Enlarge image

Reset Form

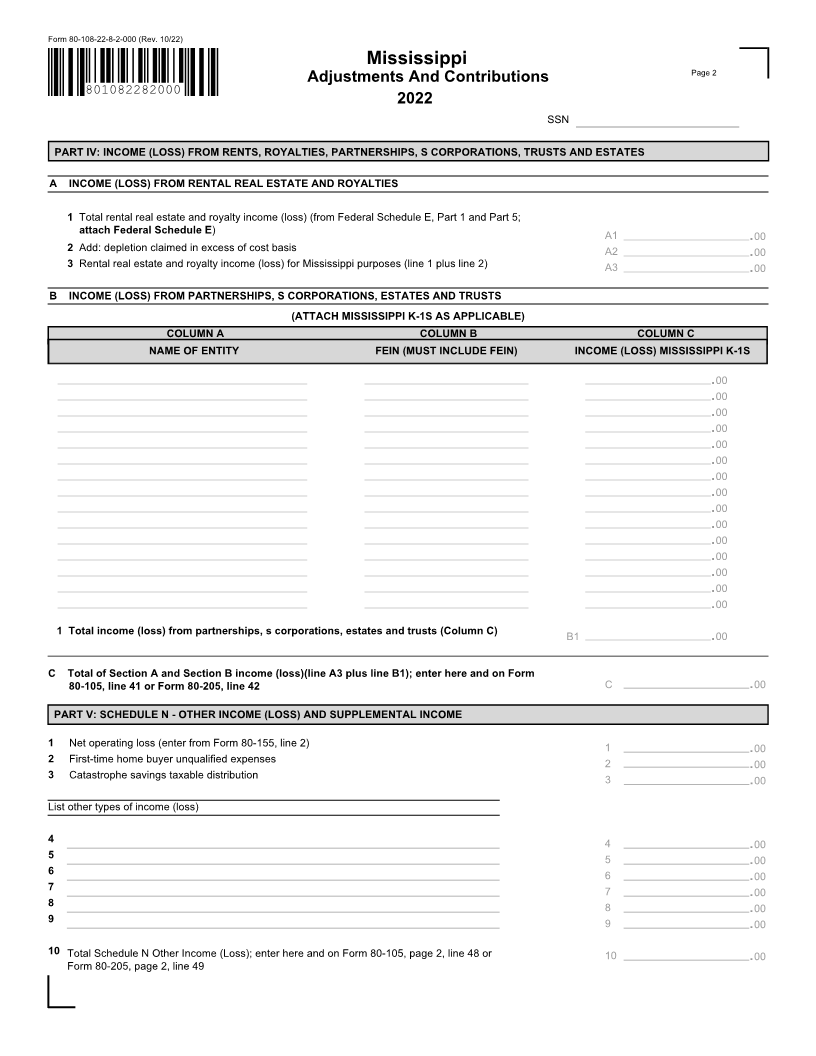

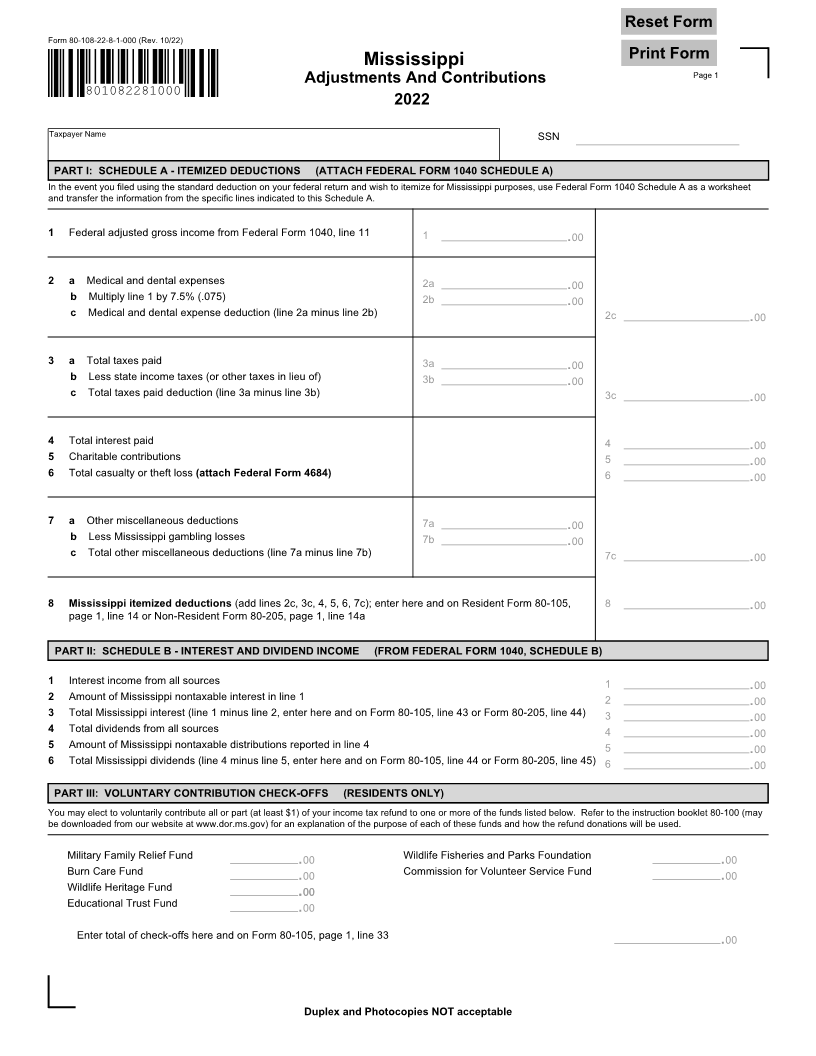

Form 80-108-22-8-1-000 (Rev. 10/22)

Print Form

Mississippi

Adjustments And Contributions Page 1

801082281000

2022

Taxpayer Name SSN

PART I: SCHEDULE A - ITEMIZED DEDUCTIONS (ATTACH FEDERAL FORM 1040 SCHEDULE A)

In the event you filed using the standard deduction on your federal return and wish to itemize for Mississippi purposes, use Federal Form 1040 Schedule A as a worksheet

and transfer the information from the specific lines indicated to this Schedule A.

1 Federal adjusted gross income from Federal Form 1040, line 11 1 .00

2 a Medical and dental expenses 2a .00

b Multiply line 1 by 7.5% (.075) 2b .00

c Medical and dental expense deduction (line 2a minus line 2b) 2c .00

3 a Total taxes paid 3a .00

b Less state income taxes (or other taxes in lieu of) 3b .00

c Total taxes paid deduction (line 3a minus line 3b) 3c .00

4 Total interest paid 4 .00

5 Charitable contributions 5 .00

6 Total casualty or theft loss (attach Federal Form 4684) 6 .00

7 a Other miscellaneous deductions 7a .00

b Less Mississippi gambling losses 7b .00

c Total other miscellaneous deductions (line 7a minus line 7b) 7c .00

8 Mississippi itemized deductions (add lines 2c, 3c, 4, 5, 6, 7c); enter here and on Resident Form 80-105, 8 .00

