Enlarge image

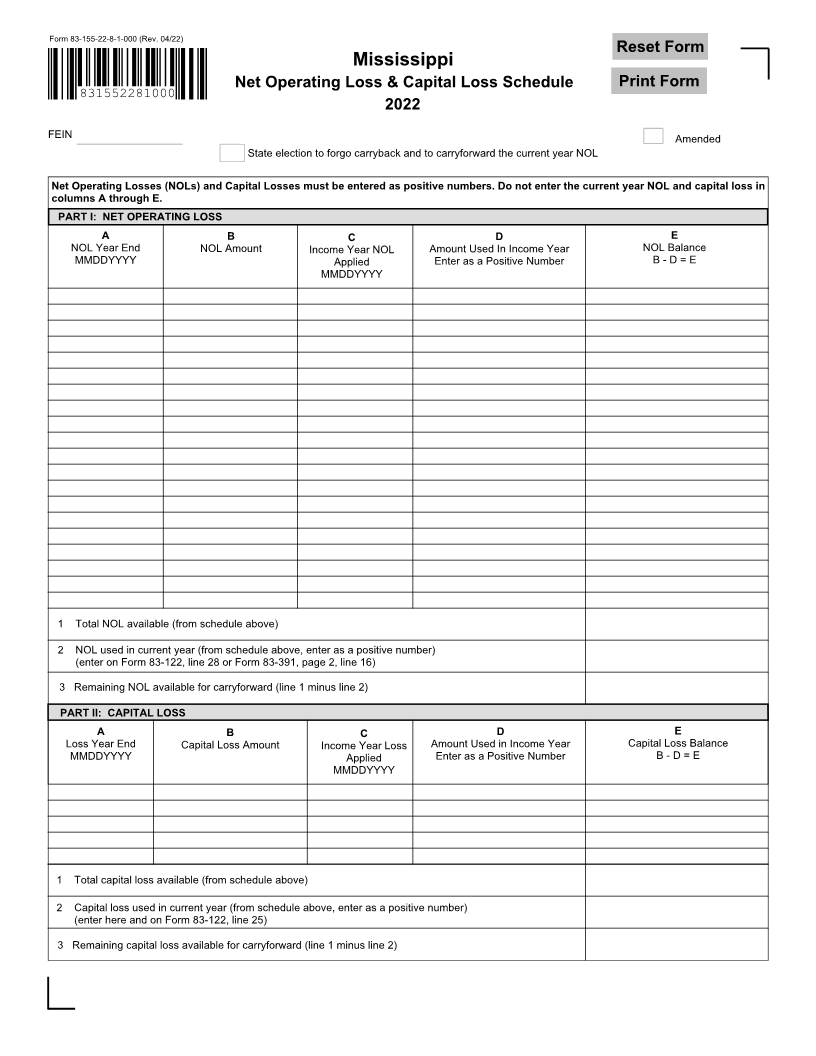

Form 83-155-22-8-1-000 (Rev. 04/22)

Reset Form

Mississippi

Net Operating Loss & Capital Loss Schedule Print Form

831552281000

2022

FEIN Amended

State election to forgo carryback and to carryforward the current year NOL

Net Operating Losses (NOLs) and Capital Losses must be entered as positive numbers. Do not enter the current year NOL and capital loss in

columns A through E.

PART I: NET OPERATING LOSS

A B C D E

NOL Year End NOL Amount Income Year NOL Amount Used In Income Year NOL Balance

MMDDYYYY Applied Enter as a Positive Number B - D = E

MMDDYYYY

1 Total NOL available (from schedule above)

2 NOL used in current year (from schedule above, enter as a positive number)

(enter on Form 83-122, line 28 or Form 83-391, page 2, line 16)

3 Remaining NOL available for carryforward (line 1 minus line 2)

PART II: CAPITAL LOSS

A B C D E

Loss Year End Capital Loss Amount Income Year Loss Amount Used in Income Year Capital Loss Balance

MMDDYYYY Applied Enter as a Positive Number B - D = E

MMDDYYYY

1 Total capital loss available (from schedule above)

2 Capital loss used in current year (from schedule above, enter as a positive number)

(enter here and on Form 83-122, line 25)

3 Remaining capital loss available for carryforward (line 1 minus line 2)