Enlarge image

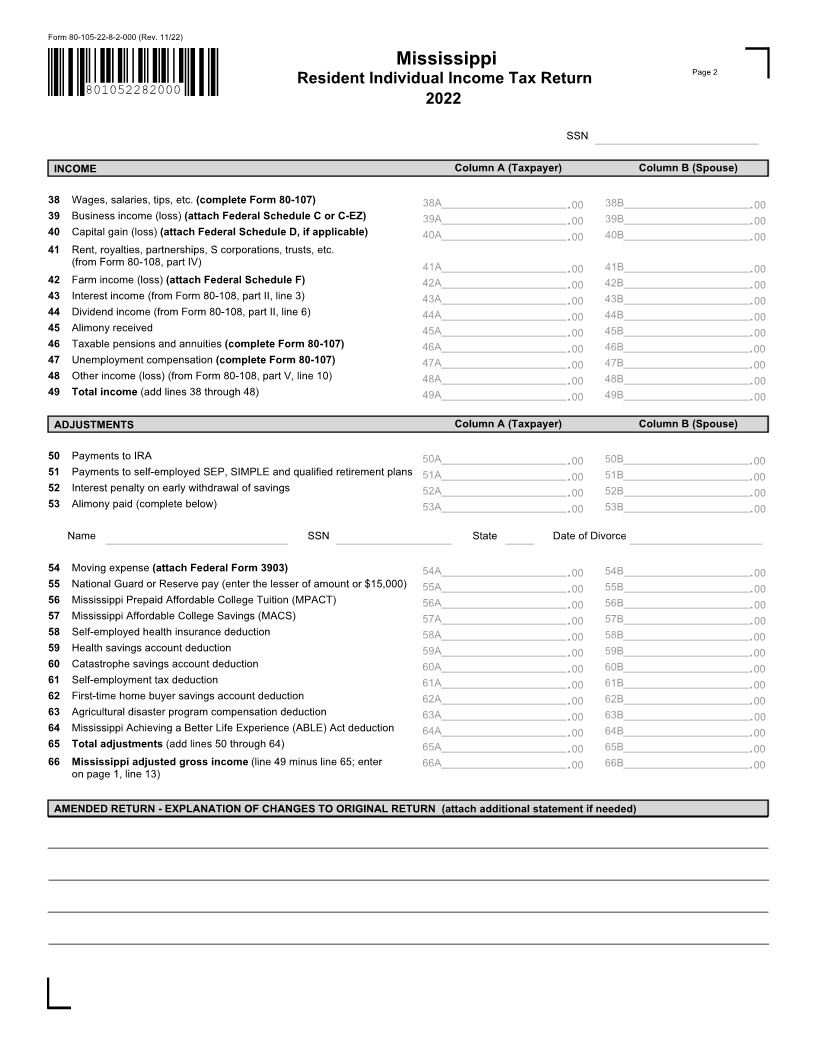

Form 80-105-22-8-1-000 (Rev. 11/22) Reset Form

Print Form

Mississippi

Resident Individual Income Tax Return

801052281000

2022 Amended

Taxpayer First Name Initial Last Name SSN

Spouse SSN

Spouse First Name Initial Last Name

1 Married - Combined or Joint Return ($12,000)

Mailing Address (Number and Street, Including Rural Route) 2 Married - Spouse Died in Tax Year ($12,000)

3 Married - Filing Separate Returns ($12,000)

City State Zip County Code 4 Head of Family ($8,000)

5 Single ($6,000)

EXEMPTIONS

Dependents (in column B, enter "C" for child, "P" for parent or "R" for relative) 8 Taxpayer Age 65 or Over Spouse Age 65 or Over

6 (A) Name (B) (C) Dependent SSN Taxpayer Blind Spouse Blind

9 Total dependents line 7 plus number of boxes checked line 8

10 Line 9 x $1,500 10 00

.

11 Enter filing status exemption 11 00

.

7 Total number of dependents (from line 6 and Form 80-491) 12 Total (line 10 plus line 11) 12 00

.

MISSISSIPPI INCOME TAX Column A (Taxpayer) Column B (Spouse)

13 Mississippi adjusted gross income (from page 2, line 66) 13A 00 13B .00

.

14 Standard or itemized deductions (if itemized, attach Form 80-108) 14A 00 14B .00

.

15 Exemptions (from line 12; if married filing separately use 1/2 amount) 15A 00 15B .00

.

16 Mississippi taxable income (line 13 minus line 14 and line 15) 16A 00 16B .00

.

17 Income tax due (from Schedule of Tax Computation, see instructions) 17 .00

18 Credit for tax paid to another state (from Form 80-160, line 13; attach other state return) 18 .00

19 Credit for tax paid on an electing Pass-Through Entity Tax Return (from Form 80-161, line 3d) 19 .00

20 Other credits (from Form 80-401, line 1) 20 .00

21 Net income tax due (line 17 minus line 18, line 19 and line 20) 21 .00

22 Consumer use tax (see instructions) 22 .00

23 Catastrophe savings tax (see instructions) 23 .00

24 Total Mississippi income tax due (line 21 plus line 22 and line 23) 24 .00

PAYMENTS

25 Mississippi income tax withheld (complete Form 80-107) 25 00

.

26 Estimated tax payments, extension payments and/or amount paid on original return 26 00

.

27 Refund received and/or amount carried forward from original return (amended return only) 27 00

.

28 Total payments (line 25 plus line 26 minus line 27) 28 00

.

REFUND OR BALANCE DUE

29 Overpayment (if line 28 is more than line 24, subtract line 24 from line 28; if zero, skip to line 35) 29 00

.

30 Interest and penalty (from Form 80-320, line 11 and/or line 12) 30 00

.

31 Adjusted overpayment (line 29 minus line 30) 31 00

.

32 Overpayment to be applied to next year estimated tax account Farmers or Fishermen 32 00

(see instructions) .

33 Voluntary contribution (from Form 80-108, part III) 33 00

.

34 Overpayment refund (line 31 minus line 32 and line 33) REFUND 34 .00

Direct Deposit Request

(check box and go to page 3)

35 Balance due (if line 24 is more than line 28, subtract line 28 from line 24) BALANCE DUE 35 .00

36 Interest and penalty (from Form 80-320, line 19) 36 00

.

37 Total due (line 35 plus line 36) AMOUNT YOU OWE 37 .00

Installment Agreement Request

(see instructions for eligibility; attach Form 71-661)

PLEASE SIGN THIS TAX RETURN ON THE BOTTOM OF PAGE 3