Enlarge image

Form 83-391-22-8-1-000 (Rev. 04/22) Reset Form

Mississippi Print Form

Insurance Company Income Tax Return

833912281000 2022

Tax Year Beginning Tax Year Ending

mm dd yyyy mm dd yyyy

FEIN Mississippi Secretary of State ID

Legal Name and DBA CHECK ALL THAT APPLY

Address Amended Return Accident and Health

Final Return Fire and Casualty

City State Zip +4 Life Insurance

Accrual Basis

County Code NAICS Code Receipts and

Disbursements Basis

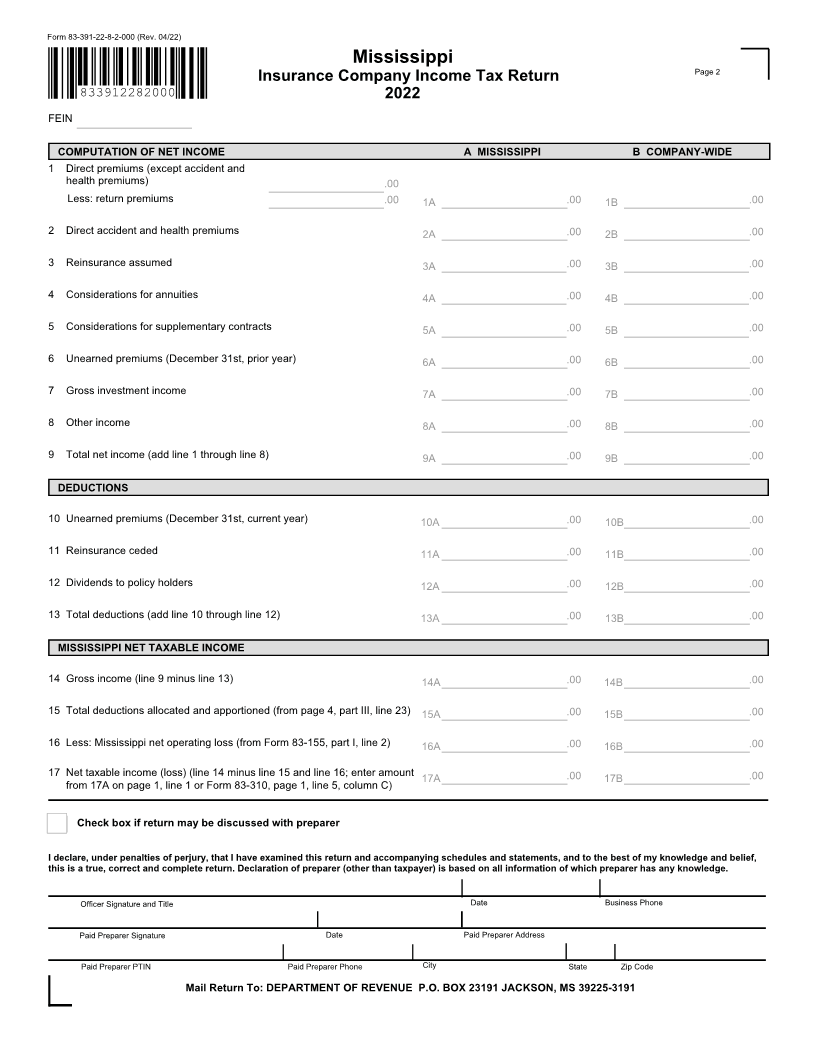

COMPUTATION OF TAX (ROUND TO THE NEAREST DOLLAR)

Combined income tax return (enter FEIN of reporting company)

1 Mississippi net taxable income (from page 2, line 17A or Form 83-310, page 1, line 5, column C) 1 .00

2 Income tax 2 .00

3 Retaliatory taxes paid to other states (Mississippi corporations only; from page 4, part V, line 1) 3 .00

4 Income tax credits (from Form 83-401, line 3 or Form 83-310, page 1, line 5, column B) 4 .00

5 Net income tax due (line 2 minus line 3 and line 4) 5 .00

PAYMENTS AND TAX DUE

6 Overpayment from prior year 6 .00

7 Estimated tax payments and payment with extension 7 .00

8 Total payments (line 6 plus line 7) 8 .00

9 Net total income tax due (line 5 minus line 8) 9 .00

10 Interest and penalty on underestimated income tax payments (from Form 83-305, line 19) 10 .00

11 Late payment interest 11 .00

12 Late payment penalty 12 .00

13 Late filing penalty (minimum $100) 13 .00

14 Total balance due (if line 5 is larger than line 8, add lines 9 through 13) 14 .00

15 Total overpayment (if line 8 is larger than line 5, subtract line 5 from line 8) 15 .00

16 Total overpayment credited to next year (from line 15) 16 .00

17 Total overpayment refunded (line 15 minus line 16) 17 .00

See instructions for electronic payment options or attach check or money order for balance due.