Enlarge image

Form 83-300-22-8-1-000 (Rev. 06/22)

Mississippi

Corporate Income Tax Voucher

Instructions

Estimated Tax Payments

Every corporate taxpayer having an annual income tax liability in excess of $200 must make estimated tax payments. For more information about

estimated income tax payments for corporations, please see the Instructions, Form 83-100.

Return Payments

This voucher, 83-300, should be used to remit return payments for corporations. Composite S corporations and composite partnerships use Form

84-300, Pass-Through Entity Income Tax Voucher. Partnerships that elect to remit 5% of the partnership's net gain/profit to each partner's tax

account as an estimated payment should use Form 84-387, Partnership Income Tax Estimate Voucher.

Payment Options

• To pay this amount online, go to www.dor.ms.gov, click on Taxpayer Access Point (TAP) and follow the instructions.

• To pay by check or money order, complete the payment coupon below:

- Make the check or money order payable to Department of Revenue

- Mail both the payment coupon and check/money order to: P.O. Box 23192, Jackson, MS 39225-3192

- Check the appropriate box on the voucher for the payment type you are remitting.

- Check the amended return box on the voucher if you are making a payment with an amended return.

- Write the identification number on the check or money order.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _Cut_Along_ _the_ _Dotted_ _Line_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

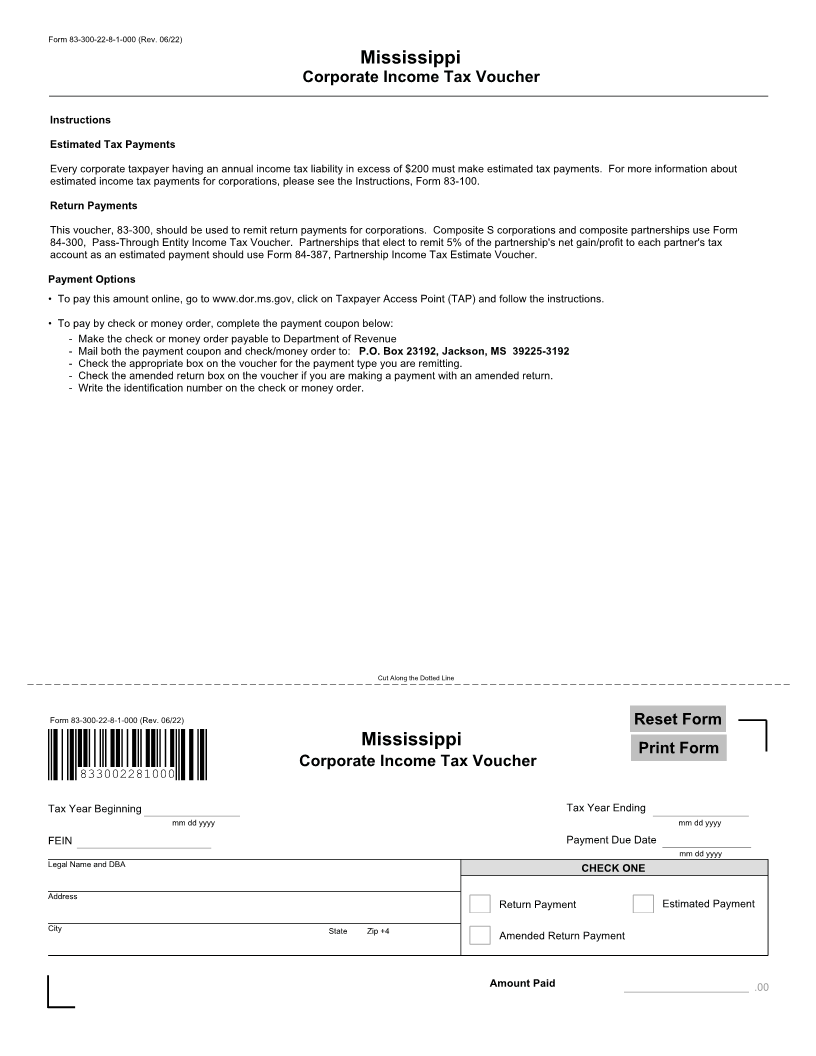

Form 83-300-22-8-1-000 (Rev. 06/22) Reset Form

Mississippi

Print Form

Corporate Income Tax Voucher

833002281000

Tax Year Beginning Tax Year Ending

mm dd yyyy mm dd yyyy

FEIN Payment Due Date

mm dd yyyy

Legal Name and DBA CHECK ONE

Address

Return Payment Estimated Payment

City State Zip +4

Amended Return Payment

Amount Paid .00