Enlarge image

Reset Form

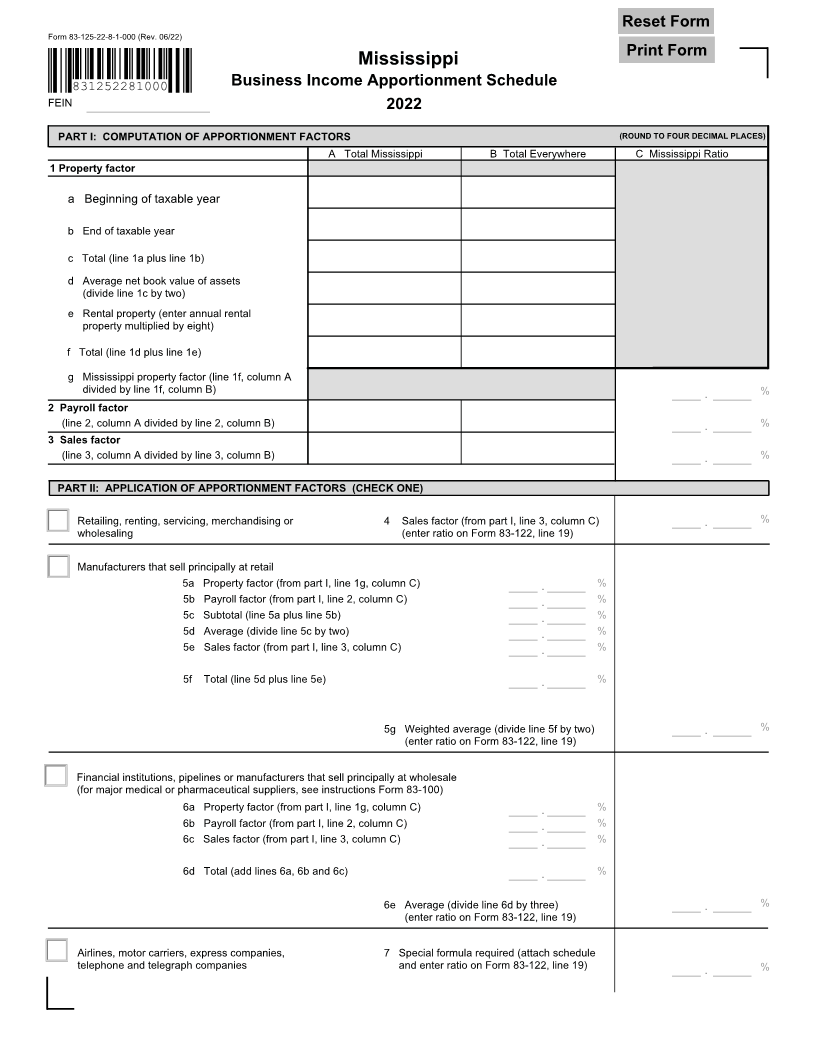

Form 83-125-22-8-1-000 (Rev. 06/22)

Print Form

Mississippi

831252281000 Business Income Apportionment Schedule

FEIN 2022

PART I: COMPUTATION OF APPORTIONMENT FACTORS (ROUND TO FOUR DECIMAL PLACES)

A Total Mississippi B Total Everywhere C Mississippi Ratio

1 Property factor

a Beginning of taxable year

b End of taxable year

c Total (line 1a plus line 1b)

d Average net book value of assets

(divide line 1c by two)

e Rental property (enter annual rental

property multiplied by eight)

f Total (line 1d plus line 1e)

g Mississippi property factor (line 1f, column A

divided by line 1f, column B) . %

2 Payroll factor

(line 2, column A divided by line 2, column B) . %

3 Sales factor

(line 3, column A divided by line 3, column B) . %

PART II: APPLICATION OF APPORTIONMENT FACTORS (CHECK ONE)

Retailing, renting, servicing, merchandising or 4 Sales factor (from part I, line 3, column C) . %

wholesaling (enter ratio on Form 83-122, line 19)

Manufacturers that sell principally at retail

5a Property factor (from part I, line 1g, column C) . %

5b Payroll factor (from part I, line 2, column C) . %

5c Subtotal (line 5a plus line 5b) . %

5d Average (divide line 5c by two) . %

5e Sales factor (from part I, line 3, column C) . %

5f Total (line 5d plus line 5e) . %

5g Weighted average (divide line 5f by two) . %

(enter ratio on Form 83-122, line 19)

Financial institutions, pipelines or manufacturers that sell principally at wholesale

(for major medical or pharmaceutical suppliers, see instructions Form 83-100)

6a Property factor (from part I, line 1g, column C) . %

6b Payroll factor (from part I, line 2, column C) . %

6c Sales factor (from part I, line 3, column C) . %

6d Total (add lines 6a, 6b and 6c) . %

6e Average (divide line 6d by three) . %

(enter ratio on Form 83-122, line 19)

Airlines, motor carriers, express companies, 7 Special formula required (attach schedule

telephone and telegraph companies and enter ratio on Form 83-122, line 19) . %