Enlarge image

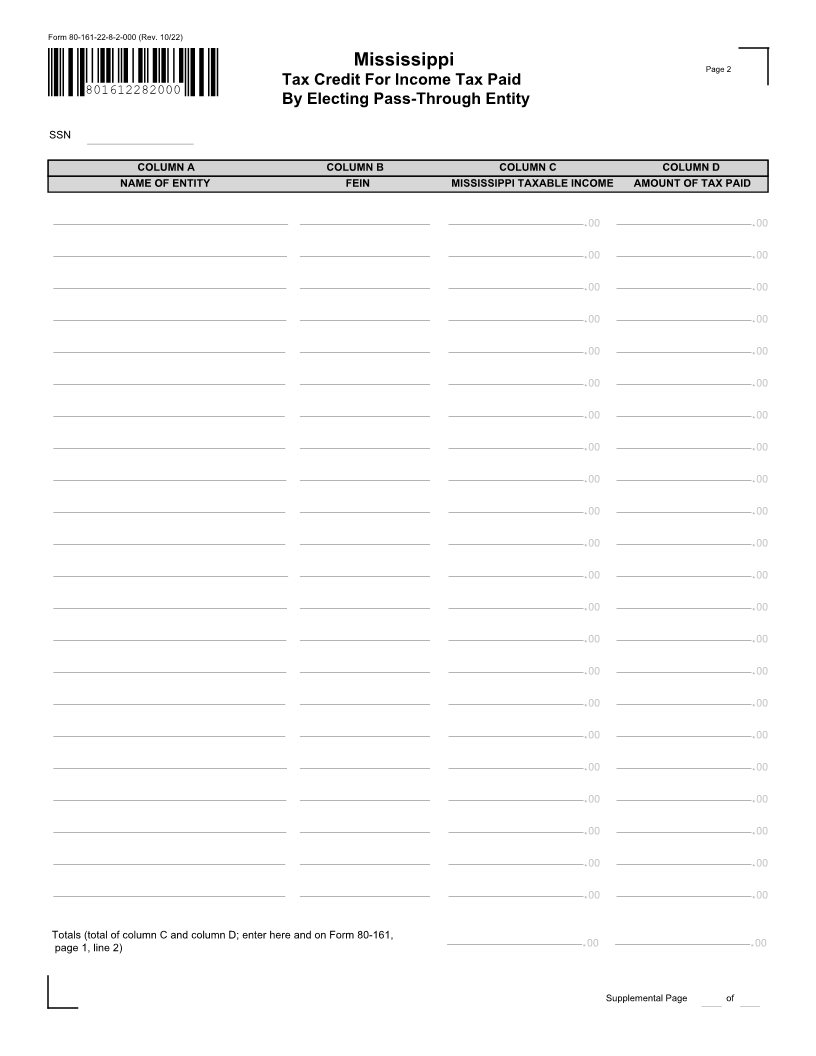

Form 80-161-22-8-1-000 (Rev. 10/22) Reset Form

Print Form

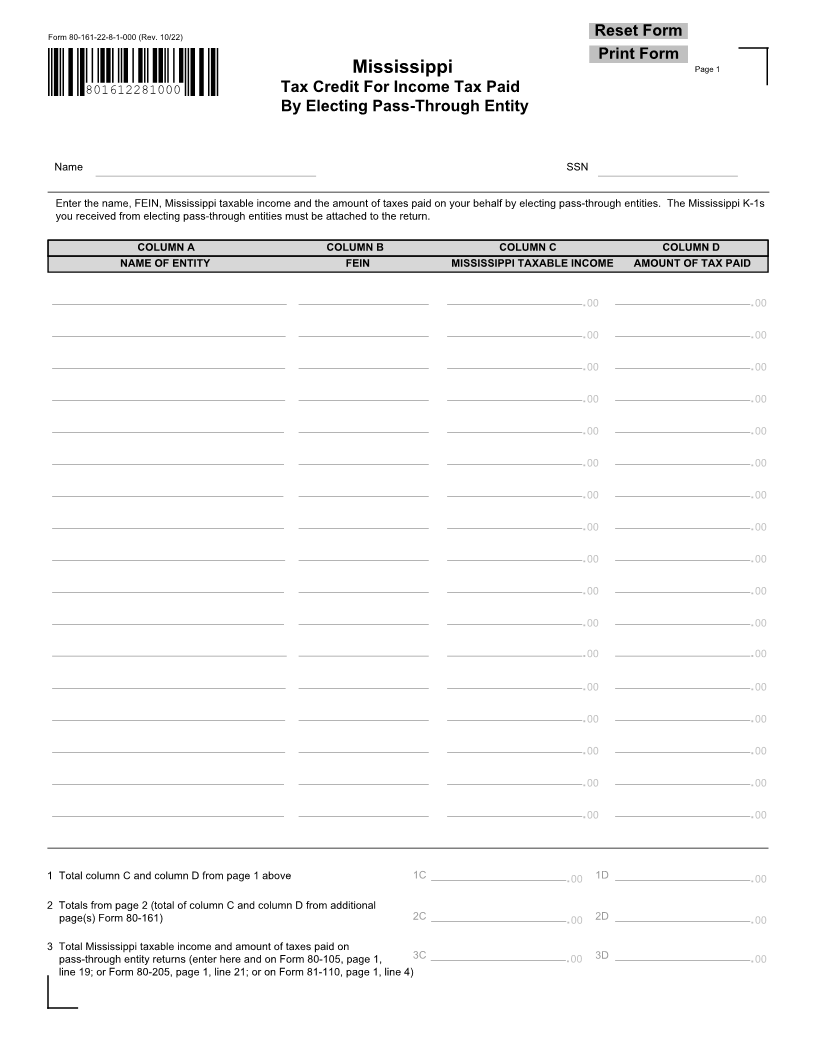

Mississippi Page 1

801612281000 Tax Credit For Income Tax Paid

By Electing Pass-Through Entity

Name SSN

Enter the name, FEIN, Mississippi taxable income and the amount of taxes paid on your behalf by electing pass-through entities. The Mississippi K-1s

you received from electing pass-through entities must be attached to the return.

COLUMN A COLUMN B COLUMN C COLUMN D

NAME OF ENTITY FEIN MISSISSIPPI TAXABLE INCOME AMOUNT OF TAX PAID

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

1 Total column C and column D from page 1 above 1C .00 1D .00

2 Totals from page 2 (total of column C and column D from additional

page(s) Form 80-161) 2C .00 2D .00

3 Total Mississippi taxable income and amount of taxes paid on

pass-through entity returns (enter here and on Form 80-105, page 1, 3C .00 3D .00

line 19; or Form 80-205, page 1, line 21; or on Form 81-110, page 1, line 4)