Enlarge image

Reset Form

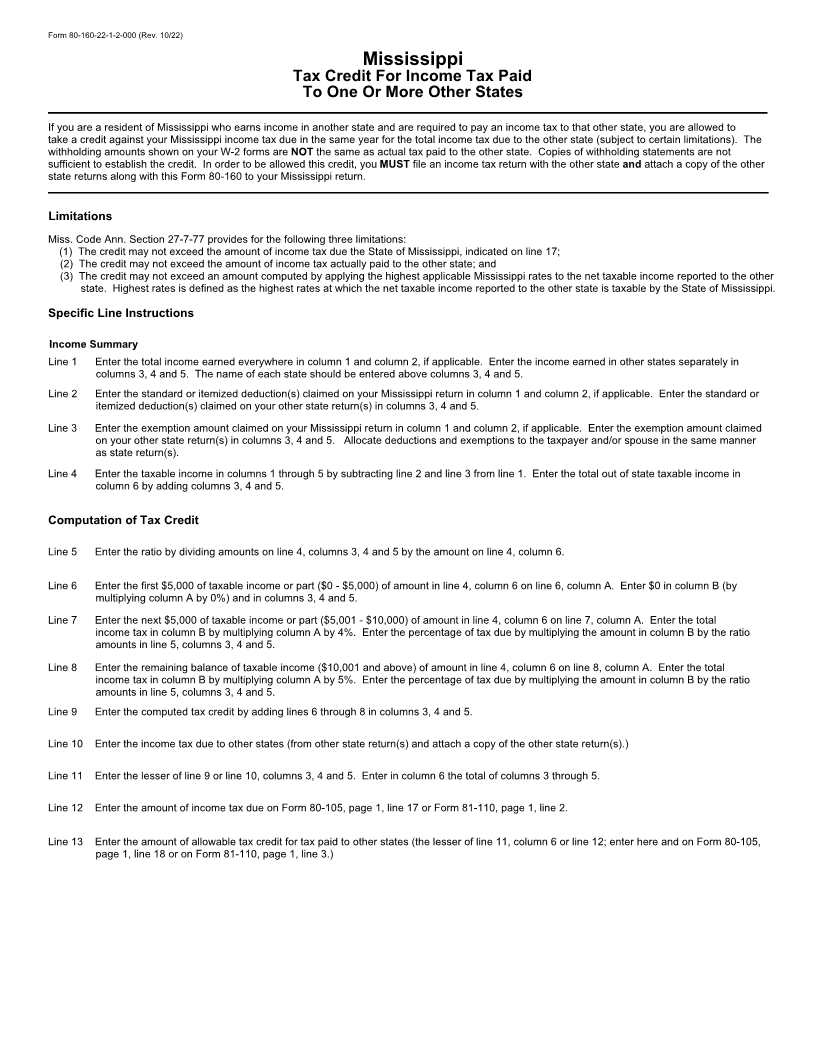

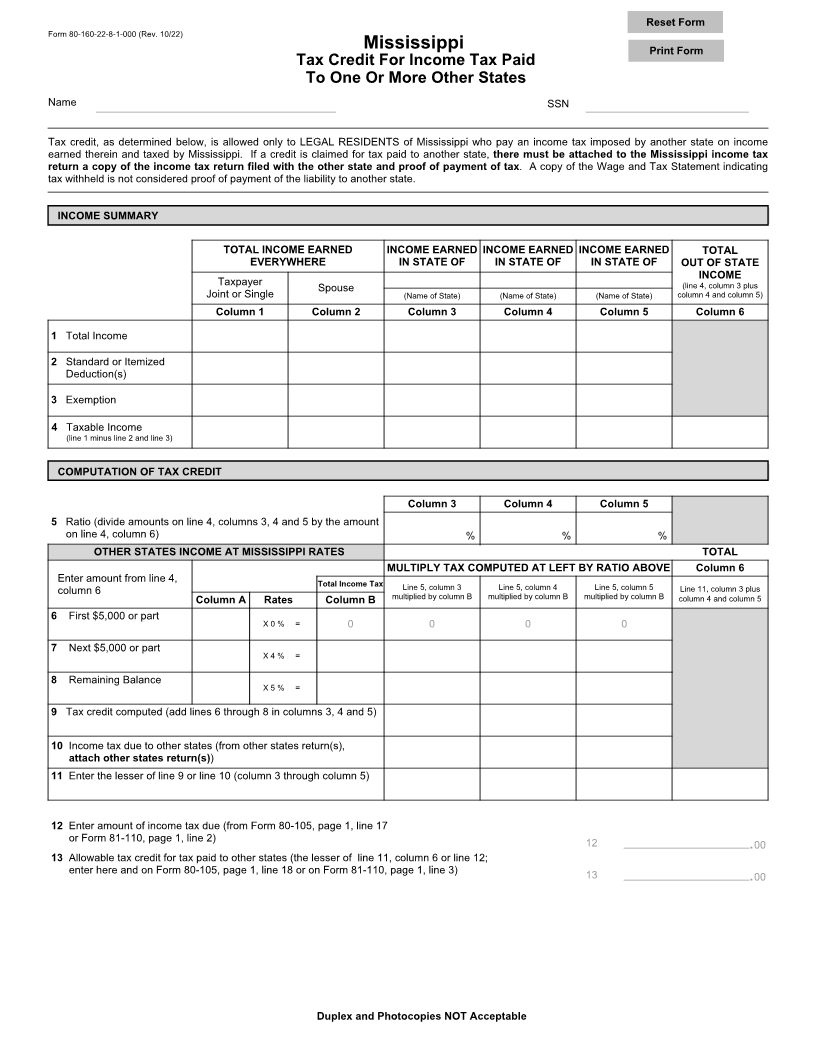

Form 80-160-22-8-1-000 (Rev. 10/22)

Mississippi Print Form

Tax Credit For Income Tax Paid

To One Or More Other States

Name SSN

Tax credit, as determined below, is allowed only to LEGAL RESIDENTS of Mississippi who pay an income tax imposed by another state on income

earned therein and taxed by Mississippi. If a credit is claimed for tax paid to another state, there must be attached to the Mississippi income tax

return a copy of the income tax return filed with the other state and proof of payment of tax. A copy of the Wage and Tax Statement indicating

tax withheld is not considered proof of payment of the liability to another state.

INCOME SUMMARY

TOTAL INCOME EARNED INCOME EARNED INCOME EARNED INCOME EARNED TOTAL

EVERYWHERE IN STATE OF IN STATE OF IN STATE OF OUT OF STATE

INCOME

(line 4, column 3 plus

Joint or Single

Taxpayer Spouse (Name of State) (Name of State) (Name of State) column 4 and column 5)

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6

1 Total Income

2 Standard or Itemized

Deduction(s)

3 Exemption

4 Taxable Income