page 1, line 14 or Non-Resident Form 80-205, page 1, line 14a

PART II: SCHEDULE B - INTEREST AND DIVIDEND INCOME (FROM FEDERAL FORM 1040, SCHEDULE B)

1 Interest income from all sources 1 .00

2 Amount of Mississippi nontaxable interest in line 1 2 .00

3 Total Mississippi interest (line 1 minus line 2, enter here and on Form 80-105, line 43 or Form 80-205, line 44) 3 .00

4 Total dividends from all sources 4 .00

5 Amount of Mississippi nontaxable distributions reported in line 4 5 .00

6 Total Mississippi dividends (line 4 minus line 5, enter here and on Form 80-105, line 44 or Form 80-205, line 45) 6 .00

PART III: VOLUNTARY CONTRIBUTION CHECK-OFFS (RESIDENTS ONLY)

You may elect to voluntarily contribute all or part (at least $1) of your income tax refund to one or more of the funds listed below. Refer to the instruction booklet 80-100 (may

be downloaded from our website at www.dor.ms.gov) for an explanation of the purpose of each of these funds and how the refund donations will be used.

Military Family Relief Fund .00 Wildlife Fisheries and Parks Foundation .00

Burn Care Fund .00 Commission for Volunteer Service Fund .00

Wildlife Heritage Fund . .0000

Educational Trust Fund .00

Enter total of check-offs here and on Form 80-105, page 1, line 33 .00

Duplex and Photocopies NOT acceptable