Enlarge image

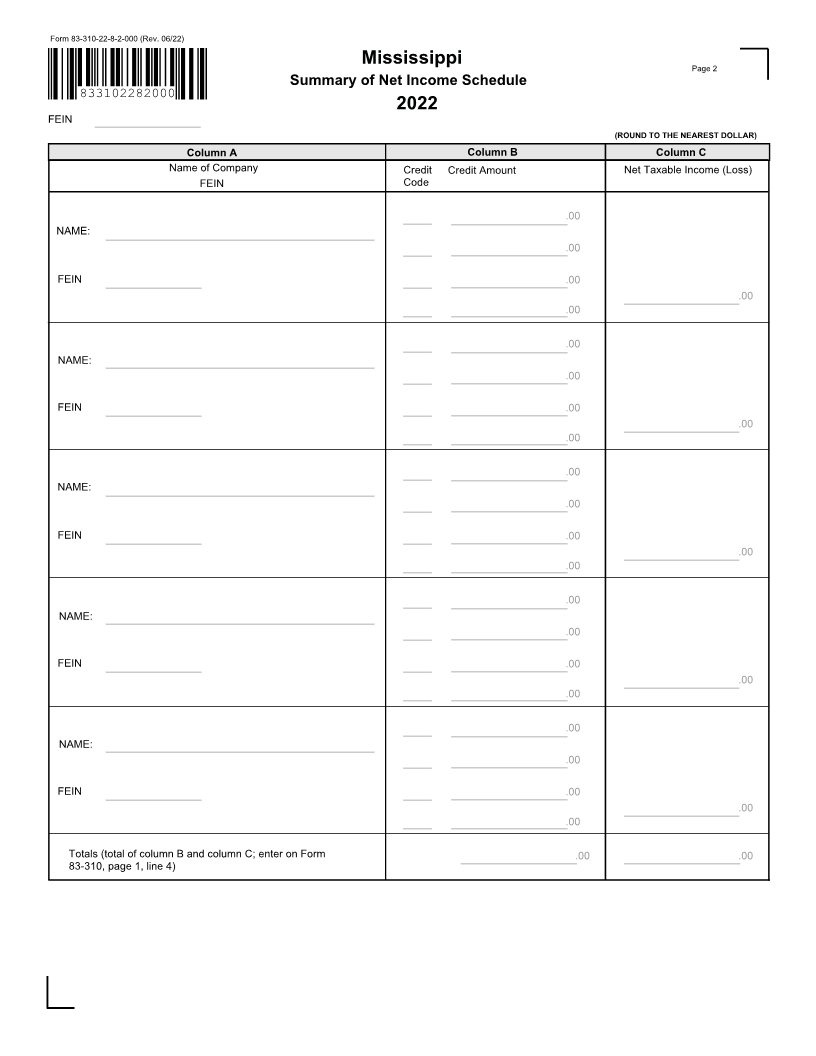

Form 83-310-22-8-1-000 (Rev. 06/22) Reset Form

Mississippi Print FormPage 1

Summary of Net Income Schedule

833102281000

2022

FEIN

(ROUND TO THE NEAREST DOLLAR)

Column A Column B Column C

Name of Company Credit Credit Amount Net Taxable Income (Loss)

FEIN Code

1 Reporting company

.00

NAME

.00

FEIN .00

.00

.00

2 Subsidiary companies

.00

NAME

.00

FEIN .00

.00

.00

.00

NAME

.00

FEIN .00

.00

.00

.00

NAME

.00

FEIN .00

.00

.00

.00

NAME

.00

FEIN .00

.00

.00

3 Total column B and column C (total of credit amounts

line 1 and line 2, column B and total net taxable income .00 .00

(loss) from column C)

4 Totals from page 2 (total of column B and column C

from additional page(s) Form 83-310) .00 .00

5 Total income tax credits and net taxable income (loss) (sum of

line 3 and line 4. Enter the total from column B on Form 83-105,

page 1, line 8 or Form 83-391, line 4, page 1. Enter the total from

column C on Form 83-105, page 1, line 5 or Form 83-391, page 1,

line 1. If the total in column C is negative, enter zero on Form .00 .00

83-105, page 1, line 5 or Form 83-391, page 1, line 1)