Enlarge image

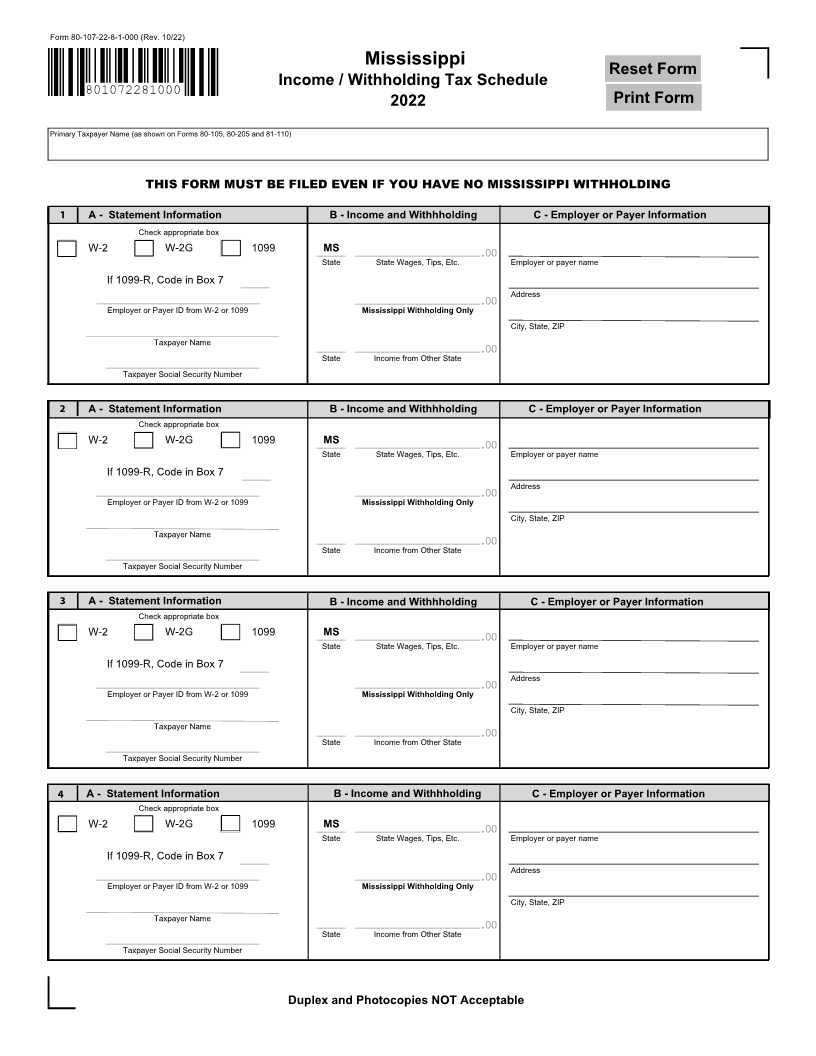

Form 80-107-22-8-1-000 (Rev. 10/22)

Mississippi

Reset Form

Income / Withholding Tax Schedule

801072281000

2022 Print Form

Primary Taxpayer Name (as shown on Forms 80-105, 80-205 and 81-110)

THIS FORM MUST BE FILED EVEN IF YOU HAVE NO MISSISSIPPI WITHHOLDING

A - Statement Information B - Income and Withhholding C - Employer or Payer Information

Check appropriate box

W-2G State State Wages, Tips, Etc. .00 Employer or payer name

W-2 1099 MS

If 1099-R, Code in Box 7

Address

Employer or Payer ID from W-2 or 1099 Mississippi Withholding Only .00

City, State, ZIP

Taxpayer Name

State Income from Other State .00

Taxpayer Social Security Number

A - Statement Information B - Income and Withhholding C - Employer or Payer Information

Check appropriate box

MS

W-2 W-2G 1099 State .00 Employer or payer name

State Wages, Tips, Etc.

If 1099-R, Code in Box 7

Address

Employer or Payer ID from W-2 or 1099 Mississippi Withholding Only .00

City, State, ZIP

Taxpayer Name

State Income from Other State .00

Taxpayer Social Security Number

A - Statement Information B - Income and Withhholding C - Employer or Payer Information

Check appropriate box

MS

W-2 W-2G 1099 State .00 Employer or payer name

State Wages, Tips, Etc.

If 1099-R, Code in Box 7

Address

Employer or Payer ID from W-2 or 1099 Mississippi Withholding Only .00

City, State, ZIP

Taxpayer Name

State Income from Other State .00

Taxpayer Social Security Number

A - Statement Information B - Income and Withhholding C - Employer or Payer Information

Check appropriate box

MS

W-2 W-2G 1099 State .00 Employer or payer name

State Wages, Tips, Etc.

If 1099-R, Code in Box 7

Address

Employer or Payer ID from W-2 or 1099 Mississippi Withholding Only .00

City, State, ZIP

Taxpayer Name

State Income from Other State .00

Taxpayer Social Security Number

Duplex and Photocopies NOT Acceptable