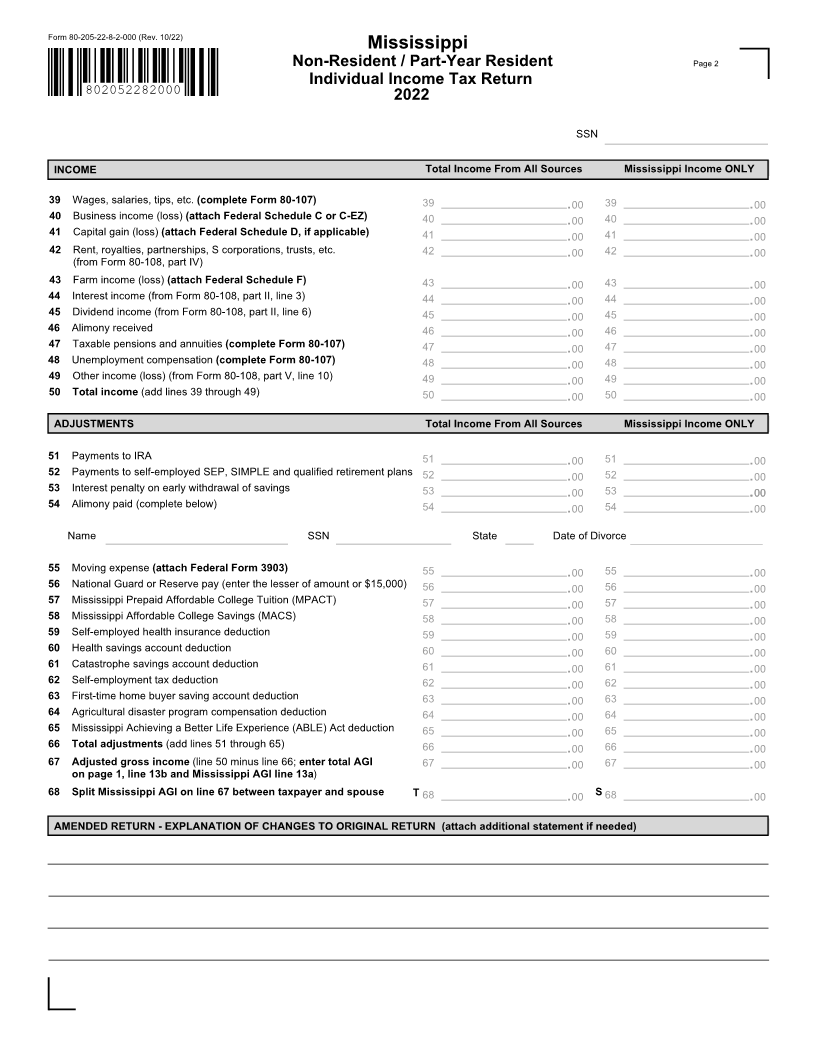

PRORATION (COMPLETE PAGE 2 BEFORE PROCEEDING FURTHER)

13a Mississippi adjusted gross income 14a Standard or itemized deductions 15a Exemptions (from line 12; if married

filing separate, use 1/2 amount)

.00 .00

bAdjusted gross income from all sources bMississippi deductions 00

.

(line 14a multiplied by line 13c) bMississippi exemption

cLine 13a divided by line 13b.00 (line 15a multiplied by line 13c)

.00

. % .00

MISSISSIPPI INCOME TAX Column A (Taxpayer) Column B (Spouse)

16 Mississippi adjusted gross income (from page 2, line 67 or line 68) 16A .00 16B 00

.

17 Deductions (from line 14b; if itemized, attach Form 80-108) 17A .00 17B 00

.

18 Exemptions (from line 15b) 18A .00 18B 00

.

19 Mississippi taxable income (line 16 minus line 17 and line 18) 19A .00 19B 00

.

20 Income tax due (from Schedule of Tax Computation, see instructions) 20 .00

21 Credit for tax paid on an electing Pass-Through Entity Tax Return (from Form 80-161, line 3d) 21 . .0000

22 Other credits (from Form 80-401, line 1) 22 0000

. .

23 Net income tax due (line 20 minus line 21 and line 22) 23 00

.

24 Consumer use tax (see instructions) 24 00

.

25 Catastrophe savings tax (see instructions) 25 00

.

26 Total Mississippi income tax due (line 23 plus line 24 and line 25) 26 .00

27 Mississippi income tax withheld (complete Form 80-107) 27 00

.

28 Estimated tax payments, extension payments and/or amount paid on original return 28 00

.

29 Refund received and/or amount carried forward from original return (amended return only) 29 00

.

30 Total payments (line 27 plus line 28 minus line 29) 30 00

.

31 Overpayment (if line 30 is more than line 26, subtract line 26 from line 30; if zero, skip to line 36) 31 00

.

32 Interest and penalty (from Form 80-320, line 11 and/or line 12) 32 00

.

33 Adjusted overpayment (line 31 minus line 32) 33 .00

34 Overpayment to be applied to next year estimated tax account Farmers or Fishermen 34 00

.

35 Overpayment refund (line 33 minus line 34) (see instructions) REFUND

35 .00

Direct Deposit Request

(check box and go to page 3)

36 Balance due (if line 26 is more than line 30, subtract line 30 from line 26) BALANCE DUE 36 .00

37 Interest and penalty (from Form 80-320, line 19) 37 .00

38 Total due (line 36 plus line 37) AMOUNT YOU OWE 38 .00

Installment Agreement Request

(see instructions for eligibility; attach Form 71-661)

PLEASE SIGN THIS TAX RETURN ON THE BOTTOM OF PAGE 3