(line 1 minus line 2 and line 3)

COMPUTATION OF TAX CREDIT

Column 3 Column 4 Column 5

5 Ratio (divide amounts on line 4, columns 3, 4 and 5 by the amount

on line 4, column 6) %%%

OTHER STATES INCOME AT MISSISSIPPI RATES TOTAL

MULTIPLY TAX COMPUTED AT LEFT BY RATIO ABOVE Column 6

Enter amount from line 4, Total Income Tax Line 5, column 3 Line 5, column 4 Line 5, column 5 Line 11, column 3 plus

Column A Column B

column 6 Rates multiplied by column B multiplied by column B multiplied by column B column 4 and column 5

6 First $5,000 or part X 0 % = 00 0 0

7 Next $5,000 or part X 4 % =

8 Remaining Balance X 5 % =

9 Tax credit computed (add lines 6 through 8 in columns 3, 4 and 5)

10 Income tax due to other states (from other states return(s),

attach other states return(s))

11 Enter the lesser of line 9 or line 10 (column 3 through column 5)

12 Enter amount of income tax due (from Form 80-105, page 1, line 17

or Form 81-110, page 1, line 2) 12 .00

13 Allowable tax credit for tax paid to other states (the lesser of line 11, column 6 or line 12;

enter here and on Form 80-105, page 1, line 18 or on Form 81-110, page 1, line 3) 13

.00

Duplex and Photocopies NOT Acceptable